Key Events This Monster Week: Rate Hike, Earnings Juggernaut, Recession Confirmation And Much More

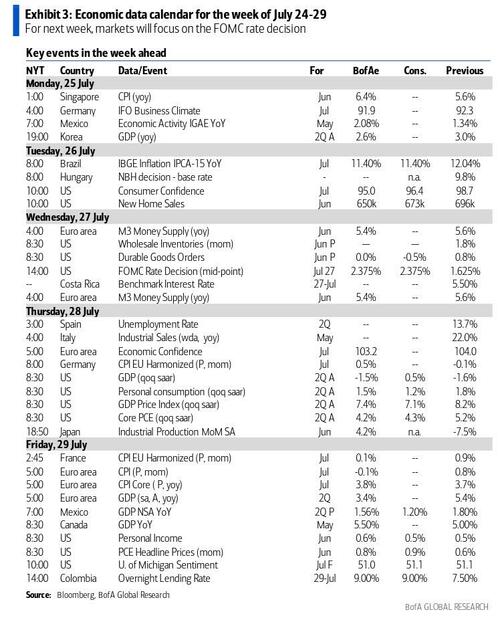

If last week was all things European (Gas, Italy, the ECB, one step closer to a recession), this week belongs to the US with the highlight being the FOMC concluding on Wednesday.

Unless we hear otherwise in a newspaper over the next 48 hours, the Fed is expected to raise rates 75bps, but DB’s Jim Reid goes through some of the nuances below. An important US Q2 GDP number on Thursday will tell us whether we’re in a technical recession or not (Atlanta Fed tracker -1.6%, but Biden is frontrunning the negative print by pretending 2 quarters of negative GDP no longer means a recession). Expect lots and lots of headlines if we are and even more headlines explaining why we aren’t actually.

In case you thought it was safe to take your eye off Europe though, on Thursday and Friday we will also sees multiple Q2 GDP and CPI releases. Don’t forget as well that Putin has suggested that if the turbine is not back early this week then gas flow may fall to 20% capacity even though originally this turbine wasn’t expected to be needed until September. So watch out for gas politics.

Elsewhere we have US durable goods (Wednesday), consumer confidence numbers (tomorrow), spending and income data (including the important core PCE deflator), and final consumer confidence numbers with the important revisions to inflation expectations to round out a big macro week on Friday.

The micro will also be significant with 166 S&P 500 and 197 Stoxx 600 companies reporting, including results from the BigTech, oil majors and key consumer-focussed companies.

“Big week ahead with the Fed likely to go ahead with another jumbo rate hike and 30% of S&P 500 companies reporting earnings this week — including the big tech,” said Charu Chanana, market strategist at Saxo Capital Markets. “Investors are being cautious and closing their positions ahead of the slew of risk events.”

Focusing on the Fed, DB’s economists expect +75bps this week (to 2.375%) followed by +50bps hikes in September and November, with a further +25bps in December until a terminal rate of 4.1% is reached which is notably above ever lower market pricing of 3.3%. There won’t be new economic projections in this meeting so all focus will be on how the Fed guides us in a world where no-one should really believe central bank forward guidance anymore as it’s proved very unreliable over the last year. However the market will still devour clues as to whether the committee are leaning towards 50 or 75 for September. To be fair there are two CPIs before then so it’s likely the Fed don’t really know at the moment.

In terms of the press conference, it will be interesting to see how Powell navigates the line between tackling inflation and supporting growth, especially now that Democrats have their knives out for the Fed chair. That said, the market is increasingly pricing a more dovish pivot at some point early in 2023, with odds a full rate cut in Q1 rising to 100% on Friday before easing on Monday, so all eyes on how firm Powell is that inflation is the number one priority or whether he looks set to blink on growth weakness.

Turning to corporate earnings, it will be a busy week filled with results from the BigTech, oil majors and key consumer-focussed companies. Starting with the former, Microsoft, Alphabet (tomorrow), Meta (Wednesday), Apple and Amazon (Thursday) all report. Notable hardware tech firms reporting include NXP Semiconductors (today), Texas Instruments (tomorrow), SK Hynix, Qualcomm, Lam Research (Wednesday), Samsung, Intel (Thursday) and Sony (Friday).

In commodities, oil majors Shell, Total Energies (Thursday), Exxon and Chevron (Friday) will be among the largest companies reporting. Utilities will be in focus too amid energy concerns in Europe, with results due from Iberdrola (Wednesday), Enel, EDF and EDP (Thursday). Finally, key players in materials like Rio Tinto (Wednesday), Vale and Anglo American (Thursday) will also report. Industrial highlights include Raytheon Technologies (tomorrow) and Honeywell (Thursday). In healthcare, Pfizer, Merck and Sanofi (Thursday) will release. Major automakers releasing include General Motors (tomorrow), Mercedes-Benz, Ford (Wednesday) and Volkswagen (Thursday). In staples and food, the spotlight will be on Coca-Cola, McDonald’s, Unilever and Mondelez (tomorrow), Kraft Heinz (Wednesday), Nestle and AB InBev on Thursday and Procter & Gamble and Colgate-Palmolive on Friday.

