Bitcoin Slides After Tesla Admits Dumping Most Of Its Crypto In Q1

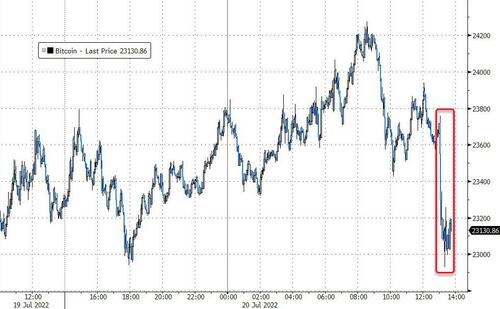

After a solid 8-day stretch of gains, which saw Bitcoin rise almost 30% and back above $24,000, the world’s largest cryptocurrency is taking a hit after hours following news from Tesla’s earnings report that the car-maker sold a majority of its Bitcoin holdings in Q1.

As a reminder, Tesla announced in early Feb 2021 that it had bought $1.5 billion of bitcoin on to its balance sheet, in anticipation of accepting the cryptocurrency as payment for its cars (which it did in March 2021 but suspended them shortly after in May after Musk proclaimed the company was “concerned about rapidly increasing use of fossil fuels for bitcoin-mining and transactions.”), and offering “more flexibility to further diversify and maximize returns on our cash.”

Given the announcement’s timing, this means that Musk’s firm was potentially buying bitcoin from November 2020 through the end of Jan 2021.

In Q1 2021, Tesla sold $272 million of its bitcoin holdings, leaving the firm with around $1.33 billion in bitcoin on its books.

No, you do not. I have not sold any of my Bitcoin. Tesla sold 10% of its holdings essentially to prove liquidity of Bitcoin as an alternative to holding cash on balance sheet.

— Elon Musk (@elonmusk) April 26, 2021

In May 2022, after Bitcoin’s collapse had begun, Tesla took a write-down part of its holdings from its cost “basis,” which, according to Forbes, stood at $30,000 per coin.

And in today’s earnings report, Tesla announces it has sold 75% of its bitcoin holdings for $936 billion.

All of which suggests that Musk sold the company’s crypto at around breakeven (75% of the $1.33 billion holding would be around $997.5 million)…

We can’t help but wonder if Tesla’s sales was designed to ensure positive free cash flow in Q2 (FCF would be negative $300 million otherwise)…

Some are arguing this is good news for the overall bitcoin market as it removes Musk’s somewhat chaotic overhang from crypto’s ecosystem.

We look forward to hearing from the man himself on why he sold now.

Tyler Durden

Wed, 07/20/2022 – 17:07