High Gas Prices At Pump Alter Driving Habits, AAA Finds

Soaring gasoline prices at the pump motivated consumers to go on a buyers’ strike, according to a new survey by auto club AAA.

In June, 64% of the 1,002 respondents altered their driving habits due to months of soaring gasoline and diesel prices at the pump. Of these, 88% said they reduced driving altogether, 74% combined errands, and more than half reduced restaurant and shopping visits. Many respondents postponed travel this summer.

The survey’s findings outline precisely what we said in late June when we first noticed gasoline demand destruction emerged as lower- and middle-income households felt the pinch of energy, food, and shelter inflation.

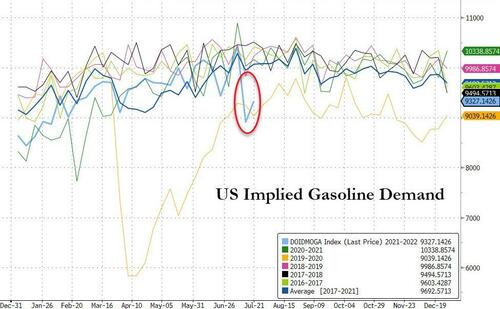

The DoE’s official implied gasoline demand data shows the weakest demand since the COVID lockdowns (on a seasonal basis) and weakest overall since 2013…

Slowing demand topped West Texas Intermediate oil futures prices at $122 a barrel on June 8. Gasoline prices at the pump have also slumped for 41 days, including the single most significant weekly drop in nearly 14 years. However, at $4.355 a gallon, prices are still 38% higher than a year ago and 2x from COVID lows.

Since wages haven’t kept up with inflation, creating worsening negative real wage growth, it might not be enough to get drivers back on the roads. Also, the latest data from Bank of America’s aggregated credit and debit card flows show consumers are tapped out after maxing out credit cards.

OANDA market analyst Jeffrey Halley pointed out that while Brent outperforms due to tight physical markets, “WTI, on the other hand, is a domestic benchmark, meaning that US recession nerves seem to be more heavily weighing on its price.”

The spread between WTI to Brent continued to widen. The US benchmark was more than $9 a barrel cheaper than Brent on Friday, the most since early March.

In the meantime, the Federal Reserve will meet Wednesday and likely raise interest rates by three-fourths of a percentage point following June’s hot consumer print. Aggressive tightening by the Fed has sparked concern the economy could roll into recession.

Tyler Durden

Tue, 07/26/2022 – 19:50