Euro Surges On Report ECB Looking “Closely” At 50bps Rate Hike As Lagarde Rushes To Complete “Italian Bond Purchase” Mechanism

One month after the Fed leaked a last minute 75bps rate cut via the WSJ during the central bank’s “quiet period” and which proved accurate when the Fed followed through with its biggest rate hike since 1994, earlier today European traders enjoyed a similar drill when first Reuters and then Bloomberg reported a “people familiar with the situation” story that on the same day Russia is expected to resume gas flows via Nord Stream 1 (but won’t), the European Central Bank is considering raising interest rates on Thursday by 50bps, or double the quarter-point it outlined just last month because of the worsening inflation backdrop, as the ECB lifts off from its record low -0.50% deposit rate.

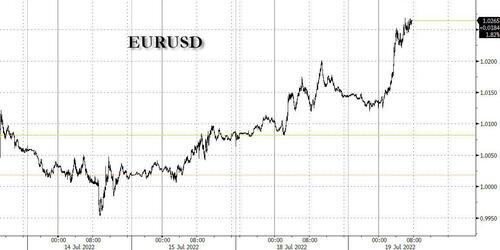

While unlikely, as such a move would represent a credibility-crushing deviation from guidance that the majority of Governing Council members have stuck to since it was laid out at the June 9 policy meeting, the market certainly was freaked out by this trial balloon which most likely was intended to push the Euro higher, and sure enough it achieved its goal: the EURUSD surged 1.1%, or about 100pips, rising above 1.02 after plumbing below parity late last week.

Of course, if the ECB disappoints and hikes “only” 25bps on Thursday, expect the entire move to reverse lower. And if there is no gas flowing in the NS1 pipeline on that day, we expect the EURUSD to hit a fresh two decade low.

Meanwhile, money markets see a 40% probability of a half-point hike this week compared with 20% odds on Monday. Still, as shown below, as of this moment the only fully-priced in 50bps rate hike is in September as the ECB proceeds to “renormalize” rates to 1.25% by March 2023.

Of course, that will never happen since Europe will be dragged into a painful recession long before then but let markets have their ridiculous forecasts.

In a June 28 speech, ECB President Christine Lagarde left space to go beyond 25 basis points, just days before data showed euro-zone inflation surged more than expected to a new all-time high of 8.6% – more than four times the 2% target.

“There are clearly conditions in which gradualism would not be appropriate,” she said. “If, for example, we were to see higher inflation threatening to de-anchor inflation expectations, or signs of a more permanent loss of economic potential that limits resource availability, we would need to withdraw accommodation more promptly to stamp out the risk of a self-fulfilling spiral.”

What is unclear is how sending Europe into a recession will alleviate the ongoing variable Russian supply shock. Sure, collapsing your entire heavy industry will crush all demand for Russian commodities going forward but it will also, well… collapse your entire heavy industry and spark a depression the likes of which Europe has never seen before!

That said, the majority of economists predict the ECB will hike by 25 basis points this week, with just four of 53 in a Bloomberg survey predicting a half-point increase.

“We do not rule out a 50 basis point rate hike at this week’s meeting,” Matthew Ryan, Head of Market Strategy at Ebury, said before the latest deliberations were reported. “We have already seen most major central banks deliver bumper rate increases in recent weeks in an attempt to control rampant price growth — there is even talk that the FOMC may consider a one percentage point move later this month.”

There is, of course, another reason why the ECB finds itself in an unprecedented dilemma: yes, the ECB can hike 25bps, or even 50bps and why not 1%, but in doing so it will send Italian bonds plunging, spark a renewed round of fragmentation fears and eventually lead to the collapse of the eurozone which the ECB has been fighting tooth and nail to preserve for the past 12 years when it became clear that the common currency is a doomed concept.

It’s why just a few hours after the 50bps story hit, Bloomberg followed up with a second report that Christine Lagarde “is redoubling efforts to forge agreement on a still-incomplete new crisis tool” a tool which has some ridiculous technical name but which we call the “Italian Bond Purchase Mechanism.”

Citing “people familiar with the matter”, Bloomberg said that two days before Thursday’s decision, policy makers still have work to do to reach a deal on a measure that can stem market speculation on weaker euro-zone members.

Why? Because by pushing through with such a “anti-fragmentation tool” the ECB admits defeat, as one can’t be “tightening” at the same time as one is reversing on QT which is what incremental purchases of Italian bonds represents, unless of course one is an idiot and somehow buys into the ECB’s garbage argument that one can pursue tightening even as one injects liquidity into the weakest European link .

According to Bloomberg, alongside lingering legal concerns, outstanding issues include conditions countries benefiting from ECB bond purchases would need to meet. They may include sound fiscal policy, with some officials insisting on involving the European Commission, the European Stability Mechanism or both to avoid being the only judge, they said.

Money markets are placing 40% odds on a half-point rate hike this week but have trimmed wagers on outcomes beyond, pricing 97 basis points of tightening by September after earlier baking in a one-percentage-point increase. The euro rose 1.2% against the dollar, climbing to $1.0269, the highest since July 6.

The lack of agreement on the so-called Transmission Protection Mechanism, to use its working title, may leave Lagarde with only a fudged outcome to unveil for now, which however would be fitting for a central bank which has so far only come out with fabricated and grotesquely absurd “whatever it takes” solutions to problems. That could come with the prospect of a more drawn-out process of decision-making to fully complete the creation of a credible measure.

The risk of such a result is that it could invite another bout of financial-market speculation on the ECB’s determination to defend the integrity of the euro, which recently slipped to parity with the dollar for the first time in two decades.

It would also invite another round of rate cuts by the ECB which would then finds itself not only at square one, but most likely with even more negative rates and with an even bigger QE when all is said and done.

* * *

Finally, what all this means for the Euro, here is Bloomberg’s Mark Cranfield explaining why the rally will end after the ECB’s decision:

EUR/USD has enjoyed a respite after slipping below parity last week, but that will come to an end with this week’s ECB meeting. The fragile political situation in Italy along with the high risk of recession as Europe grapples with an energy crisis means the ECB is likely to underwhelm euro bulls.

Gazprom’s declaration of force majeure on several European natural-gas buyers, could signal it intends to keep supplies capped, which would deepen the crisis. Meanwhile, a halt of Russian gas supplies to the EU could reduce its GDP by as much as 1.5% if the next winter is cold, and the region fails to take preventive measures to save energy, according to new estimates from the bloc.

The EU will call on member states to immediately cut gas usage, an FT report says.

It was less than two months ago that Christine Lagarde’s plan to exit negative interest-rate policy by the end of 3Q was seen by some ECB members as not aggressive enough. Yet, the headwinds facing Europe have accelerated since then, which could mean the rate hiking window closes very quickly. All of this suggests interest-rate differentials will continue to favor the dollar and weigh on the euro

Tyler Durden

Tue, 07/19/2022 – 09:09