Giant Corporations Are Causing Inflation?

Authored by Lance Roberts via RealInvestmentAdvice.com,

“Giant corporations are using inflation as cover to raise their prices & boost their profits. In industry after industry, we have too little competition & companies have too much power to increase prices. I’ve been calling out this corporate profiteering & price gouging”

Another version of this argument as of late is accusing “Big Oil” of price-gouging consumers to make record-profit margins at a time when consumers are struggling. As Andrew Wilford penned:

“High corporate profits are the smoking gun that proves businesses are using ‘inflation’ as a cover for driving up prices simply because they want more money. This vague finger-pointing even took the form of a messaging bill aimed at oil ‘price-gouging’ that would have done nothing to bring down high gas prices.”

Here is the problem with these arguments that ultimately get regurgitated by the mainstream media.

They aren’t true.

Basic economics says that companies can only set prices at a level where the current supply will meet demand. Moreover, looking at prices in a vacuum is also very misleading because it doesn’t account for changes in the firm’s input or operating costs.

As Milton Friedman once stated, corporations don’t cause inflation; governments create inflation by printing money. There was no better example of this than the massive Government interventions in 2020 and 2021 that sent subsequent rounds of checks to households (creating demand) when an economic shutdown constrained supply due to the pandemic.

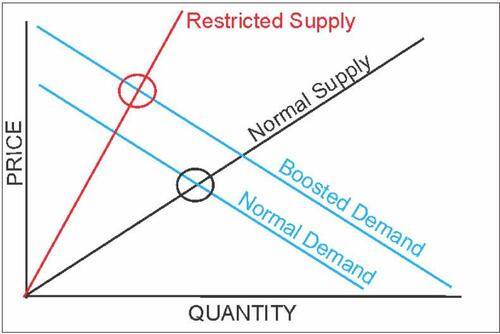

The following economic illustration shows such taught in every “Econ 101” class. Unsurprisingly, inflation is the consequence if supply is restricted and demand increases by providing “stimulus” checks.

Notably, this has nothing to do with giant corporations taking advantage of consumers. It is just the economic consequence of “too much money chasing too few goods.”

A Real-Time Example

We can dispel the myth of giant corporations’ “greed” by looking at one of the “villains” – Exxon Mobil.

“My message to the companies running gas stations and setting prices at the pump is simple: this is a time of war and global peril. Bring down the price you are charging at the pump to reflect the cost you’re paying for the product. And do it now.”

– President Biden

While the Administration is pandering to voters, given the upcoming Midterm elections, his statement has many falsehoods.

The first and most apparent is that oil companies don’t set gasoline prices at your local retailer. The local retail sets that price in response to, you guessed it, the supply and demand for gasoline and the price his competitors are charging on the other corner and down the street.

Secondly, and more importantly, while oil companies are getting criticized for increasing profit margins, which is their job to shareholders, everyone tends to forget about the other half of the equation – input costs. Exxon Mobil’s “pre-tax margin” has regained normality following negative oil prices in 2020. (I don’t remember the White House applauding oil companies then)

However, due to rising input costs, Exxon’s return on capital remains suppressed despite surging oil prices.

What is clear is that Exxon isn’t “raping and pillaging” the consumer, as the White House states. Such is because everyone forgets inflation affects Exxon Mobil also. While the cost per barrel of oil has risen, so have all of Exxon’s input costs, including:

Wages

Benefits

Drilling

Transportation

Operating

Material

Administrative

Etc.

However, it’s not just Exxon but every company currently impacted by inflation.

Corporate Profits Already Falling

As previously discussed, the “cure for high prices is high prices.”

While the Fed is hiking rates to quell inflation, inflation would eventually cure itself through the normal economic cycle if it did nothing. With the massive deluge of government-provided liquidity now used, disposable incomes are falling, constraining consumer spending. Unsurprisingly, over the next 12-18 months, inflation will return to the long-term trend of 2% annualized.

Since the beginning of this year, as the Fed was discussing its plans to tighten monetary policy, the stock market, interest rates, and inflation effectively tightened monetary policy in advance of the Fed. As shown, effective monetary policy is significantly tighter currently. (The index is comprised of short-term rates which impact consumption. Long-term rates which affect capital expenditures and mortgages, U.S. dollar, and inflation.)

Notably, producer prices, as shown below, have risen substantially faster than consumer prices. Such shows that as those “giant corporations” absorb input costs, it eventually impairs profitability. There is a high correlation between corporate earnings and inflation.

When the inflation spread rises enough to impair profitability, corporations take defensive measures to reduce costs (layoffs, cost cuts, automation.) As job losses increase, consumers contract spending, which pushes the economy towards a recession.

Furthermore, there is a significant correlation between economic growth and corporate profits. As economic growth has slowed markedly this year, corporate profits have already begun contracting.

Notably, the market has yet to account for the contraction in corporate profits.

The Market Will Catch Down To Profits

It isn’t just the economic data that historically correlates with markets, but earnings and profits also. Earnings can not live in isolation from the economy.

It would be best if you didn’t dismiss the fact markets can and do, deviate from long-term earnings. Historically, such deviations don’t work out well for overly “bullish” investors. The correlation is more evident when looking at the market versus the ratio of corporate profits to GDP.

Why profits? Because “profits” are what gets reported to the IRS for tax purposes and are much less subject to manipulation than “earnings.”

With correlations at 90%, the relationship between economic growth, earnings, and corporate profits should be evident. Hence, neither should the eventual reversion in both series.

Currently, the S&P index is trading well above its historical trend in earnings. As corporate profits decline, the current levels of earnings estimates will decrease also.

The detachment of the stock market from underlying profitability guarantees poor future outcomes for investors. But, as has always been the case, Wall Street is always late in catching up with economic realities.

It is worth remembering that:

“Profit margins are probably the most mean-reverting series in finance, and if profit margins do not mean-revert, then something has gone badly wrong with capitalism. If high profits do not attract competition, there is something wrong with the system, and it is not functioning properly.”

– Jeremy Grantham

Such is particularly the case of surging stocks against a weakening economy, reduced global liquidity, and rising inflation. While investors cling to the “hope” the Fed has everything under control, there is more than a reasonable chance they don’t.

Blaming giant corporations for causing inflation is not only erroneous; it is a dangerous thing for investors to believe.

Tyler Durden

Fri, 07/15/2022 – 09:51