Goldman Desk: We Now Have An Answer Whether “Long-Only” Demand Would Return After Barrage Of Soft Earnings

Back on Thursday, we wrote that according to the Goldman flow desk, “most clients were hating this rally“, sentiment which Nomura’s Charlie McElligott picked up on that same day when he wrote that the risk over the near term is a “further pile-on to the crowd who has expected another surge lower in stocks, instead squeezing their shorts and accelerating the enormous Systematic buying already going through as CTAs cover and flip long.”

We also wrote that – for at least a few hours – it appeared that the most steadfast bears who are recently capitulated bulls, and who according to the latest BofA Fund Manager Survey, are now the most pessimistic on record – are starting to capitulate yet again, this time calling a bottom to stocks, and are starting to buy. Indeed, as Goldman flow trader John Flood wrote in in his Thursday end of day wrap, “some noteworthy long-only clients have now started to passively buy on our desk throughout the day (velocity picked up this afternoon as mkt moved higher)” adding that “executed flow across US equities franchise had +338bp buy skew vs 30d avg of -30bp sell skew. L/Os buy skew +9.8% was highest here since since 6/30.”

That said, before concluding that this is more than just another bear market rally, Flood wrote that “it will be interesting to see if this “long-only” momentum will sustain into Friday post “a slew of relatively disappointing earnings” post close, from companies such as SNAP, COF, CRSR, SAM, SIVB, STX.

Well, fast forward to Friday when despite strong earnings from American Express, the post-SNAP disappointment was just too great and risk sentiment collapsed. And so, picking up on his rhetorical question from Thursday, Goldman’s Flood – who had said that “it will be interesting to see if this “long-only” momentum will sustain post the barrage of poor earnings from SNAP, COF, CRSR, SAM, SIVB, STX – wrote in his Friday end of day wrap that he had an answer: “As of close today answer ending up being a hard no RE if the L/O demand would come back post a sleeve of soft earnings.”

But while this week ended inconclusively, it is “next week that when will certainly find out where the bodies lie as 50% of S&P’s mkt cap reporting paired with FOMC likely forces active managers to show their hands.”

Here are a few other points, courtesy of Goldman’s Prime Brokerage, which show that most hedge funds continue to dump risk into this “most unloved” rally:

Avg U.S. Fundamental HF +371bps on the week bringing ytd performance to -15.71%. Fundamental L/S Gross leverage +2.0 pts to 172% (26th percentile 1-year) and Net leverage +3.2 pts to 49% (15th percentile 1-year).

The Prime book was net bought for the 1st time in 4 weeks (+0.6 SDs 1-year), though flows were definitively risk-off with short covers outpacing long sales 2.3 to 1 – this week’s $ short covers were the largest since Dec ’21. Macro Products (Index and ETF combined) were net bought led by short covers, while Single Stocks were net sold for a 3rd straight week driven by long sales.

Unloved rally in to today as hedge funds covered ETF shorts and unwound Single Stock risk at the fastest pace since March. US-listed ETF shorts were net covered for 8 straight days, while US Single Stocks were net sold for 7 straight days driven by long sales and to a lesser extent short covers.

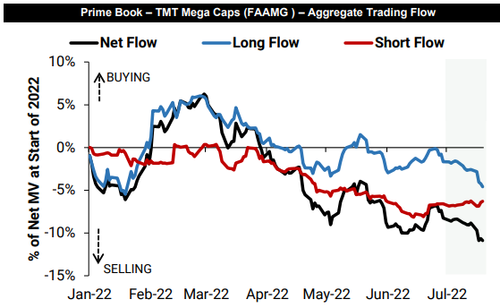

Managers remain highly cautious on the TMT mega caps and further reduced exposures heading into earnings next week. The current FAAMG Net exposure (as % of the overall Prime book) ranks in the 7th percentile vs. the past year and in the 3rd percentile vs. the past five years.

Finally, there are two key factors that can change the risk dynamic next week: the return of buybacks, and acceleration of buying from CTAs. Here is Flood again:

Corporates have been the most consistent buyer of the US stock market this year. $1.3T in authorizations for this year ($1.1T of which we think will be executed…the most ever). That being said our buyback desk has been relatively quiet the last 2 weeks as corps firmly in blackout period. Our model shows blackout period ending post close today. AKA expect corp bid to return to the mkt next week.

CTAs: have $5b of S&P to buy per week at these levels. North of 4070 (long term momentum) this demand essentially doubles.

More in the full note available to pro subscribers.

Tyler Durden

Sat, 07/23/2022 – 16:00