Rabobank: “We Are Not Convinced Of The Case For An “Unexpected” 50bps Hike By The ECB”

By Philip Marey, Senior US Strategist at Rabobank

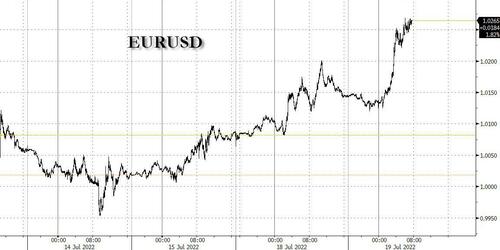

EUR/USD jumped above 1.02 yesterday morning after reports that the ECB may consider a 50 bps hike on Thursday, instead of the 25 bps outlined at the June policy meeting.

In contrast, during the weekend, the Fed entered its blackout period after Fed speakers pushed back against the possibility of a 100 bps rate hike on July 27. The idea of an even larger than 75 bps hike gained traction in markets after the US CPI data surprised to the upside on July 13. However, with Fed speakers less enthusiastic about 100 bps than markets, the latter have moderated their expectations and at the moment futures markets are pricing in only about 81 bps for the July meeting. These diminished expectations are also keeping the upward potential for 10 year US treasury yields in check and the downward potential for EUR/USD, which has been trading above parity again this week.

While the Fed has been slow to react to the rise in inflation that started last year, the ECB has had an even longer sleep. This has contributed to EUR/USD falling to parity, but speculation about a more aggressive move by the ECB this week is causing a modest rebound of the euro.

The timing of this report certainly strikes us as odd. Our ECB watcher Bas van Geffen notes that if there was serious and (near) unanimous concern about the inflation outlook, and the Council was genuinely preparing for a 50bp hike, they could have started flagging that possibility well before their blackout period. Yesterday’s final release of the June inflation data confirms that the modest decline in core inflation was largely the result of the German government’s decision to offer public transit tickets at steep discounts, and this arguably adds to the ECB’s worries about the stickiness of inflation. However, we find it hard to believe that the ECB hadn’t already drawn these conclusions when the preliminary data were released earlier this month. In other words, little seems to have changed since the start of the blackout period. And we are therefore still not entirely convinced of the case for an ‘unexpected’ 50, although the upside risk of a 50bp move has risen with these reports and the resulting shift in market pricing ahead of the meeting.

After all, a bigger hike may be used as a bargaining chip in the difficult discussions on the anti-fragmentation instrument – which may become a heated debate if Lagarde pushes for a decision on the instrument at this meeting, as reported yesterday as well. And these ‘leaks’ should therefore also be seen in light of the horse-trading between the hawks and the doves in the ECB’s Governing Council, in contrast to the coordinated signal given by the Fed’s Board of Governors to the Wall Street Journal prior to the Fed’s 75bps (instead of 50bps) hike last month. As our ECB watchers explain, the hawks are probably increasingly concerned that their window of opportunity to hike is closing as the economy slows. Assuming that the ECB does announce the Transmission Protection Mechanism (TPM), we cannot rule out that it is accompanied by a 50bp hike: it could be the carrot that west the hawks on board with looser TPM modalities. However, we believe that the Council prefers to wait and see how their new instrument is received by markets.

For the Fed, which meets next Tuesday and Wednesday, we expect a 75 bps hike, followed by 50 bps hikes at each meeting in the remainder of the year. This would raise the target range for the federal funds rate to 3.75-4.00% by the end of the year, which is more than indicated by the FOMC’s dot plot (3.4%) and futures markets (3.55%). However, we think that the Fed is still underestimating the persistence in inflation, and has yet to acknowledge that a wage-price spiral has already started in the US. US CPI inflation rose to 9.1% in June and its core measure stands at 5.9%. With shelter already at 5.6% year-on-year and rising, core inflation is likely to remain persistent. Keep in mind that shelter accounts for 41% of the core CPI and tends to lag house prices. Shelter is likely to rise above 6.0% year-on-year later this year and remain elevated next year.

At the same time, nominal wages have risen by 6.7% year-on-year in July according to the Atlanta Fed’s wage growth tracker. This does suggest that the wage-price spiral that the Fed still hopes to avert, is already here.

Tyler Durden

Wed, 07/20/2022 – 10:45