BASF Prepares To Slash Ammonia Production In Germany Amid Worsening NatGas Crunch

German chemicals company BASF SE paid an extra 800 million euros ($809.5 million) to keep its plants operating in the second quarter compared with a year earlier amid skyrocketing natural gas prices. The impact of high energy prices has forced the company to make a difficult decision: slash the production of ammonia, which could have potential consequences for farming to the food industry.

“We are reducing production at facilities that require large volumes of natural gas, such as ammonia plants,” BASF Chief Executive Martin Brudermuller said in a conference call after an earnings report.

Brudermuller said BASF would tap external suppliers to fill the deficit as German plants reduced output. He warned about potential supply disruptions that could boost fertilizer costs for farmers.

Reuters details how ammonia plays a critical role in manufacturing nitrogen-based fertilizers, plastic-making, and diesel exhaust fluid. A byproduct of ammonia production is high-purity carbon dioxide (CO2) which is heavily used in the food industry.

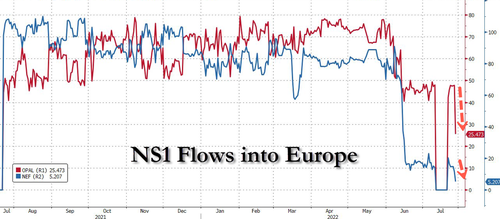

The news of BASF reducing ammonia production because of soaring NatGas prices comes as Russian state-owned energy producer Gazprom PJSC is expected to halve supplies via Nord Stream 1 to Europe to about 20% today. EU member states agreed Tuesday to reduce NatGas demand by 15% over the next eight months, though countries like Germany, without any liquefied natural gas (LNG) port terminals to replace Russian pipeline NatGas, might have to make more considerable sacrifices.

Benchmark NatGas prices in Europe at the Dutch TTF hub hit their highest level since March. Prices have shot up 35% in a week, over 200 euros per megawatt-hour (MWh), as Putin turns the screws on Europe by reducing pipeline capacity to Europe.

“Chemical companies are the biggest industrial natural-gas users in Germany, and ammonia is the single most gas-intensive product within that industry,” Reuters said.

Arne Rautenberg, a fund manager at Union Investment, said ammonia is a prime candidate by chemical companies to cut production first over the NatGas supply squeeze.

“In the northern hemisphere, nitrogen fertilizer is applied primarily during the spring. It can also be produced in the United States and shipped to Europe,” Rautenberg said, adding that the CO2 supply for the food industry could experience disruptions.

The chemical industry lobby VCI indicates German ammonia production has been curbed (some of which began last October) considerably because of soaring energy prices. This could soon impact industries that rely heavily on ammonia and ripple through the economy already facing recession.

Tyler Durden

Wed, 07/27/2022 – 08:30