SNAP Craters 25% After Reporting Weakest-Ever Growth, Removes Q3 Guidance, Drags Down All “Socials”

For the third quarter in the past four, SNAP stock has cratered after reporting catastrophic earnings.

Having plunged three months ago after slashing already dismal guidance, SNAP stock tumbled a whopping 25% moments ago when we learned that not only had it not cut enough, and reported revenue that missed, but was also the lowest growth on record.

Here is how the company did in yet another catastrophic quarter:

Revenue $1.11 billion, missing the estimate $1.14 billion, and growing just +13% y/y, the lowest on record.

Adjusted loss per share 2.0c vs. EPS 10c y/y, estimate loss/shr 4.6c

Adjusted Ebitda $7.19 million, -94% y/y, estimate loss $1.24 million

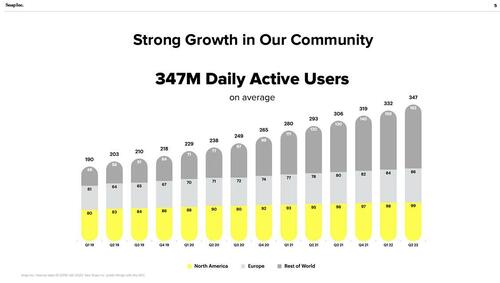

There was some good news in the daily active users which at 347 million, actually beat estimates of 343.2 million

North America daily active users 99 million, +4.2% y/y, estimate 99.1 million

Europe daily active users 86 million, +10% y/y, estimate 85 million

Rest of world daily active users 162 million, +35% y/y, estimate 157.9 million

Tragically, in a time when tech companies are firing everyone, SNAP still has the same colorblind in house graphic designer.

Of course, with more users than expected and less revenue, it meant just one thing: the monetization disappointed and sure enough, ARPU of $3.20, not only was lower vs 2021, down 4.5% y/y, but missed estimates of $3.37

North America average revenue per user $7.93, +7.6% y/y, estimate $8.16

Europe average revenue per user $1.98, +1.5% y/y, estimate $2.11

Rest of world average revenue per user 96c, -10% y/y, estimate $1.05

And yes, unlike Tesla, SNAP did not have any bitcoin to sell: Negative free cash flow $147.5 million, +27% y/y, estimate negative $52.3 million.

Commentary was also ungood: “We are also seeing increasing competition for advertising dollars that are now growing more slowly. Our revenue growth has substantially slowed.”

So yes, earnings were terrible, but it’s what the company said elsewhere that was even worse, starting with the decision not to provide any Q3 financial guidance whatsoever, and only tentatively predicting 360 million in DAUs, but with the Twitter-Musk fiasco in the background, we all know these are all just fake bots and what not.

Worse, the company also said that thus far in 3Q, revenue was “approximately unchanged” on a year-over-year basis, which means that “growth” is about to go into reverse.

And now that SNAP is no longer a growth company, it means it’s time for “streamlining” – sure enough, SNAP said it would slow the rate of hiring and rate of operating expense growth.

SNAP also announced that co-founders Bobby Murphy and Evan Spiegel signed new long-term employment pacts through at least Jan. 1, 2027, for $1 per year and no equity compensation. The Board agreed to stock split in form of a dividend of one Class A share for each outstanding Class A share if the Class A share price reaches $40 within the next 10 years; would allow co-founders to donate or sell additional Class A shares instead of donating or selling Class B or Class C shares

And most remarkably, even though the company authorized a new $500 million stock repurchase program over the next 12 months to offset a portion of dilution related to the issuance of restricted stock units to employees, the stock still cratered over 25% after hours following these absolutely catastrophic numbers.

The results were so horrific they dragged down all social peers: Facebook -2.3% and Pinterest -3.1%, Twitter, which is mired in a legal battle with Elon Musk, is down 1.7% (ahead of its results tomorrow). Even Google, which also derives revenue from online advertising, is down 1.8%.

And cure the return of the “recession is coming” panic which stocks so gingerly managed to tapdance around for the past three days…

Tyler Durden

Thu, 07/21/2022 – 16:39