The Drumbeat Of Weaker Earnings Is Getting More Urgent

By Simon White, Bloomberg Markets Live Analyst and Reporter

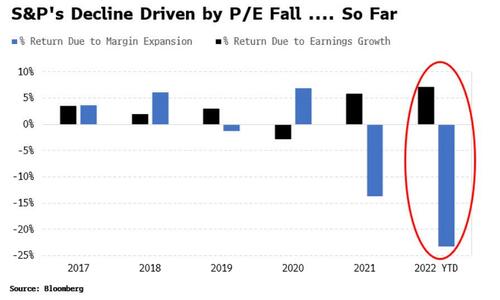

Earnings have contributed positively to S&P returns this year. That is about to change.

Earnings upgrades are easing, and we’re seeing more downgrades, which indicates further declines in earnings growth and the likelihood of an earnings recession by the end of this year.

The S&P is down 17% on the year, but it would be down closer to 25% if earnings had contributed no growth. But profit warnings are proliferating, with Walmart the latest to cut its outlook, citing concerns around food and fuel inflation.

Individual guidance, though, gives little predictive information for the market as a whole. Analysts’ earnings estimates tend to be overly optimistic and backwards looking. Forward earnings tend to rise even after a recession has begun, with analysts only cutting their estimates on average about 6-8 weeks after a downturn’s start.

It’s better to look at earnings downgrades versus upgrades in the aggregate. This is turning down and anticipates that earnings will continue to lose momentum and will soon be contracting on an annual basis. Sentiment is likely to continue to deteriorate.

The ratio of trailing 12-month earnings versus forward earnings one year ago gives us the degree of surprise in earnings. The ISM shows earnings will very likely keep under-delivering over the rest of this year at least.

The rise in the dollar also promises to be a headwind, although the relationship has weakened in recent years as the proportion of S&P 500 firms’ revenues from abroad has fallen.

Many firms used the pandemic to increase profit margins faster than ever before, so if firms are protective of these margins, equity prices would see more support than otherwise from falling earnings. That’s good for shareholders, if not for consumers.

Weaker earnings do not automatically translate into weaker prices, but it will be challenge for equities to stage a sustainable rally when earnings growth is weakening and margins are falling.

Tyler Durden

Tue, 07/26/2022 – 12:26