Futures Jump, Dollar Slides As Euro Surges On Hawkish ECB Report

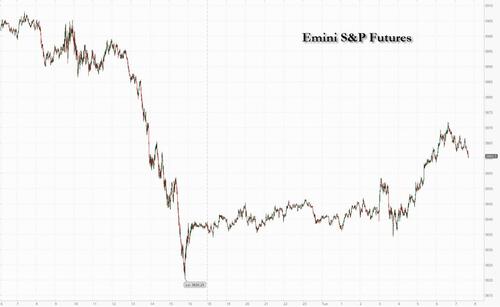

After yesterday’s sharp late-day swoon sparked by news that Apple is reining in hiring (which, of course, is expects as the US slides into recession, and is a necessary condition for the Fed to end its rate hikes), sentiment reversed overnight and US index futures climbed to session highs, rising as high as 1% just before 7am ET, as traders remained focused on the earnings season, with tech stocks set to rebound following Monday’s losses.

Nasdaq 100 and S&P 500 contracts were 0.7% higher by 7:30am in New York. Both indexes declined Monday as investors worried over the strength of the economy after Apple joined a growing number of companies that are slowing hiring.

Meanwhile, the euro soared more than 1% against the dollar after a Reuters report that the ECB may consider raising interest rates by 50 basis points because of the worsening inflation backdrop (even though this report was followed by the far more dovish Bloomberg news that “Lagarde Redoubles Push on New ECB Tool to Reach Deal This Week”). German bunds fell, while benchmark Treasuries traded little changed after paring gains following the report.

Markets are pricing in about 38 basis points of tightening on Thursday, when the ECB is expected to raise rates for the first time in more than a decade. That reflects about a 50/50 chance of a 50-basis point increase. An outsized hike would put the ECB more in line with global peers moving up their policy rates at warp speed.

Back to the US, and looking at premarket trading, cryptocurrency-related stocks gained for the second day as Bitcoin extended its rally but it was ether that stole the show, rising almost 50% in the past week. IBM dropped 5 after the IT services company cut its annual forecast for free cash flow due to the strong dollar and the loss of business in Russia. Bank stocks climb in premarket trading Tuesday amid a broader push higher by risk assets. S&P 500 futures are also higher this morning, gaining as much as 1%, while the US 10-year yield holds steady at about 2.98%. In corporate news, Veritas Capital is in talks to buy NCR Corp., according to a Dow Jones report. Meanwhile, Jefferies said it plans to spin off its Vitesse Energy unit to shareholders and sell Idaho Timber as part of a strategy to shrink its merchant-banking portfolio. Here are the other notable US premarket movers:

Exxon Mobil (XOM US) rises 1.7% in US premarket trading on Tuesday as Piper Sandler upgraded the stock to overweight from neutral, saying in a note that the setup for US energy stocks heading into 2Q earnings is looking increasingly attractive.

US cryptocurrency-related stocks gain in premarket trading, as Bitcoin rallies for a second day in a row and comes closer to the breaking of a one-month-old range. Marathon Digital (MARA US) +7.2% after entering into a five-year pact with Applied Blockchain (APLD US), which jumps 33%.

Riot Blockchain (RIOT US) +4.3%, Hut 8 Mining (HUT US) +2.9%, Coinbase (COIN US) +1.8%

IBM (IBM US) shares were down 5.1% in premarket trading, after the IT services company cut its annual forecast for free cash flow due to the strong dollar and the loss of business in Russia. Piper Sandler says FX headwinds will likely hit other technology companies too.

Cinemark (CNK US) shares gain 4.6% in US premarket trading as the stock was upgraded to overweight from equal- weight at Morgan Stanley, with the return of consumers to theaters seemingly not reflected in its shares.

Marten Transport (MRTN US) shares rose as much as 4.5% in US postmarket trading on Monday after the firm reported earnings per share for the second quarter that beat the average analyst estimate, with KeyBanc saying results show that the trucking company has seen a “hot start.”

Keep an eye on US solar stocks as Piper Sandler cut its ratings on SunRun (RUN US) and Sunnova (NOVA US) and upgraded FTC Solar (FTCI US), saying that the resilience of the sector to recession is likely to come into focus heading into 2Q earnings.

Watch Apollo (APO US) and StepStone (STEP US) shares as Morgan Stanley strategists cut the stocks to equal-weight from overweight, taking a more cautious near-term view on alternative asset managers.

