Is The Market Getting Ahead Of Itself By Pricing In Rate Cuts

As we showed last night, a huge gap has opened between what the Fed forecasts it will do (at least until the Fed joins the ECB in admitting it has zero clue what happens next and does away with forward guidance completely) and what the market expects will happen.

As a reminder, after today’s 75bps rate hike, the Fed is widely expected to hike 50bps in September before slowing further to 25bp hikes in November and December leaving the Fed funds rate at 3.25-3.50% in December, about 100bps above neutral. At this point things gets complicated, and as we also discussed overnight opinions diverge dramatically between JPM which sees rates being cut and Morgan Stanley and Goldman which sees sticky high rates remaining for awhile, if not rising, at least until inflation is defeated.

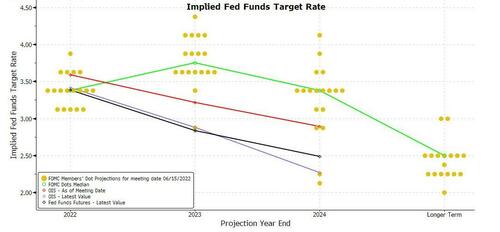

What about the market? Well, according to the OIS, rates peak around 3.50-3.75% in February, before the Fed starting to cut rates in Q1 2023 as markets start to incorporate ongoing growth concerns and the impact of tighter policy with markets implying a terminal rate of 2.75-3.00% in November 2023. Meanwhile, as shown in the dot plot below, the median in the Fed’s June SEPs sees the terminal rate between 3.75-4.00% in 2023, before cutting to 3.25-3.50% in 2024. In other words, someone will be very wrong: either the Fed or markets.

And while it is safe to bet that the Fed is always wrong about everything – because it is – DB’s Jim Reid plays devils advocate and suggests that it is the market that is too sanguine about the Fed’s terminal rate, anticipating a peak of around 3.36% by the December meeting, before pricing in the probability of cuts in Q1 2023.

Reid first brings attention to a note published by a member of his research team (available to pro subs), which looks at how accurate 12-month Treasury bills have been at predicting the path of the Fed back to 1960. T-bills tend to under-price Fed tightening during hiking cycles, and overprice how tight policy will be during cutting cycles. However the analysis suggested that when inflation was above 4% (core PCE YoY), the market more aggressively under-prices the Fed. In lower inflation environments markets are too hawkish in advance which has been the case for much of the last 20 years.

Which begs the question: are markets simply extrapolating what they know from the recent past?

A second reason why markets may be getting ahead of themselves was also address by DB’s economists (and also available to pro subs) argues that the Fed cannot reverse course and start cutting rates next year unless inflation materially slows, unemployment moves above 6%, and the Fed reaction function starts to take labor slack into consideration contrary to their recent one-track focus on inflation.

While there are more details in the full note, in short, the Deutsche Bank house view remains a terminal rate of 4.1% reached in December and with difficulties thereafter in cutting rates (of course, DB also expects a strong recession next year so it’s not like those “difficulties” will be insurmountable).

All of this was largely captured by a Bill Ackman tweet yesterday morning, discussing the reflexivity of the Fed’s rate cut decision which the market is starting to frontrun, thus easing financial conditions, and making rate cuts less likely since the Fed needs to contain inflation first and foremost.

Tomorrow, Powell is likely to be asked: “Market pricing implies that the terminal FF rate will peak at 3.4% in 12/22 immediately declining thereafter to 2.7% by YE ‘23. What factors would cause the @federalreserve to immediately lower rates after just raising them?” Interestingly

— Bill Ackman (@BillAckman) July 26, 2022

Of course, Ackman’s complaint is very well-known (just as it is known that Ackman is talking his book). What is less well known are the growing structural limitations on the bond market which have resulted from the ongoing liquidity drain by the Fed, which prompted Barclays repo market guru Joseph Abate to join BofA’s former NY Fed guru Marc Cabana in calling for an early end to QT. We will discuss that particular angle in a subsequent post.

Tyler Durden

Wed, 07/27/2022 – 10:53

Recent Comments