State Of The US Consumer: McDonald’s Customers Trading Down, Buy Value Items As Combos Increasingly Unaffordable

McDonald’s Corp. is one of the first major restaurant chains to report this earnings season and offered a grim warning about inflation and consumers.

Same-store sales increased 9.7% in the second quarter versus a year ago. Wall Street analysts were expecting 7.5%, according to Bloomberg data. US store sales rose 3.7%, while analysts expected a 3% increase. Adjusted profit came in above estimates, at $2.55 a share, compared with an estimate of $2.46.

Price hikes and value offerings supported US sales growth.

“The McDonald’s System continues to demonstrate strength and resiliency,” CEO Chris Kempczinski said.

“Our second quarter performance reflects outstanding execution against our Accelerating the Arches strategy. By focusing on our customers and crew, enabled by a rapidly growing digital capability, we delivered global comparable sales growth of nearly 10%.”

Despite beating on sales due to price hikes and value menu items, McDonald’s said inflationary pressures would continue to impact margins for the remainder of the year due to the souring macroeconomic conditions.

McDonald’s executive said wage inflation and higher energy costs are impacting margins. The executive said food and paper costs are up 12-14% for the year and warned that macro uncertainty has increased over the year’s first half.

In April, the company said customers traded down for less expensive menu items. The executive repeated this and continued to say that lower-tier customers ditched combo meals for value offerings.

The biggest takeaway is the state of the consumer and one that is not as robust as the Biden administration touts. If consumers have to trade down combo meals for value items, that is troubling ahead of what some believe is a recession.

We have routinely pointed out consumers have maxed out their credit cards and drained personal savings amid the worst inflation in forty years. The latest evidence of a weakening consumer was news some AT&T subscribers couldn’t afford to pay their phone bills.

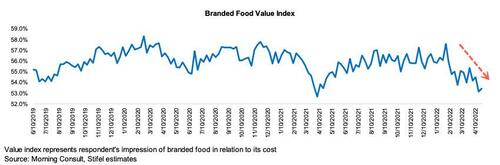

And there’s also this from Stifel Financial Corp.’s managing director of consumer and retail, who recently told clients that their proprietary branded food “value” index showed consumers continue trading down top brands for generic ones.

Our proprietary branded food “value” index supports our view that while prices are rising across the grocery store, consumers still view branded foods as a good value in relation to their cost.

The chart above tracks our value index over time and denotes consumers’ feelings about the value of branded food products currently – the index currently stands above 53%, below the rate during the height of the pandemic when shopping habits were disrupted, but generally in line with historical levels. We have been watching this closely and clearly the recent round of price increases at a time of increased inflation besetting the consumer has led to a shift down in this index.

We believe this recent move down and the potential for a further decline as more pricing takes hold at retail could presage an increase in elasticity for the industry. While we have only seen this on a limited basis so far, we believe it could start to accelerate, validating most of the large food companies that have built in more like historical levels of elasticity to be conservative.

The strong consumer narrative pushed by the Biden administration appears to be breaking.

Tyler Durden

Tue, 07/26/2022 – 12:45