Investor allocation to stocks plunged in the week through July 15 to levels last seen in October 2008, while exposure to cash surged to the highest since 2001, according to BofA’s latest fund manager survey (more details shortly). High inflation is now seen as the biggest tail risk, followed by a global recession, hawkish central banks and systemic credit events.

Signs that high inflation and monetary tightening are squeezing consumers and employment could feed into worries that an equity revival since mid-June is merely brief. Corporate updates such as Apple’s are helping markets to calibrate the risk of recession. Netflix Inc., Johnson & Johnson and Lockheed Martin Corp. headline another busy day for earnings.

“Inflation and its detrimental effect on consumers’ pockets and corporate margins is yet to be fully seen,” Mizuho strategists Peter McCallum and Evelyne Gomez-Liechti wrote in a note. “Until then, we don’t expect investors to feel properly comfortable buying on dips other than in the most defensive names.”

In Europe, Euro Stoxx 50 reversed an earlier loss of as much as 0.6% and traded 0.2% higher, at session highs. Spain’s IBEX outperformed peers, adding 0.8%. Tech, financial services and chemicals are the worst performing Stoxx 600 sectors. Here are some of the biggest European movers today:

Electricite de France shares climb as much as 15% as trading resumes after the French government offered to pay about 9.7 billion euros to fully nationalize the utility in a move welcomed by analysts, which say the deal has a high chance of success.

Wise shares jump as much as 16%. The money transfer firm’s fiscal 1Q update shows a 12% beat on revenue, Morgan Stanley (equal-weight) writes in a note, while Citi (sell) says update shows a “decent beat” on volumes and revenue, primarily driven by personal remittance business.

Informa rises as much as 5% after reporting better-than-expected preliminary 1H results while announcing the acquisition of business news site Industry Dive for $389 million. Citi says the newsflow is encouraging “across the board.”

Novartis shares gain as much as 1% after the company reported a “solid” 2Q with a surprise beat in its Sandoz generics unit, analysts say. ZKB notes that Cosentyx sales were weak, but this was offset by Sandoz and a solid performance for other drugs, such as Kesimpta.

Deliveroo shares rise for a second day following its trading update, with Berenberg raising the stock to buy from hold on improved risk-reward. Shares rally as much as 5.5% after a 6.9% gain on Monday.

Alstom shares were down as much as 6.7% after company reported 1Q earnings. Investor worries are around inflation, potential gas disruptions on production in Europe and chip shortages.

Telenor shares dropped as much as 5.2% after Norway’s telecommunications company posted a 2.5 billion-krone ($250 million) impairment on its Pakistan operations due to a jump in funding costs and an adverse court ruling.

SGS shares fall as much as 4.7% with analysts saying the testing and inspection firm delivered solid organic growth but with weaker margins.

Getinge drops as much as 7.4%, with Handelsbanken analyst Rickard Anderkrans (buy) saying its 2Q results were a “mixed bag” across its divisions and adjusted Ebitda margin looked “fairly soft”.

European stocks could slump another 10% if Russia cuts off gas to the region, triggering a recession, according to Citigroup Inc. strategists. A halt of Russian gas supplies could potentially reduce the euro area’s gross domestic product by about 1%, which would imply a 10% contraction in European earnings-per-share over the next 12 months, according to Citi.

Earlier in the session, Asian stocks fluctuated as China’s policy efforts to resolve the mortgage boycott crisis failed to lift sentiment amid lingering woes in the sector and global growth concerns. The MSCI Asia Pacific Index erased a drop of as much as 0.4% to trade 0.1% higher as of 5 p.m. Hong Kong time. Technology shares were the biggest drags after a report on Apple Inc.’s plan to slow hiring highlighted growth risks. Industrial and financial shares gained. Hong Kong and Chinese equities were among the worst performers regionally, cutting short a rebound in the previous session. A gauge of developer shares fell despite a report that China may allow homeowners to temporarily halt mortgage payments on stalled projects, part of a broader policy push to stabilize the property market. Asian equities have seen choppy trading recently as traders expect another large interest rate increase by the Federal Reserve this month. China’s Covid cases are also on the rise again, raising the risk of more lockdowns.

