Goldman: Markets Are Reverting To “Bad News Is Good News”, But More Pain Is Coming

Last week there was a mix of positive and negative news: NS1 flows partially resumed relieving some market pressure, but macroeconomic data surprised to the softer side – Euro Area PMIs dipped into contractionary territory and the Philly Fed mfg index came in below expectations. Additionally, the ECB delivered a hawkish surprise raising the key policy rates by 50bp and the resignation of President Draghi precipitated a political crisis in Italy.

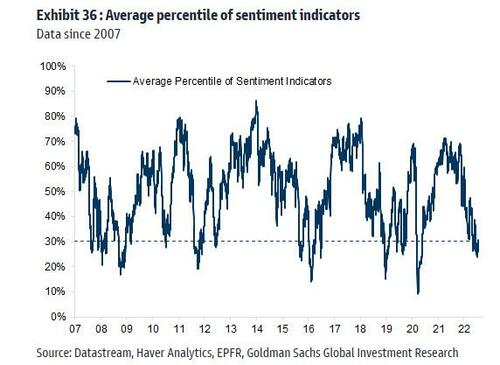

To the surprise of many professional traders, markets took the bad news just as well as the good, with equities extending the rally since mid-June, further reversing some of the YTD losses especially in the longer-duration pockets of the market. Continued light levels of positioning and record bearish sentiment coupled with somewhat resilient US earnings have supported the rally, but more recently duration has been the main driver.

In fact, despite the ECB’s hawkish surprise (or perhaps thanks to the move which will accelerate Europe’s recession), German 2-year yields have registered the largest daily decrease since the GFC…

…. and markets’ expectations for monetary policy easing over the next year have increased in both Europe and the US – the weak data and the ECB dropping its forward guidance have also likely contributed to the dovish repricing.

Long story short, as we have been discussing for months, and as Goldman picks up in a GOAl Kickstart note published overnight by Cecilia Mariotti (and available to professional subscribers) due to the much weaker activity data, markets have turned more optimistic on the “central bank put” and are reverting to a “bad news is good news” regime that has been a feature of a large part of the past cycle when central banks regularly had large dovish pivots during growth slowdowns.

This is accurate, and as shown in the next chart, equities have recently been negatively correlated with macro surprises again.

Cyclicals have also repriced higher vs. defensives over the past week and Goldman’s ‘Global Growth’ factor has turned less negative.

Interestingly, credit has lagged, at least in Europe – despite some recent relief in credit spreads, there continues to be a large gap between European HY credit and equity volatility.

Given the uncertain macro outlook as well as the increased political uncertainty in Europe, risks are skewed towards equity volatility catching up with credit, in Goldman’s view.

Putting it all together, Goldman casts aside its traditional permabullish bias and writes that at this stage, the bank “would be wary in calling for a sustained pro-cyclical shift across assets as we think markets might be underestimating the risks of continued inflationary pressures, which might keep the central bank put far out of the money for longer.”

It’s why Goldman’s economists expect a continuation of the hiking cycle in both Europe and the US with a 75bp hike at tomorrow’s Fed meeting. Also, earnings are turning more negative – European earnings have disappointed for the first time since the COVID-19 crisis and this week 50% of S&P 500 market cap will report. It’s why Goldman remains defensive in its 3m asset allocation (OW cash, Neutral equities & bonds) and with call skew being very elevated, Goldman recommends collars (sell calls to buy puts) to protect equity exposure.

More in the full note available to pro subs

Tyler Durden

Tue, 07/26/2022 – 16:33