China Has Dumped Over $100 Billion Of US Treasuries In The Last 6 Months

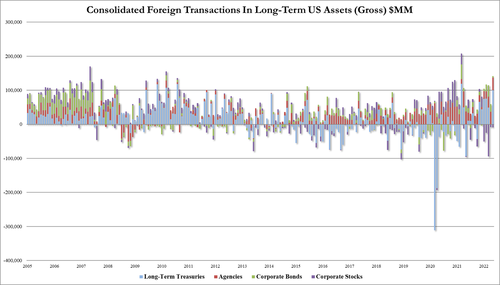

The latest data of Treasury International Capital flows (from May) shows a 5th straight month of equity selling:

Long-term Treasurys: +99.864BN, vs -$1.153BN sold in April

Agencies +37.283BN, similar to the $36.714BN in April

Corporate bonds bought $4.462BN, down from $22.5BN in April

Equities sold $9.15BN, down from $7.04BN in April and the 5th consecutive month of stock sales by foreigners, longest stretch since late 2018!

Foreign official institutions sold $34.1 billion in USTs in May…

BUT… foreign private investors (not central banks or reserve managers) bought a record $133.94 billion in May…

Most notably, China’s holding of US Treasuries fell below $1 trillion for the first time since June 2010…

Source: Bloomberg

This is the 6th straight month of selling by China for a total of $100 billion over that period.

China was the biggest seller in May (the latest month available) followed by Ireland and Canada.

Japan remains the largest holder of USTs with $1.2 trillion (though it too saw a decrease in May of $5.7 billion).

The Cayman Islands (proxy for hedge funds) saw a $1.7 billion increase in UST holdings to $293.3 billion.

Switzerland bought most in May ($22.5 billion) along with UK and Belgium.

Finally, we note the de-dollarization trend continues (though there was some selling of gold reserves in the latest period)…

As UST holdings drop to their lowest since Oct 2020.

Tyler Durden

Mon, 07/18/2022 – 16:18