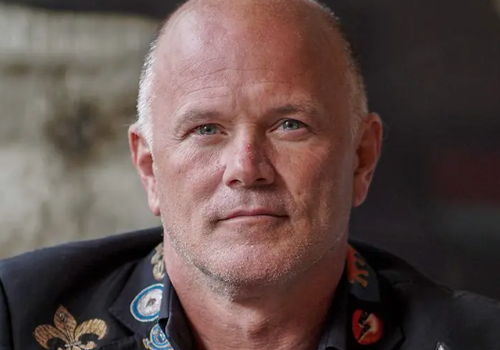

Crypto Going Through A “Full Fledged Credit Crisis”, Says Mike Novogratz In Latest Mea Culpa

Mike Novogratz is in the midst of continued crypto mea culpas in addition to having to literally wear one on his sleeve every day.

This time, Novogratz has come around on the idea of the risks of crypto leverage, admitting this week to Bloomberg that he was “darn wrong” about the “magnitude of leverage” in the crypto universe.

Novogratz said that crypto is in the midst of a “full-fledged credit crisis” at the Bloomberg Crypto Summit Tuesday. He commented: “What I don’t think people expected was the magnitude of losses that would show up in professional institutions’ balance sheets and that caused the daisy chain of events.”

“It turned into a full fledged credit crisis with complete liquidation and huge damage on confidence in the space,” Novogratz continued.

After throwing his support behind Terraform Labs, which subsequently collapsed, Novogratz told Bloomberg that he learned that both the industry and retail investors “really had very, very little concept of risk management.”

Speaking of which, it’s a great time to remind readers that Novogratz got a tattoo on his arm dedicated to Luna months before the “stablecoin” blew up.

He also took aim at the SEC for not putting into place enough regulation to stop the chaos, stating: “I don’t know what the SEC should have done, or could have done or might have done, but they didn’t do a lot to protect the retail investors.”

Recall, Zero Hedge contributor Quoth the Raven last week pointed out comments from FTX CEO and crypto-billionaire Sam Bankman-Fried that seemed to indicate blowups in the crypto lending space weren’t finished yet. Bloomberg’s Matt Levine dryly called crypto lending “the ponzi business” during the same interview.

Asked one netizen on Twitter:

Tyler Durden

Wed, 07/20/2022 – 13:05