“We Are In A Very Critical Moment”: IMF Cuts Global GDP, Raises Inflation Outlook, Warns “World Teetering On Edge Of Recession”

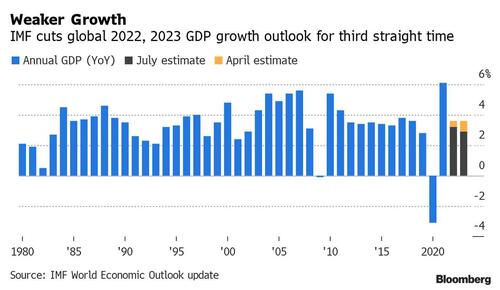

The IMF slashed its global growth forecasts for the third quarter in a row, while raising its projections for inflation (i.e., stagflation is here), warning that the risks to the economic outlook are “overwhelmingly tilted to the downside” and that the world “may soon be teetering on the edge” of recession.

The fund now expects global growth to slow to 3.2% in 2022, down 0.4% from its April estimate, down from 4.4% in January, and roughly half the pace of last year’s expansion. In 2023, global growth is set to weaken further to 2.9%, but of course even shoeshine boys now know that 2023 will be a year of global central bank-sparked recessson. Compared with April’s projections, the new estimates are each more than 1 percentage point lower.

Focusing on key regions, the IMF now sees the Eurozone growing 2.6% in 2022, down from 2.8% in April, and expects 2023 growth to be just 1.2%, down from 2.3% in April. As for the US, the IMF expects the economy to slow to just 2.3% in 2022, down 1.4% from the April forecast, and growth is expected to come to a crawl in 2023 at just 1.0%, down more than half from 2.3% during the IMF’s previous forecast as soaring inflation eats away at households’ ability to buy goods and services, consumption ebbs and the Federal Reserve’s historically aggressive monetary tightening campaign begins to bite.

While the growth-outlook downgrades were broad, but the projection for US expansion took the biggest hit, with the IMF cutting it by 1.4 percentage points relative to the April estimate to 2.3% because of lower growth earlier this year, reduced household purchasing power and tighter monetary policy. The forecast for 0.6% growth in the fourth quarter of 2023 on a year-over-year basis “will make it increasingly challenging to avoid a recession,” according to the IMF.

While the IMF is still forecasting positive growth, that will do little to quell rising concern of receding expansion or even outright recession in major economies as accelerating price increases eat away at incomes, savings and profits.

At the same time, global inflation is likely to intensify, with the IMF raising its forecasts for this year and next by nearly a full percentage point to 8.3% and 5.7%, respectively. So yes: stagflationary recession here we come.

Some more key findings:

The baseline forecast is for growth to slow from 6.1% in 2021 to 3.2% 2022 (April WEO view 3 6%). In 2023, global output is seeing growing by just 2.9%.

Lower growth earlier this year, reduced household purchasing power, and tighter monetary policy drove a downward revision of 1.4ppts in the United States.

In China further lockdowns and the deepening real estate crisis have led growth to be revised down by 1 1ppts.

in Europe, significant downgrades reflect spillovers from the war in Ukraine and tighter monetary policy.

Inflation is anticipated to reach 6.6% (April WEO view 5.7%) in advanced economies and 9.5% (April WEO view 8.7%) in emerging market and developing economies this year

With increasing prices continuing to squeeze living standards worldwide, taming inflation should be the first priority for policymakers Tighter monetary policy will inevitably have real economic costs but delay will only exacerbate them

Pierre-Olivier Gourinchas, the IMF’s top economist, warned in an interview with the FT that it will also be an environment that tests the “mettle” of central banks around the world to continue raising interest rates in a bid to restore price stability even if the economy is slowing,

“We are in a very critical moment here,” he said. “It’s easy to cool off the economy when the economy is running hot. It’s much harder to reduce inflation when the economy is close to a recession.”

“The outlook has darkened significantly since April. The world may soon be teetering on the edge of a global recession, only two years after the last one,” Gourinchas said in a blog accompanying the release of the update.

Once adjusted for inflation, “real” GDP growth in the US of only 0.6% on a year-over-year basis is expected in the fourth quarter of 2023. “It doesn’t take much to knock the economy off into something that you might call a technical recession”, Gourinchas said.

He added that emerging markets had become a chief concern, as the Fed’s tightening cycle pushes up borrowing costs globally. While “disorderly” financial market conditions had not yet taken root, he said, the big wild card was just how much additional pressure economies can withstand.

Emerging markets are likely to come under even more intense pressure should the fund’s alternative scenario of a sharp drop in Russia’s oil and gas exports come to pass, with inflation expectations mounting and central banks forced to tighten monetary policy even more aggressively.

Under those circumstances, global growth is forecast to decline in 2022 and 2023 to just 2.6 per cent and 2 per cent, respectively. According to the fund, it has fallen below 2 per cent just five times since the 1970s.

Meanwhile, patting itself on the back for finally getting something right, the fund said that the risks the fund outlined in the April edition of the World Economic Outlook are materializing. Such dangers include a worsening of the war in Ukraine, escalation of sanctions on Russia, a sharper-than-anticipated slowdown in China, renewed Covid-19 flare-ups and an inflation wave that’s forcing central banks to raise interest rates.

And the risks to the revised outlook “are overwhelmingly tilted to the downside,” it said. Among the plethora of concerns is the potential for “a sudden stop” of European gas imports from Russia due to the war, more persistent inflation and a further escalation of a property crisis in China.

Looking ahead, the IMF said that taming inflation through tighter monetary policy should be the first priority for officials, even if it means a certain recession. This “will inevitably have real economic costs, but delay will only exacerbate them,” it said.

With emerging and developing economies’ debt at multidecade highs, the increase in global borrowing costs and exchange-rate depreciation is making dollar-denominated debt more difficult to service. The World Bank says about 60% of the world’s 75 poorest countries are in or at risk of debt distress, and this is spreading to middle-income countries.

The IMF said it’s placing an “unusually strong emphasis” on downside-risk scenarios in its update. “Should additional shocks hit the global economy, economic outcomes would be even worse,” it said.

Tyler Durden

Tue, 07/26/2022 – 09:51