Bonds & Big-Tech Surge As Ugly Data Hammers Rate-Hike Hopes

ECB hiked rates (50bps) for the first time in 11 years and attempted a word-salad to explain their defragmentation ‘tool’ to save spreads from blowing out. In the US, there was more ugly data today with 8-month highs for initial jobless claims and Philly Fed plunging to COVID-lockdown lows (and AT&T admits Americans can’t afford to pay their phone bills?!)

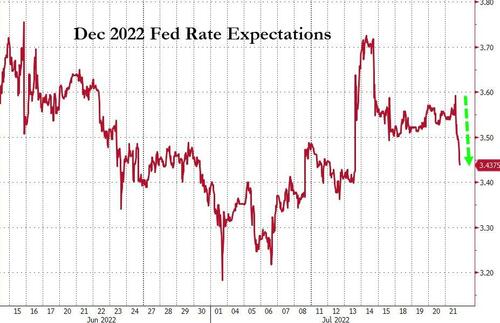

This prompted a very dovish dive in rate-hike expectations

Source: Bloomberg

Additionally expectations for a rate-cut in Q1 are re-accelerating…

Source: Bloomberg

As Curvature’s Scott Skyrm notes, after the rally today, the market is only pricing a 15% chance of a 100 basis point tightening next week. Of course, 75 basis points is still fully priced-in.

Source: Bloomberg

The market expect fed funds to peak in February 2023 at 3.47% and then begin to decline after that, pricing a 25 basis point ease just a few months later.

Source: Bloomberg

US Treasuries were aggressively bid today after the ugly data with the belly of the curve dramatically outperforming (5Y -15bps, 30Y -8bps). Today’s rally erased all the week’s losses, pushing short-end yields lower on the week…

Source: Bloomberg

Today’s puke smashed 10Y yields back below 3.00% once again…

Source: Bloomberg

European bond spreads widened significantly (though did compress a little towards the close) despite The ECB

Source: Bloomberg

Put another way, this was the market’s reaction to The ECB’s new tool…

US bond yields began to recouple with stocks today…

Source: Bloomberg

Big-Tech led the charge higher in stocks though with Nasdaq up over 1% and Small Caps lagged but in the last 5 mins, everything melted up…

Two names that stood out in equity land were AT&T (crashing) and Tesla (not crashing)…

AT&T crashed by the most in 20 years after unpaid bills (yes the strong consumer can’t afford to pay its bills) contributed to the barrier cutting free cash flow forecasts…

TSLA spiked back above $800 after solid earnings last night…

US Cyclical stocks are up 5 straight days as defensives remains around flat…

Source: Bloomberg

The short-squeeze of the last few days appeared top run out of ammo today…

Source: Bloomberg

The dollar ended the day flat today, but a volatile day in the euro sparked some chaotic swings intraday…

Source: Bloomberg

Bitcoin ended marginally lower but managed to hold on to $23,000 (erasing the kneejerk losses after TSLA reported selling)…

Source: Bloomberg

Oil prices tumbled today as demand fears eased (ECB hike and gasoline inventories in the US) along with supply improving (Libya and Gazprom). This sent WTI back below $100…

Gold rebounded back above $1700 today

Finally, we note that silver – which tested down to $18 earlier in the week – remains significantly ‘cheap’ relative to gold here…

Source: Bloomberg

If the market is really starting to price in a return to a dovish Fed, then is silver a better bet than gold here?

Tyler Durden

Thu, 07/21/2022 – 16:00