Beijing Panics, Scrambles To Halt Mortgage Boycott By “Urging” Banks To Rush Developer Loans

Last week, when we warned that China finds itself on the edge of a violent debt jubilee as millions of “disgruntled” homebuyers have suddenly refused to pay their mortgages (on unfinished construction projects, mind you, so they are completely in their right), we said that “the government is likely to step in sooner rather than later as the mortgage boycotts start to undermine social stability. Either banks have to chip in to provide cheap funds for developers to complete projects, or they have to allow homebuyers to delay their payments. Neither is an attractive option.”

This was correct, and while Beijing has not yet gone “balls to the wall” on injecting liquidity so to speak – as the PBOC has been far more cautious about stimulating the economy now that Chinese debt levels are the highest in known history – it is taking the first steps in that direction with Bloomberg reporting overnight that Chinese regulators “sought to defuse a growing consumer boycott of mortgage payments by urging banks to increase lending to developers so they can complete unfinished housing projects”, in the process sending China’s bank and property stocks higher and restarting China’s massive debt-fueled growth dynamo, which however always blows up spectacularly a few years later.

The guidance from the China Banking and Insurance Regulatory Commission was issued in response to the boycotts and is aimed at expediting the delivery of homes to buyers, a newspaper published by the watchdog reported Sunday, citing an unidentified senior official at the agency.

According to the weekend report, the CBIRC will strengthen its coordination and cooperation with the Ministry of Housing and Urban Development and the central bank to support local governments to help ensure housing project delivery, the official was cited as saying: “While following market principles and the rule of law, (banks) should also actively assume social responsibility, and do whatever possible to ensure home deliveries,” the official said.

Translation: courtesy of debt, China’s housing risk is being quietly shifted away from developers and on to the state-owned banking system. This happens as China is scrambling to contain the protests that have flared up at 100 housing projects across 50 cities, threatening to spread the real estate crisis to the banking system and spark a grassroots debt-payment moratorium that would crush China’s $50+ trillion financial system which is more than double the size of the US.

Regulators met with banks last week to discuss the boycotts, while state media have cited analysts warning that the stability of the financial system could be hurt if more home buyers follow suit.

“The core issue here is for the government to step in quickly to boost confidence, to solve the problem at hand, and also provide more clarity to the market and investors on how this downturn in the property sector is going to be resolved,” Hui Shan, chief China economist at Goldman Sachs Group Inc. said in an interview on Bloomberg Televison.

And of course it is, the core question, however, is how does China does this without overstimulating the markets and without causing a fresh lurch into bubble territory.

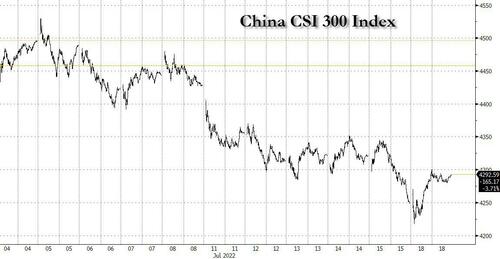

Of course, with speculation of more stimulus on deck, bank stocks predictably rallied on the report, as the CSI 300 Bank Index jumped 1.4%, its first gain in nine sessions. An index of property shares rose 2.9% Monday, reversing a 7.7% plunge in shares of Chinese lenders last week, the biggest decline in more than four years. The news of Beijing’s rushed response also helped pushed US equity futures higher overnight.

Worse, in a housing “doom loop”, the growing number of boycotts over project delays also pose a risk to the broader housing market by keeping potential homebuyers on the sidelines. The market had seen signs of stabilizing in recent months, with some analysts calling for a turnaround in the second half of the year, but that now appears in jeopardy. Last week, China reported that output in the real estate industry, a key economic contributor, contracted 7% in the second quarter from a year ago. It remained the biggest drag on the world’s second-largest economy among all sectors, and performed worse than the first quarter of 2022.

“In a worst-case scenario, the issue could trigger systemic financial risk and social instability, given housing’s role as a bedrock of the broader financial system,” Gabriel Wildau, a managing director at global business advisory firm Teneo, wrote in a note July 15. “But our base case is that regulators will succeed in containing the crisis by strong-arming state-owned banks into supporting troubled developers so that they can complete stalled projects.”

In separate comments on the weekend, Bloomberg reports that China’s central bank also said it will step up the implementation of its prudent monetary policy to provide stronger economic support. The economy is facing “certain downward pressures” due to the pandemic and external factors even as domestic inflation is relatively low, Governor Yi Gang said in a meeting of G-20 central bank governors and finance ministers.

Besides assisting with easier loan injections, the China Banking and Insurance News also reported Sunday that regulators had urged banks to support mergers and acquisitions by developers to help stabilize the real estate market. Banks were also asked to improve communications with home buyers and to protect their legal rights, the report said.

China’s commercial banks that have disclosed their overdue loans on unfinished homes have so far detailed more than 2.11 billion yuan ($312 million) of credit at risk. GF Securities Co. expects that as much as 2 trillion yuan of mortgages could be impacted by the boycott.

While the lenders have called the situation controllable, concerns have persisted given the importance of the sector. The real estate industry, when including construction, sales and related services, accounts for about a fifth of China’s gross domestic product. An estimated 70% of the country’s middle-class wealth is also tied up in property. According to calculations by Goldman Sachs, the Chinese property markets is the largest single asset in the entire world.

No wonder it is in the establishment’s best interest to prevent this biggest asset bubble from deflating.

Tyler Durden

Mon, 07/18/2022 – 13:50