Courtesy of DB Day-by-day calendar of events

Monday July 25

Data: US July Dallas Fed manufacturing activity index, June Chicago Fed national activity index, Japan June nationwide and Tokyo department store sales, Germany July IFO survey, UK July CBI survey

Earnings: Newmont Corp, NXP Semiconductors, Ryanair

Tuesday July 26

Data: US July Conference Board consumer confidence index, Richmond Fed manufacturing index, June new home sales, May FHFA house price index, Japan June services PP

Central banks: BoJ minutes of the June meeting

Earnings: Microsoft, Alphabet, Visa, LVMH, Coca-Cola, McDonald’s, UPS, Texas Instruments, Raytheon Technologies, Unilever, Mondelez, 3M, General Electric, UBS, General Motors, ADM, Chipotle, Deutsche Boerse

Other: IMF economic outlook update, EU’s energy ministers meet

Wednesday July 27

Data: US June advance goods trade balance, wholesale and retail inventories, durable and capital goods orders, pending home sales, China June industrial profits, Germany August GfK consumer confidence index, France July consumer confidence index, Eurozone June M3, Italy July consumer confidence index, manufacturing confidence, economic sentiment, June hourly wages

Central banks: Fed’s decision.

Earnings: SK Hynix, LG Chem, Equinor, United Microelectronics, Meta, T-Mobile, Qualcomm, Bristol-Myers Squibb, Boeing, Airbus, Rio Tinto, Kering, Iberdrola, Lam Research, Mercedes-Benz, Boston Scientific, Shopify, Ford, Kraft Heinz, BASF, Universal Music Group, Danone, Hilton, Vici, Spotify, Credit Suisse

Thursday July 28

Data: US Q2 GDP, personal consumption, core PCE, initial jobless claims, July Kansas City Fed manufacturing activity index, Germany July CPI, France June PPI, Italy May industrial sales, Eurozone July economic, industrial and services confidence

Central banks: ECB’s Visco speaks

Earnings: Samsung, Apple, Amazon.com, Petrobras, Vale, Mastercard, Nestle, Pfizer, Merck, Thermo Fisher Scientific, L’Oreal, Comcast, Intel, Shell, Linde, TotalEnergies, Sanofi, Honeywell, AB InBev, Volkswagen, Schneider Electric, Air Liquide, Enel, Valero, Santander, EDF, Stellantis, Anglo American, STMicroelectronics, Capgemini, Telefonica, Barclays, PG&E, ArcelorMittal, EDP, BT, Repsol, Roku, First Solar, Hertz, Leonardo

Friday July 29

Data: US Q2 employment cost index, June PCE deflator, personal income, personal spending, July MNI Chicago PMI, Japan July Tokyo CPI, consumer confidence index, June retail sales, jobless rate, industrial production, housing starts, France July CPI, Q2 GDP, June consumer spending, Germany Q2 GDP, July unemployment change, Eurozone and Italy Q2 GDP and July CPI, UK June consumer credit, mortgage approvals, M4, Italy June PPI, Canada May GDP

Central banks: BoJ summary of opinions

Earnings: Sony, Exxon, Procter & Gamble, Chevron, AbbVie, AstraZeneca, Colgate-Palmolive, BNP Paribas, Eni, Intesa Sanpaolo, LyondellBasell, Engie, BBVA, NatWest, Citrix

* * *

Finally, focusing on just the US, the key economic data releases this week are the Q2 GDP advance release on Thursday, as well as the employment cost index, core PCE, and University of Michigan consumer sentiment reports on Friday. The July FOMC meeting is this week, with the release of the statement at 2:00 PM ET on Wednesday, followed by Chair Powell’s press conference at 2:30 PM.

Monday, July 25

10:30 AM Dallas Fed manufacturing index, July (consensus -22.0, last -17.7)

Tuesday, July 26

09:00 AM FHFA house price index, May (consensus +1.5%, last +1.6%)

09:00 AM S&P/Case-Shiller 20-city home price index, May (GS +1.5%, consensus +1.50%, last +1.77%): We estimate that the S&P/Case-Shiller 20-city home price index rose by 1.5% in May, following a 1.77% (21.2% yoy) increase in April.

10:00 AM Richmond Fed manufacturing index, July (consensus -15, last -11)

10:00 AM Conference Board consumer confidence, July (GS 97.5, consensus 96.8, last 98.7): We estimate that the Conference Board consumer confidence index decreased by 1.2pt to 97.5 in July, reflecting weak signals from other confidence measures.

10:00 AM New home sales, June (GS -9.0%, consensus -5.0%, last +10.7%): We estimate that new home sales declined 9.0% in June, following an 10.7% increase in May.

Wednesday, July 27

08:30 AM Advance goods trade balance, June (GS -$102.5bn, consensus -$103.1bn, last -$104.3bn): We estimate that the goods trade deficit decreased by $1.8bn to $102.5bn in June compared to the final May report, reflecting a decrease in imports.

