Uber-Bear Mike Wilson Is Almost Ready To Turn Bullish… Except For One Thing

One week ago, before he hinted at turning bullish as a result of record bearish sentiment when he said that while he anticipates poor fundamentals for H2 2022, “sentiment says stocks/credit rally in coming weeks”, Bank of America’s Chief Investment Strategist Michael Hartnett – who until now had proven himself as Wall Street’s most bearish and most accurate analyst – predicted that the Fed will pivot in November, effectively unleashing the next bull market in early 2023 (soaring commodity prices notwithstanding), and naturally the big trade on Wall Street remains frontrunning said pivot because by the time Powell capitulates much of the reversal will already be in the books.

More importantly, with Hartnett – who recently said “At SPX 3600 Nibble, At 3300 Bite, At 3000 Gorge” – becoming tactically bullish, that meant that Morgan Stanley’s in-house Michael (that would be chief US equity strategist Wilson) had seemingly assumed the title of biggest Wall Street bear. Or did he? After all, the last time we heard from him he was warning stocks would plunge to 3,000 as the “slowdown was even worse than he expected.”

Well, in his latest Weekly Warm-up Note (available in its entirety to professional subscribers) which was written somewhat cryptically for the clearly spoken Wilson, he echoes the latest observations from Goldman’s flow trading desk, namely that “with equity markets seemingly shrugging off bad news on the economy and earnings, we explore the idea that it may be trying to get ahead of the eventual pause by the Fed that is always a bullish signal.” So yes, seemingly even Wilson has decided that it is more prudent to chase momentum upward during this particular rally, while keeping his bearishness on the backburner. However, unlike some of his bearish colleagues, Wilson hedges that “the problem this time is that the pause is likely to come too late.”

Let’s deconstruct Wilson’s argument which begins with a question: “Is the Market Trying to Price a Fed Pause?” (incidentally a question which we answered one month ago in “Fed Rate-Hikes To End This Year, Followed By 3% Of Rate-Cuts & QE“.)

According to Wilson, since the June lows, the US equity market has been range trading between those lows and 3950. However, this past week the S&P 500 peeked its head above the 50 day moving average, touching 4000 for a few hours. And while Wilson naturally is unconvinced this is anything but a bear market rally, “it does beg the question is something going on here we are missing that could make this a more sustainable low and even the end to the bear market?” Of course, we posed that exact same question one month ago, when quoting a Goldman trading who observed the “First Real Buying In 3 Weeks” and we asked if this is “The Start Of The Next Big Move Higher” (so far we are certainly higher compared to the depths of June if nowhere near the January all time highs).

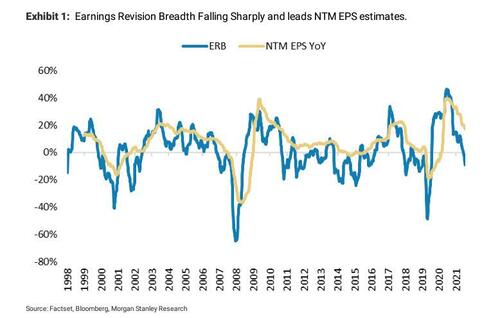

Going back to Wilson, he writes that from a fundamental standpoint, he is “more convicted in our view that bottoms up NTM S&P 500 earnings estimates are too high and have meaningful (i.e. 10%+) downside from the recent peak of $240. So far, that forecast has only dropped by 0.5% making it difficult for us to agree with the view the market has already priced it.” Of course, Wilson concedes, he could also be wrong about the earnings risk and perhaps the current $238 is an accurate reflection of reality. However, given the extraordinary deterioration in earnings revision breadth, he still thinks the evidence is building for his view (the recessionary one even though Morgan Stanley still cowardly refuses to make a recession its base case) to play out over the next several months.

As earnings get worse, financial conditions are only getting tighter with the ECB finally joining the hiking party last week with it’s own 50bps move, the largest in 22 years. Here Wilson, just like us, couldn’t help but be reminded of the infamous 25bps hike by the ECB in July 2008, when Europe was already in a recession and just 2 months before the Lehman bankruptcy and onset of the Great Financial Crisis, not to mention that other hike just months before the peak of the European sovereign debt crisis, which only culminated after Draghi vowed to do whatever it takes.

Last week’s move was eerily similar in many ways. Obviously, the rationale for raising rates now is to join the fight against inflation while also defending the Euro against the US Dollar. However, as Wilson correctly notes, the battle on inflation should have begun a year ago, not now when demand destruction is already well developed and likely to take care of inflation on its own. If that wasn’t enough, the ECB’s rate hikes in 2011 also look unnecessary in hindsight with recession likely already baked before those two 25bps increases. Could this time be different? It seems unlikely with Eurozone GDP growth fast approaching zero and likely to move into negative territory soon.

And so, with most of Morgan Stanley’s leading indicators on growth rolling over hard, Wilson thinks this is the more important variable to watch for stocks at this point rather than inflation or the Fed’s reaction to it.

Having said that, he does agree with the narrative that inflation has likely peaked from a rate of change standpoint with commodities as the best real time evidence of that claim:

We think the equity market is smart enough to understand this too and more importantly that growth is quickly becoming a problem. Therefore, part of the recent rally may be the Equity market looking forward to the Fed’s eventual attempt to save the cycle from recession and with time running short on that front, that opportunity is now or never.

