Gordon Growth Model Shows Stocks Not Going Anywhere

Recession or no recession, US stocks may find it difficult to make much headway from current levels.

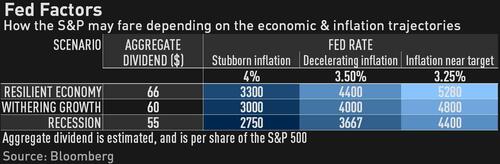

That’s the argument made by Bloomberg Markets Live commentator and reporter Ven Ram, who writes that an application of the Gordon growth model combined with scenario analysis, shows that the S&P 500 will stay around 4,000 should growth in the US slow, but not enough to cause a pronounced deceleration in inflation. At the same time, if gross domestic product shrinks sufficiently for the National Bureau of Economic Research to call a recession, and the Fed funds rate were around 3.50% by then, stocks would struggle to rise.

Ram’s full thoughts below:

US stocks are unlikely to rally over the next few months should the economy slow, but inflation stay well above the Federal Reserve’s target. An application of the Gordon growth model combined with scenario analysis shows that the S&P 500 will stay around 4,000 should growth in the US slow, but not enough to cause a pronounced deceleration in inflation.

Should the economy, however, prove resilient, while inflation stays around current levels, there is considerable downside for stocks. If gross domestic product shrinks sufficiently for the National Bureau of Economic Research to call a recession, and the Fed funds rate were around 3.50% then, stocks would struggle to make headway.

The one scenario where stocks would emerge a winner despite a drop in dividend – a key input into the model – would be one where inflation magically crumbles toward the Fed’s target, leading to an assumed Fed funds rate of around 3.25%.

The various scenarios for the S&P 500 are laid out below. It assumes that aggregate dividend per share on the S&P 500 will range from $55 to $66, and also assumes a steady growth rate of 2%, more or less consistent with the long-term trend growth in the US economy.

One of the key assumptions of the study is that the Fed will raise rates to at least 3.50% by the end of the year. While that is more or less the central scenario for many economists, St. Louis Fed President James Bullard has said that the policy committee should increase its benchmark rate to a range of 3.75% to 4% by the end of 2022. His comments can’t be ignored since he is often thought of as the Voice of the Fed.

However, since he made those remarks, the telltale 10-year/three-month segment of the Treasury curve has approached inversion, while the services sector PMI for July shrank — hence my conservative estimate on the Fed rate.

The S&P has bounced off a cyclical low of 3,636 in mid-June, not far off the 3,594 level posited here. The Nasdaq 100 has, meanwhile, rebounded from a low of 11,037, compared with a level of 10,751 forecast based on differential yields against credit rated Baa. Noted economist Ed Yardeni has remarked that the S&P’s low in June likely marked the trough for the cycle.

An inflection point in stocks may be visible around the fourth quarter, when we will have more data about how the economy is holding up — after all, one PMI doesn’t make a trend — and where the Fed funds rate is headed.

To be sure, stocks may find some tailwind disproportionate to the valuations outlined above should 10-year yields de-couple significantly from where they are indicated by the Fed funds rate and inflation.

Barring such a surprise, dip buyers in stocks are boarding a putative gravy train that isn’t headed anywhere exactly just yet.

Tyler Durden

Wed, 07/27/2022 – 11:13

Recent Comments