Nomura Warns Hopes For Return To CB-Supported ‘Goldilocks’ Regime Are “Greatly Overstated”

There is a growing chorus of “hike fast and get it over with” coming from the market with an expectation that getting back to neutral fast will spark a recessionary environment that will prompt a pivot from The Fed back to easing rates and unleashing a fresh round of QE.

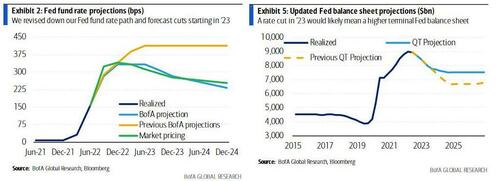

As we have recently detailed, BofA’s top Rates strategist, and former NY Fed analyst, Marc Cabana expects Powell to be forced to end QT much sooner than expected

We expect the Fed will stop QT with rate cuts due to the contradictory signal it sends on monetary policy and to simplify policy communications; the Fed will likely not want to be easing with rate cuts but tightening with QT.

Cabana reminds us that the Fed has established a playbook for such an action in 2019 when the Fed cut started cutting rates in July ’19 and simultaneously announced a cessation of QT.

Then BofA chief investment strategist Michael Hartnett explained that he expects The Fed to pivot in November (or earlier if there is a market meltdown in the next eight weeks).

The Biggest Picture: hike, hike, hike… until everything breaks. The intense central bank hiking cycle which has seen virtually every developed and developing world central bank tighten financial conditions…

… means there is now risk for consensus of shallow recession + “shallow recession kills inflation allowing Fed pivot” but real policy rates are still extremely negative (-6.7% Fed, -8.8% ECB, -6.1% BoE, -2.5% BoJ) which means the current hiking cycle followed by a pivot would result in even greater inflation around the world!

Finally, piling on, Goldman trader Rich Privorotsky warns that “the bearish trade is now consensus,” adding that he expects an ‘all clear’ from The Fed after 3 straight months of declining CPI prints.

So having said all that, Nomura’s Charlie McElligott has a different view of the way forward.

While recognizing that sentiment and positioning is extremely bearish…

The “bleed” of pervasive negativity and skepticism is showing in our Nomura SPX Sentiment Index, with the recent window (50 day rolling avg) at 1.9%ile since 2004…

…in other words, it historically hasn’t been worse than this over the past ~ two decades.

McElligott explains that this is because:

The market is more seemingly far more concerned about either:

1) long-term destruction from inflation becoming “unanchored” …or conversely,

2) the Fed pivoting policy on inflation TOO EARLY, which then risks inflation expectation reacceleration thereafter then risking more incoherent and inconsistent “lunging” of Fed monetary policy in the years ahead…

Than it is concerned about 3) a currently perceived “short and shallow” recession in late ’22 / early ’23

He notes that dealers’ option gamma is actually somewhat ‘stabilizing’ for markets…

Interestingly, the Nomura strategist points out that this “acceleration of the cycle-turn,” (i..e the “glass half full” with regard to more focus now on the next move being the “dovish Fed pivot” and general fatigue from downside catalysts), continues to be a large part of the reason that 6m SPX index options Skew is 2%ile and 6m Put Skew is 3%ile, versus 6m Call Skew sitting at 96%ile (all 5 year lookback)

In other words, with positioning (as in, “no exposure”) and economic cycle vibes so already “trashed,” we are now far more concerned about missing the Equities upside “right” tail than a new escalation of the downside “left” tail.

And with Spot rallying and Vol / Skew fading further, we now see Options Dealers back exactly at the 3900 “zero / neutral Gamma” level in SPX and outright “Long Gamma” vs Spot in mission-critical index heavyweight QQQ / megacap Tech type names, which will beget even further market stabilization against large swings, as Dealer hedge flows insulate.

But, and it’s a big but, McElligott asks qualitatively: what if the “inflation peaking, then lower” outcome (particularly as Energy and Commod prices have recently retrenched over the past 1m), alongside the now base-case of a Fed “engineered” and “short-and-shallow recession” – hence, the generally-expected Fed policy pivot “from tightening to easing” move as soon as 1Q23 – is not so black-and-white or “tidy”?

It’s increasingly my view that despite the widely anticipated easing in inflation seen in coming-months from recent backward-looking energy price “shock” levels and lagging “rent” inputs, that it will remain structurally “sticky” and higher-for-longer – tying CB hands versus expectations born in the market’s recency bias.

And with that, the muscle memory from the prior decade long “goldilocks” regime, where during any idiosyncratic “growth scare” or “crisis,” we could simply watch the Fed or other global CBs “cut to ZIRP” while again too resume expansion of the balance-sheet into the anticipated economic hard-stop – is greatly overstated.

What does that mean?

Instead of a prior conditioning that says the perception of a “Fed Pivot” is unambiguously “risk-on” (and of course it will initially trade that way), McElligott fears that the longer-term challenge becomes that markets instead see a grueling sideways “chop” with persistently “tighter” financial conditions, due to an inflection in future Central Bank policy that is hamstrung relative to prior “full-tilt” easing dynamics during the era of sub 2.0% inflation (see SPX flat btwn Summer ’71 and Summer ’79).

Simply put – don’t expect a quick Fed pivot to save your 401)k).

A power re-flattening (including resumption of inversions) across nominal curves, as this “stagflation” drag creates limited Fed optionality with regard to the increased likelihood of a local “recession”.

I.e. – even with the extremes in positioning don’t buy the dip yet.

Tyler Durden

Mon, 07/18/2022 – 14:31