“It is not just the mortgages or the property, but also Covid that has gotten back a lot of attention. It will be quite challenging for the regional markets to overcome the overall bad risk sentiment that we have with the global headwinds,” Stefanie Holtze-Jen, Asia Pacific chief investment officer at Deutsche Bank International Private Bank, said in a Bloomberg TV interview. Japanese shares edged higher on Tuesday after reopening from a holiday. Traders will look ahead to a policy decision from the Bank of Japan on Thursday

Japanese stocks advanced as investors returned from a long weekend and await a policy decision from the Bank of Japan on July 21. The Topix Index rose 0.5% to 1,902.79 at the market close in Tokyo, while the Nikkei advanced 0.6% to 26,961.68 on Tuesday. Sony Group Corp. contributed the most to the Topix Index gain, increasing 2.3%. Out of 2,170 shares in the index, 1,321 rose and 754 fell, while 95 were unchanged.

In Australia, the S&P/ASX 200 index fell 0.6% to close at 6,649.60, as healthcare and technology shares tumbled. Technology shares had their worst day in a month, following regional and US peers lower after Bloomberg reported Apple plans to slow hiring in some divisions to cope with a potential economic downturn. Mining shares swung to a loss after posting early gains following BHP’s production output, as the mining giant joined rival Rio Tinto Group in signaling more turbulence. Energy shares bucked the trend and edged higher after oil futures jumped above $100 a barrel on concerns about tighter supplies globally. In New Zealand, the S&P/NZX 50 index was little changed at 11,162.73

Stocks in India were mostly higher, with banks and property developers among the winners as signs pointed to improved sales. The S&P BSE Sensex rose 0.5% to 54,767.62 in Mumbai, while the NSE Nifty 50 Index gained 0.4%. Reliance Industries was the biggest contributor to the Sensex, rising 0.8%, followed by ICICI Bank, which rose 1.1%. Out of 30 shares in the Sensex, 19 rose and 11 fell. Among sectoral gauges, the realty index led with a 2.7% gain behind rallies by Sobha Ltd. and Oberoi Realty, the latter on demand outlook for a luxury project in Mumbai. Consumer-goods producer Hindustan Unilever is scheduled to report quarterly earnings after trading hours, with analysts watching for its outlook to assess recovery in demand. India’s rupee touched another record low, with one drag being the continued selling of equities by foreign investors. Net outflow of $29.7b of local shares as of July 15 was the most in Asia after China and Taiwan.

The Bloomberg Dollar Spot Index fell 0.6%, dropping to its lowest level in two weeks, with Scandinavian currencies outperforming Group-of-10 peers against the greenback. The euro rose to a two-week high in the wake of the reports that the ECB were considering a larger initial move in their tightening cycle, gaining as much as 1.2% to 1.0269, eyeing the 21-DMA at 1.0307. German 2-year yields surged as much as 12 basis points to 0.64% as traders moved in to price at one point over 100 basis points of rate hikes from the ECB by September.Gilts rallied and traders trimmed bets on the pace of BOE interest-rate hikes after lower-than-forecast UK average earnings in May suggest inflation may slow.

In rates, Treasuries were little change on the day with yields broadly within one basis point of Monday’s close despite weakness seen across European core rates after Reuters reported ECB officials are discussing a half-point hike on Thursday. 10-year TSY yields around 2.98%, slightly richer from Monday while bunds underperform 4bp in the sector; Treasuries curve is mildly steeper with spreads broadly within one basis point of Monday close also. Following Reuters report on ECB the euro jumped to two-week high while two-year German yields remain cheaper by 8.5bp on the day. US auctions this week include 20-year bond reopening Wednesday and 10-year TIPS on Thursday. German Bund curve bear-flattens with 2s10s narrowing 5.3bps. Peripheral spreads tighten to Germany with 10y BTP/Bund narrowing 0.8bps to 206.0bps.

In commodities, oil slipped but held above $100 a barrel after posting the biggest one-day advance since May, aided by a tightening market and a cooling in dollar gains. WTI drifts 0.7% lower to trade near $101.88. Brent falls 0.8% near $105.42. Base metals are mixed; LME lead falls 2.4% while LME nickel gains 2.7%. Spot gold rises roughly $3 to trade near $1,713/oz.

Bitcoin remains firmer on the session and have marginall eclipsed Monday’s USD 22.75k best to a USD 22.95k high thus far.

Looking to the day ahead now, and data releases include UK employment data for June, US housing starts and building permits for June, and the final CPI reading for June from the Euro Area. Central bank speakers include BoE Governor Bailey and the ECB’s Makhlouf. Earnings releases include Johnson & Johnson, Lockheed Martin and Netflix. And in politics, there’s another ballot of UK Conservative MPs as they select their next leader and the country’s next Prime Minister.

