There’s An Amazing Glut Of Office Space In Every Major Metro Area

Authored by Mike Shedlock via MishTalk.com,

Occupancy is an engine of local economies. But there’s a huge glut of space available…

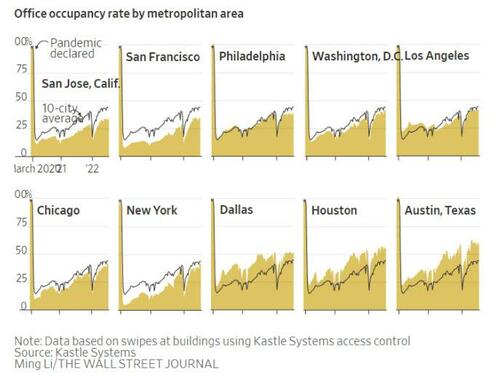

Office Swipe rates via WSJ

A Glut of Office Space

The Wall Street Journal reports Big Cities Can’t Get Workers Back to the Office

More than two years into the Covid-19 pandemic, exasperation is growing among business, city and community leaders across the U.S. who have seen offices left behind while life returns to normal at restaurants, airlines, sporting events and other places where people gather. Even after many employers have adopted hybrid schedules, less than half the number of prepandemic office workers are returning to business districts consistently.

The problem is most pronounced in America’s biggest cities. Nationally, office use hit a pandemic-era high of 44% in early June, while cities like Philadelphia, Chicago, San Francisco and New York have lagged behind, according to Kastle Systems, which collects data on how many workers swipe into office buildings each day.

From April 2020 to March 2021, 26,300 New York City small businesses closed permanently, according to a report the mayor released in the spring. Available office space in New York has grown to about 125 million square feet, up from 90 million in the first quarter of 2020, according to data firm CoStar Group Inc. Retail rents in Manhattan have declined for 18 consecutive quarters, starting well before the pandemic, according to commercial real estate services firm CBRE Group Inc.

One issue for workers in big cities is time spent in transit. New York, Washington, D.C., San Francisco and Chicago have some of the nation’s longest commute times—as well as some of the lowest return-to-office rates, according to a Wall Street Journal analysis of the country’s 24 largest metropolitan areas in May.

More than 25% of the employers surveyed by Gartner at the end of March said they were providing free lunch or snacks to workers to lure them back to offices. Five percent said they were subsidizing or reimbursing commuting costs.

Smokestack Chasing, Would You Move to Tulsa OK or Greensburg IN?

Adding to the glut of office space, companies like Airbnb have adopted work from anywhere policies.

In addition, some workers have just had enough of huge metro area and are attracted to places like Tulsa Oklahoma.

For discussion, please see Smokestack Chasing, Would You Move to Tulsa OK or Greensburg IN?

Smokestack chasing is very small scale. But it is symptomatic of the desire of some to do anything to avoid lengthy commutes or pay astronomical prices for apartments close to major downtown areas.

My Experiences

When I was in corporate America, close to 20 years at Harris Bank in downtown Chicago. I liked the comradery and social interaction at the office.

When I got married, my wife insisted on moving away from the crime to the suburbs. She was mugged (purse snatch) where we had an apartment.

That led to a one hour and twenty minute commute on the train plus another 20 minutes to get to the train. I despised that commute.

I left Harris as a consultant in 2000 but that had me on the road in New York City, then Elgin (only a 20 minute drive), then Minneapolis.

I did not mind the plane travel actually. Every other weekend I would fly home and the other weeks my wife would fly in. We got to see the east coast. Minneapolis was an alternate week drive,

After 9/11, consulting jobs dried up and I was out of work for nearly three years. I know full well the depression of being out of a job.

In 2003, I was unemployed, hanging around on stock message boards on Silicon Investor. Calculated Risk (Bill McBride) was one of the participants on my forum.

He started his blog and created the template for my blog. We went on to become two of the top three economic bloggers in the county in terms of traffic. I survived on ad revenue.

Occasionally, I would have the most traffic in month but usually it was Barry Ritholtz or Calculated Risk.

I owe a lot to Calculated Risk, also Barry Ritholtz. The latter promoted my blog frequently in the early going.

Now I could not fathom working for anyone but myself, out of my house or on the road wherever I am doing photography.

By the way, I believe I have written a blog post every day, 365 or 366 days a a year without missing a single day since March 2003. On Christmas and New Years it was typically just Merry Christmas or Happy New Year, but it was something every day.

Existing Home Sales Dive Another 5.4 Percent in June, Down Fifth Month

The weakness in housing accelerates further in June. Existing home sales are down 21.1 percent since January.

For discussion, please see Existing Home Sales Dive Another 5.4 Percent in June, Down Fifth Month

Also note Single-Family Housing Starts and Permits Dive Eight Percent in June

Single-family has weakened from 1,220,000 starts in November 2021 to 982,000 in July 2022. That’s a 19.5 percent decline.

Both residential and office space are under severe pressure.

* * *

Tyler Durden

Thu, 07/21/2022 – 09:28