Euro Tumbles, Spreads Blow Out As Market Realizes ECB’s TPI Is Just Another Useless Word Salad

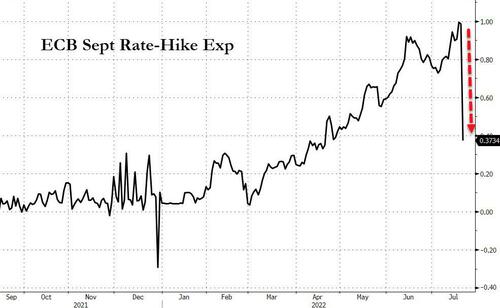

Initially, both European bonds and the EURUSD moved higher after the ECB unveiled a higher than expected 50bps rate hike (although the same as leaked, so the ECB effectively destroyed any remaining credibility its forward guidance may have had). However, barely had the EURUSD hit session highs when the doubts started to spread, starting with Lagarde confirmation during the ECB presser that the central bank’s prior guidance for a September rate move no longer applies, and as we showed earlier, the market immediately started pricing in a much lower rate hike in two months as it priced in a much more rapid onset of the recession thanks to the ECB tightening conditions more than expected just as the economy contracts.

It only went downhill from there – quite literally in the case of the euro – with the common currency tumbling from session highs to session lows, taking out the pre-ECB level to the downside…

… while the infamous “lo spread” (between Italian and German yields) blew out to session highs…

… for one simple reason: the market realized that the ECB’s newly unveiled Transmission Protection Instrument (TPI) – because Italy specific QE sounds a little gauche – is just another OMT-like word salad, which is meant to scare markets and never to be actually implemented practically. Here’s why:

First, as Lagarde explained, the ECB alone will decide where to deploy this “crisis tool” and that all eur-area members are eligible for the TPI.

Here is what she said: “obviously the Governing Council is going to conduct a thorough assessment of the situation in the affected countries. And the decision to begin TPI purchases, as I said, will be in the entire discretion of the Governing Council.”

She added that “TPI is a program that is designed to address a specific risk that all euro-area countries can face” and “now clearly, to assess whether you have unwarranted disorderly market dynamics, the Governing Council will take into account, multiple indicators to determine the warranted versus unwarranted.”

While it is great that every European country is viewed as a potential crisis by the ECB, what is troubling is that the decision on access will be made by the Governing Council. There is still no detail on how that decision will be made, but it seems then ECB is taking a lot of discretion on how and where it will help close bond spreads. Even Bloomberg writes that “for the central bank this seems like a very dangerous path to be on. If the GC disagrees on a country’s fiscal stance or on some other politically controlled factor then it is risking becoming a very politicized organization.” For a vivid example of this just ask Sylvio Berlusconi who lost his job in 2011 after the ECB decided to not buy Italian bonds, sending their yields through the roof.

Second, and more important however, is Lagarde’s disclosure of the four specific eligibility criteria for TPI as she claims that “the ECB determines in its own discretion, not hostage to anyone.” The conditions are the following:

Compliance with EU fiscal framework, borrowing from the European Commission

Absence of severe macroeconomic imbalances, again borrowing from the Commission

Fiscal sustainability, taking into account European Commission analysis and others such as IMF

Sound policies that are in line with the country’s commitment to the recover fund plans

There is a problem with this: since the TPI is meant to rescue Italy, if these conditions are closely adhered to, it will make TPI usage in the case of Italy impossibly, or as some sarcastically pointed out, Italy will surely be in “compliance” after the elections in Sept/Oct:

⚠️ The four country criteria for the ECB’s TPI:

1. Compliance with EU fiscal rules

2. Absence of severe macro imbalances

3. Fiscal/debt sustainability

4. Sound & sustainable macro policies

Chances of BTPs not meeting these criteria come Sep/Oct pretty high… no?$EUR

— Viraj Patel (@VPatelFX) July 21, 2022

And then there is the actual practical impact of TPI implementation. Or not, because as Bloomberg’s Alex Weber notes, the ECB also doesn’t detail how exactly it plans to ensure that TPI purchases won’t interfere with the overall monetary stance. They just promise it won’t happen:

“In order to avoid potential interference with the appropriate monetary policy stance, should the TPI be activated, the Governing Council will address the implications of the TPI purchases for the scale of the aggregate Eurosystem monetary policy debt security portfolio and the amount of excess liquidity. Purchases under the TPI would be conducted such that they cause no persistent impact on the overall Eurosystem balance sheet and hence on the monetary policy stance.”

Last but not least, is the ECB sneaking into the TPI’s bizarro term sheet that private sector securities will also be eligible for purchases!

This means the next time Putin shuts off the gas and Italian yields go stratospheric, the ECB will just start buying Italian corporates…. and why stop there, when you can go all in on European ETFs next.

Bottom line: yes, the ECB surprised with a bigger than expected rate hike, but realizing that the TPI is just another meaningless, unusable word salad, the market has sent the euro tumbling and Italian yields blowing out so wide, that the TPI may have to be used before the end of the day at this rate. Or as we put it…

You ask for miracles, EUR shorts, i give you the E… C… B…. pic.twitter.com/uItxKZRzFq

— zerohedge (@zerohedge) July 21, 2022

Tyler Durden

Thu, 07/21/2022 – 10:10