Market Snapshot

S&P 500 futures up 0.8% to 3,863.50

STOXX Europe 600 down 0.6% to 415.27

MXAP little changed at 156.43

MXAPJ down 0.3% to 515.24

Nikkei up 0.6% to 26,961.68

Topix up 0.5% to 1,902.79

Hang Seng Index down 0.9% to 20,661.06

Shanghai Composite little changed at 3,279.43

Sensex up 0.2% to 54,634.07

Australia S&P/ASX 200 down 0.6% to 6,649.60

Kospi down 0.2% to 2,370.97

Gold spot up 0.2% to $1,712.77

US Dollar Index down 0.69% to 106.62

German 10Y yield little changed at 1.26%

Euro up 1.0% to $1.0242

Top Overnight News from Bloomberg

The European Central Bank may consider raising interest rates on Thursday by double the quarter-point it outlined just last month because of the worsening inflation backdrop, according to people familiar with the situation.

The French government offered a premium of more than 50% to minority investors in Electricite de France SA, seeking a swift nationalization of the troubled company that is the backbone of the country’s energy policy.

The European Commission doesn’t expect Russia to restart a key natural gas pipeline this week, a senior official said, the clearest indication yet that the bloc is bracing for the worst

Mining giant BHP Group has joined rival Rio Tinto Group in signaling more turbulence to come for commodities producers as costs balloon and demand for everything from iron ore to copper hits headwinds.

A more detailed look at global markets courtesy of Newsquawk:

Asia-Pac stocks mostly fell after reports of Apple slowing its hiring and European energy woes stoked growth fears. ASX 200 was lacklustre amid weakness in tech and with miners choppy after a mixed quarterly update from BHP. Nikkei 225 outperformed as it played catch up to the prior day’s gains on return from the extended weekend. Hang Seng and Shanghai Comp. were pressured amid earnings updates and the COVID situation in China, but with the losses in the mainland stemmed after reports that China is considering a mortgage grace period. KKR does not plan to lead a bid for Toshiba (6502 JT); could still partake as an equity partner in a deal; waiting for more clarity for Japanese government and Co. management, according to Reuters sources.

Top Asian News

Searing Heat Tests China’s Ability to Keep Its Factories Running

Some China High-Grade Builders’ Dollar Bonds Set for Record Lows

China’s Covid Cases Near 700 as Shanghai Widens Testing

Country Garden Dollar Bond Plunges, Joining China Junk Selloff

India Said to Sell Dollars to Meet Gaps as Exchange-Rate Fair

European bourses are under modest pressure continuing with the downbeat APAC handover, with pressure from AAPL, ECB sources and IBM impacting. US futures are modestly firmer having already reacted to the AAPL developments, though IBM (-5.0% in pre-market) is impacting. Within Europe, sectors are predominently in the red though Healthcare and Banking names are proving more resilient. French gov’t intends to buy the 15.9% remaining EDF (EDF FP) shares and bonds, offering EUR 12.0/shr (12th July close EUR 10.23/shr); represents an overall value of circa. EUR 9.7bln. Buyout will be followed by a delisting.

Top European News

UK government won a vote of confidence in the House of Commons (as expected) after five hours of debate with the vote count at 349 vs. 238, according to Sky News

UK Chancellor Zahawi said they can and will get inflation back under control, while he added that they must deliver sound public finances and help households with inflation, not push up demand further. Zahawi stated that he will reform Solvency II rules to give insurers more flexibility to invest in infrastructure and aims to repeal hundreds of EU financial regulations and replace them with a UK version, according to Reuters.

France Offers to Pay $9.9 Billion for EDF Nationalization

UK Braces for Record-Breaking 40°C as Heat Wave Peaks

China Disputes Report Xi Invited Europe Heads to Beijing Meeting

Central Banks

ECB policymakers are to discuss a rate hike worth 25bp or 50bp at Thursday’s meeting, according to Reuters sources; hone in on a deal to make new bond purchases conditional on next-gen EU targets and fiscal rules. Some wanted the ESM involved, but this option has now likely been discarded.

ECB may consider increasing rates on Thursday by 50bp, via Bloomberg citing sources; due to the worsening inflation situation. Source stressed that it is unclear if there will be sufficient support for a 50bp hike.

RBA July Meeting Minutes stated that the Board remains committed to doing what is necessary to ensure inflation returns to the target over time and members agreed further steps would need to be taken to normalise monetary conditions in the months ahead, while it noted that two options for the size of the Cash Rate increase were considered which were raising the cash rate target by 25bps or by 50bps.