Of course, there are a few shades of gray between “now” and “never”, and when looking at past cycles, Wilson admits that there is always a period between the Fed’s last hike and the eventual recession–i.e. the Fed is typically long done raising rates before the recession arrives. This is in sharp contrast to the European Central Bank which was still tightening when the last two recessions began. More importantly, this period between the last Fed hike and the eventual recession has been a good time to be long the S&P 500 and many stocks/sectors.

In short – and as we have been saying since last December – the Equity market always rallies when the Fed pauses it’s tightening campaign prior to the oncoming recession. In some cases, the rally is so powerful, the S&P 500 usually makes a new all time high before everything comes crashing down. The point that Wilson wants to make here is that “IF the market is starting to think the Fed is about to pause rate hikes after next week’s move, this would provide the best fundamental rationale for why equity markets have rallied so sharply over the past few weeks and why it might signal a more durable low.”

Or, a simple way of saying all of the above is that someone read our article from last month “Fed Rate-Hikes To End This Year, Followed By 3% Of Rate-Cuts & QE” and traded on it…

So why would markets be thinking the Fed is about to pause or slow rate hikes, as Eurodollar futures clearly are, pricing in almost one full hike in Q1 2023…

… or even end QT prematurely, as former NY Fed guru Marc Cabana said will happen?

Part of the reason is the fact that the Fed is already having their desired effect on demand and so it seems quite plausible inflation could look considerably lower in 6 months time. Second, the bond market is sending similar signals with rate cuts now getting priced as early as the Fed’s early February 2023 meeting (see above) and the terminal rate and 2 year yields starting to fall as today’s auction showed. This is also in line with Wilson’s own thinking and why he has been bullish on long duration Treasuries over the past several months.

Of course, lower back end rates (both nominal and real) can also be interpreted as good for longer duration growth stocks, particularly relative to value/cyclicals. This, Wilson notes, “helps explain not only the rally in the S&P 500 but also the relative outperformance of the Nasdaq and other growth indices relative to value stocks.”

Putting it all together, Wilson agrees with the overarching case for a Fed-pivot driven rally… but there is one problem. As he explains, “the problem with this thinking beyond a near term rally is that it’s unlikely the Fed is going to pause early enough to kick save the cycle.” He explains why:

While we appreciate that the market (and investors) may be trying to leap ahead here to get in front of what could be a bullish signal for equity valuations, we remain skeptical that the Fed can reverse the negative trends for demand that are now well established, some of which have nothing to do with monetary policy–i.e. payback in demand and out of sync cost structures with too little pricing power to offset at this point.

Furthermore, the demand destructive nature of high inflation that is presenting itself today will not easily disappear even if inflation declines sharply because prices are already out of reach in areas of the economy that are critical for the cycle to extend–i.e. housing, autos, food, gasoline and other necessities.

Here Wilson reminds us of a key thing which the high school intern in charge of White House economic policy may want to note, namely that “lower inflation does not mean negative price changes for many of these items and to the extent deflation does return via discounting to drive demand, rest assured that will not be good for profit margins and/or earnings revisions.”

Adding insult to injury, the survey shows consumer intentions to spend over the next 6 months continues to deteriorate rapidly, even for things like travel and leisure, the area of spend that was supposed to offset the obvious payback on goods spending that is now well established.

Moreover, in speaking with his industry analysts, Wilson has encountered increasing concern about deteriorating volume demand in many categories of discretionary spend and discounting returning.

Finally, and most ominously, consumer delinquencies are picking up too in several categories of spend with AT&T mentioning this specifically for cell phone bills which tends to be one of the last things people stop paying. Car payments are the other one that is last to stop and here too Morgan Stanley is hearing hearing about rising delinquencies from recent buyers who borrowed more than they should have been allowed based on inflated incomes from the stimulus checks.

And then there is the market: In addition to 2 year UST yields and the terminal rate falling, the 2s-10s curve remains inverted by approximately 20bps, the most in nearly two decades. And while the bond market has been preoccupied with the generationally high inflation readings and the Fed’s reaction to it, Wilson thinks it is now starting to contemplate the impact of both on growth.

In that regard, the bond market is catching up to the equity market. Ironically, the equity market is taking the lower yields signal as a positive for stocks, particularly growth stocks as it starts to give credibility again to the soft landing scenario after having moved away from that view so aggressively in June.

Morgan Stanley’s take is that this view could persist into August if the Fed throws the markets a bone next week and insinuates it has done enough for now. While that’s not the bank’s house call or view for next week’s meeting, anything can happen in what has been an extremely unpredictable Fed that virtually no one has gotten right this year as they deviated so much from their “guidance” due to inflation surprising so much on the upside.

Even Wilson’s more hawkish view than consensus at the beginning of the year, which was the primary feature of Wilson’s Fire and Ice narrative, was far surpassed as the Fed was forced to play catch up in a way that was totally mispriced by markets just 6 months ago. We can’t say that today with the curve inverted and the terminal rate still 175 basis points above the current Fed Funds rate.

As a final comment for equity investors to consider, Wilson asks if the Fed was so off on its guidance this year due to the surprising economic and inflation outcome, perhaps this is a precursor to how bad company guidance for the year will turn out to be.

The bottom line for the Uber-bearish strategist is that “the Fed is looking more like the ECB this cycle in that they are likely to still be tightening when recession arrives this time making the window to trade the pause much shorter than usual with less upside as well.” Unless, of course, one successfully frontruns the crowd and buys when everyone else is selling just as the Fed capitulates and pivots, sending risk assets into orbit if only for a few seconds…

Much more in the full note from Wilson available to pro subscribers in the usual place.

Tyler Durden

Mon, 07/25/2022 – 15:45