08:30 AM Durable goods orders, June preliminary (GS -2.0%, consensus -0.3%, last +0.8%); Durable goods orders ex-transportation, June preliminary (GS +0.3%, consensus +0.2%, last +0.7%); Core capital goods orders, June preliminary (GS +0.5%, consensus +0.2%, last +0.6%); Core capital goods shipments, June preliminary (GS +0.5%, consensus +0.4%, last +0.8%): We estimate that durable goods orders declined 2.0% in the preliminary June report, reflecting a pullback in net commercial aircraft orders. However, we expect a continued rise in new orders of core capex equipment, reflecting higher prices and a possible rebound in East Asian demand.

10:00 AM Pending home sales, June (GS -5.0%, consensus -1.0%, last +0.7%): We estimate that pending home sales declined 5.0% in June, following a 0.7% increase in May.

02:00 PM FOMC statement, July 26-27 meeting: As discussed in our FOMC preview, we expect a 75bp rate hike at the July FOMC meeting. The key question for this week is what guidance Chair Powell will provide regarding the size of a likely rate hike in September. Powell will likely emphasize that the Committee will remain nimble and data-dependent, though he might also offer gentle reminders that 75bp hikes are unusually large and that the funds rate is now at the FOMC’s estimate of its longer-run level. We continue to expect a 50bp hike in September and 25bp hikes in November and December to a terminal rate of 3.25-3.5%.

Thursday, July 28

08:30 AM GDP, Q2 advance (GS +0.5%, consensus +0.5%, last -1.6%): Personal consumption, Q2 advance (GS +1.2%, consensus +1.2%, last +1.8%): We estimate that GDP growth rose +0.5% annualized in the advance reading for Q2, following the 1.6% annualized decline in Q1. Our forecast reflects a slowdown in consumption growth (to +1.2%) and sizeable declines in business structures (-7.9%) and residential (-10.5%) investment. We also expect a negative contribution from slower inventory growth (-1.4pp) but a boost from normalization in net exports (+1.8pp contribution). We estimate domestic final sales rose 0.3% (qoq ar). We will finalize our forecast after Wednesday’s foreign trade and inventory data.

08:30 AM Initial jobless claims, week ended July 23 (GS 245k, consensus 255k, last 251k); Continuing jobless claims, week ended July 16 (consensus 1,380k, last 1,384k): We estimate initial jobless claims declined to 245k in the week ended July 23.

11:00 AM Kansas City Fed manufacturing index, July (consensus +4, last +12)

Friday, July 29

08:30 AM Employment cost index, Q2 (GS +1.2%, consensus +1.1%, prior +1.4%): We estimate that the employment cost index (ECI) rose 1.2% in Q2 (qoq sa), which would boost the year-on-year rate by four tenths to 4.9%. The ECI is running below other wage growth measures, and while average hourly earnings decelerated in Q2, the Atlanta Fed Wage Tracker strengthened further. We nonetheless assume a sequential slowdown, as the 1.4% ECI pace in Q1 received a boost from larger-than-normal annual raises. We also assume another drag from incentive-paid industries (worth -0.1pp for headline ECI qoq sa), reflecting the sharp deterioration in the real estate market as well as further normalization in the credit intermediation industry.

08:30 AM Personal income, June (GS +0.6%, consensus +0.5%, last +0.5%); Personal spending, June (GS +1.1%, consensus +0.9%, last +0.2%); PCE price index, June (GS +0.92%, consensus +0.9%, last +0.59%); PCE price index (yoy), June (GS +6.75%, consensus +6.7%, last +6.35%); Core PCE price index, June (GS +0.56%, consensus +0.5%, last +0.35%); Core PCE price index (yoy), June (GS +4.76%, consensus +4.7%, last +4.69%): Based on details in the PPI, CPI, and import prices reports, we estimate that the core PCE price index rose by 0.56% month-over-month in June, corresponding to a 4.76% increase from a year earlier. Additionally, we expect that the headline PCE price index increased by 0.92% in June, corresponding to a +6.75% increase from a year earlier. We expect that personal income increased by 0.6% and personal spending increased by 1.1% in June.

09:45 AM Chicago PMI, July (GS 50.0, consensus 55.0, last 56.0): We estimate that the Chicago PMI declined 6pt to 50.0 in July, reflecting declines in other business surveys and a sentiment drag from the European gas crisis.

10:00 AM University of Michigan consumer sentiment, July final (GS 51.0, consensus 51.1, last 51.1): University of Michigan 5-10 year inflation expectations, July final (GS 2.8%, consensus 2.8%, last 2.8%): We expect the University of Michigan consumer sentiment index ticked down to 51.0 and that the 5-10 year inflation expectations measure remained unchanged at 2.8% in the final July reading.

Source: DB, BofA, Goldman

Tyler Durden

Mon, 07/25/2022 – 09:31