RBA Deputy Governor Bullock said wages are starting to rise a little more, while she added that they need to get rates up to some sort of neutral and that neutral is a fair bit higher than where they currently are.

HKMA intervenes; buys HKD 6.28bln from market as the HKD hits weak end of trading range.

FX

Antipodean Dollars take advantage of their US rival’s deeper reversal with the Aussie also acknowledging RBA minutes and rhetoric flagging further hikes, NZD/USD breaches 0.6200 and AUD/USD extends above 0.6850 to within a whisker of 0.6900.

Euro boosted by sources suggesting ECB might raise rates by 50bp rather than the 25bp signalled for this week, EUR/USD through 1.0200 again and probes 1.0250.

Franc rebounds amidst broad Buck retreat and in wake of Swiss trade data showing wider surplus, USD/CHF tests 0.9700 vs high close to 0.9800.

Pound peers over 1.2000 vs Greenback again, but labours after mixed UK jobs and wage metrics.

Yen firmer through 138.00, but could be hampered by option expiries at the round number (2.72 bn) and key Fib resistance (at 137.52).

Loonie lags as WTI sags, USD/CAD straddles 1.2950 after dip below 1.2900 on Monday.

Fixed Income

EZ debt rattled by hawkish ECB source report with spill-over to German Bobl auction.

Bunds recoil from 152.60 to 151.00 before paring some declines.

Gilts hold in after mixed UK labour data and decent DMO 2039 sale with the 10 year benchmark between 115.76-03 parameters vs 115.01 prior Liffe close.

10 year T-note towards bottom of 118-05/118-15+ range ahead of US housing starts and building permits.

Commodities

Crude benchmarks are pressured and continuing to consolidate with fresh developments relatively light for the complex explicitly.

White House Adviser Deese expects gasoline prices will continue to fall this month, according to MSNBC.

TC Energy issued a force majeure for oil deliveries on Keystone Pipeline after a third-party power outage in South Dakota, while TC Energy said the Keystone Pipeline is operating at reduced rates with no timeline available for the restoration of full-service, according to Reuters.

Saudi Foreign Minister says does not see a lack of oil in the market, there is a lack of refining capacity; adds, Russia is a integral part of OPEC+, via Reuters.

EU is set to backlist CEO of Russia’s zinc and copper giant UMMC, according to a draft document via Reuters.

Spot gold is marginally firmer and comfortably above USD 1700/oz as the USD pulls-back while base metals are more mixed after recent upside in copper, for instance.

US Event Calendar

08:30: June Housing Starts, est. 1.58m, prior 1.55m; Housing Starts MoM, est. 2.0%, prior -14.4%

08:30: June Building Permits, est. 1.65m, prior 1.7m; Building Permits MoM, est. -2.6%, prior -7.0%

DB’s Jim Reid concludes the overnight wrap

Well yesterday was the third hottest day on record here in the UK with today likely to be the hottest. My wife can’t sleep with even the quietest fan on in our bedroom and I can’t sleep without one. Anyone that can solve this riddle for us without resorting to seperate bedrooms please let me know. Although she might be happy with this solution. I’m too afraid to offer it up in case it’s accepted. I’ve actually slept with ice cubes on my back over the last couple of nights. Now there’s an image for you all!

Just when it looked like the market ice age was showing signs of thawing on hopes for less aggressive central banks and decent early week results, US sentiment turned late in the day following reports that tech giant Apple would be slowing hiring and spending next year, raising the stakes on the tech earnings out this week. So while European equities managed to post a strong gain, US stocks ended the day in the red (S&P 500 -0.84%). Meanwhile, easing fears of a more aggressive Fed hiking path helped Brent crude oil prices (+5.05%) rebound and the 2s10s Treasury curve (+1.8bps) steepen from its recent lows last week, with Brent crude oil prices (-0.41%) only down slightly overnight at $105.83/bbl.

