“This Year Was Quiet” – Aspen Mansion Market Cools

The luxury market appears to be cooling as soaring interest rates, stock market turmoil, elevated inflation, and threats of a recession put a damper on demand.

“We’ve definitely had the first true off-season since Covid,” Jennifer Banner, a broker at Christie’s International Real Estate Aspen Snowmass, told Bloomberg, referring to the residential property market in Aspen, Colorado.

“Over the last two years, it was busy through May and June. This year it was quiet,” Banner said.

“Overall, it seems there are some signs the market is weakening a little bit, but not enough to draw any conclusions,” Karen Setterfield, co-founder of Aspen brokerage Setterfield & Bright, said.

According to a new report from Douglas Elliman, Aspen’s single-family-home market is tiny, with approximately 28 listings in June. The resort town was in high demand during the virus pandemic as wealthy folks fled large metro areas to mountainous regions.

Tim Estin, a broker with Aspen Snowmass Sotheby’s International Realty, said the barriers to entry into Aspen for a single-family home was nearly $12mln in June.

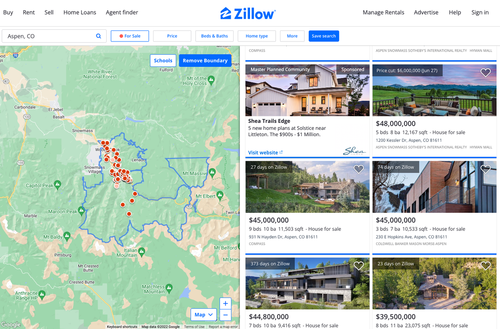

Some of Aspen’s Mansions are listed on Zillow.

The Elliman report showed that signed contracts for single-family homes in June plunged 71.4% year over year, with new listings increasing 33.3%.

“The market hasn’t flipped as much as it’s slowed down,” Stephen Kotler, Douglas Elliman’s chief executive officer of brokerage for the Western region, said.

“We’re still going to see [signed] contracts, but it won’t be at 2021 levels, maybe it will be closer to 2019 or 2020,” Kotler said.

Even though a large majority of Aspen properties are paid in cash, macro-economic uncertainty appears to have triggered a slowdown in mansions across the resort area.

“I think we’re going to see a leveling off of the kinds of price increases we saw in the last two years,” said Banner, “but we knew those were unsustainable. I don’t think we’re going to see a major drop in prices.”

The problem with Aspen is the housing market is so small that it would only take a few property owners to panic sell and cause gyrations.

Last week, Wells Fargo Investment Institute warned about a recession underway, while Guggenheim and Nomura Securities say a downturn is expected later this year. The question remains what will cause further uncertainty among the wealthiest that they would need to liquidate their Aspen mansions.

Tyler Durden

Fri, 07/15/2022 – 22:40