As the back-and-forth in sentiment yesterday showed, there are still plenty of obstacles for investors to navigate over the coming days. Not just recession risk but also the ongoing threat of a Russian gas shut-off at the end of the week. Yesterday saw Reuters report that Gazprom had declared force majeure on gas supplies to at least one major customer, with a letter saying that they couldn’t fulfil their supply obligations due to “extraordinary” circumstances. So a concerning sign amidst concerns that issues with the gas flow will go beyond the scheduled maintenance period on the Nord Stream pipeline. Separately, Germany’s Uniper, which is Europe’s largest buyer of Russian gas, applied to extend their €2bn credit line from the state-owned bank KfW, and Bloomberg also reported that a draft EU document warned that a Russian gas cutoff could cut EU GDP by 1.5% in a worst-case scenario, with even an average winter seeing a decline in EU-wide GDP between 0.6% and 1%. To be fair there have been more aggressive forecasts than this.

In spite of the bad news there, European assets still put in a strong performance yesterday, with the STOXX 600 gaining +0.93% as the more cyclical sectors and energy led the way. That positive sentiment was also reflected in sovereign bond markets, where yields on 10yr bunds (+8.2bps) saw their largest daily increase in over a week, and the spread of Italian 10yr yields over bunds (-6.5bps) saw their largest daily decline in over a month as investors await the details of an anti-fragmentation tool from the ECB this week.

While there was initial optimism in the US, it eventually soured and left the S&P 500 -0.84% lower at the close. The day started with more positive earnings than we had from financials last week, with Goldman Sachs (+2.51%) and Bank of America (+0.03%) posting better than expected results after last week’s lackluster showing from financials. They traded as much as +6% and +3.5% higher at the open, respectively, before fading later in the day.

Tech stocks were a microcosm of the broader index performance on the day. The NASDAQ was as much as +1.5% higher while the FANG+ was more than +3% higher on the early morning optimism, only to turn following news that Apple would be slowing hiring and spending in 2023, stoking fears about the broader macro outlook. The NASDAQ and FANG+ eventually closed -0.81% and +0.06%, respectively. Netflix reports tonight so all eyes on that after two spectacularly bad earnings day equity performance so far this year. In the S&P 500, cyclical stocks still managed to outperform defensives; energy was the clear outperformer, up +1.96%, while discretionary and materials, up +0.22% each, were the only other sectors in the green, and heath care led declines (-2.15%).

Treasury yields still managed to climb, and the curve managed to steepen as mentioned, though 10yr yields came off their intraday highs of +10.2bps to finish +7.0bps higher at 2.99%, and this morning they’ve shed a further -2.0bps to come down to 2.97%. With the Fed widely expected to raise rates by 75bps again next week, the latest round of housing data provided further evidence that their tightening cycle is beginning to have a significant impact, with the NAHB housing market index plummeting to 55 in July (vs. 65 expected). That’s the worst reading for the index since the initial wave of the Covid pandemic in May 2020, and if you exclude the pandemic plunge, you’ve got to go back to early 2015 for the last time that sentiment was worse. Furthermore, the 12-point decline relative to July was the largest one-month drop since the series began, with the exception of April 2020 as the world went into lockdowns, so a faster monthly drop even relative to what we saw during the GFC.

Markets in Asia are struggling this morning following that overnight sell-off on Wall Street, with major indices trading in negative territory including the Hang Seng (-1.11%), CSI (-0.70%), Shanghai Composite (-0.30%) and the Kospi (-0.23%). The main exception to that is the Nikkei (+0.71%), which is catching up from yesterday’s holiday. As well as the more negative newsflow from the US, China also reported 699 Covid cases on Monday, which is the highest daily number since May 22. Separately, yields on 10yr Australian government bonds are up +7.0bps after minutes from the RBA’s recent meeting revealed that the board saw current interest rates as being “well below” the neutral rate, indicating that further rate hikes will be needed to return inflation to the target over time. Looking forward, there are signs that the selloff has stabilised for now, with S&P 500 futures (+0.12%) pointing slightly higher

In terms of the Tory leadership race we are now down to four candidates after Tom Tugendhat was eliminated from contention yesterday. The next rounds of voting are today and tomorrow, by which point there’ll be just two candidates that’ll be voted on by the wider party membership over the coming weeks before a new leader/PM is announced in early September. The government also won a vote of confidence in the House of Commons yesterday, by 349 votes to 238.

To the day ahead now, and data releases include UK employment data for June, US housing starts and building permits for June, and the final CPI reading for June from the Euro Area. Central bank speakers include BoE Governor Bailey and the ECB’s Makhlouf. Earnings releases include Johnson & Johnson, Lockheed Martin and Netflix. And in politics, there’s another ballot of UK Conservative MPs as they select their next leader and the country’s next Prime Minister.

Tyler Durden

Tue, 07/19/2022 – 07:59