JPMorgan Tumbles After Revenue Miss, Buyback Suspension, Dire Outlook From Jamie Dimon

What was already an ugly morning for global markets, turned even uglier when moments ago JPMorgan officially launched Q2 earnings season with results that were not only disappointing from top to bottom, missing on both revenue and earnings, but a dire outlook from CEO Jamie Dimon about “never-before-seen” quantitative tightening and its effects on global liquidity, “combined with the war in Ukraine and its harmful effect on global energy and food prices are very likely to have negative consequences on the global economy sometime down the road” further spooked traders, while JPM’s announcement that it was temporarily suspending its share buybacks was the straw that broke the camel’s back, sending JPM stock plunging more than 5% in premarket trading.

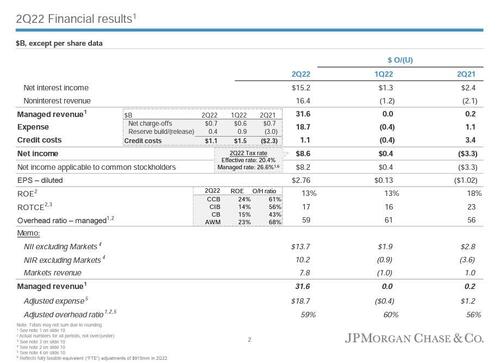

Starting at the top, JPM reported revenue of $31.63BN, which came in below expectations of $31.97BN, resulting in a 28% drop in profit and EPS of $2.76 which also missed consensus estimate of $2.88.

And while we will go down the company’s financials, here was the big shocker: the company’s announcement that it was temporarily suspending buybacks:

“As a result of the recent stress tests and the already scheduled G-SIB increase, we will build capital and continue to effectively and actively manage our RWA. In order to quickly meet the higher requirements, we have temporarily suspended share buybacks which will allow us maximum flexibility to best serve our customers, clients and community through a broad range of economic environments.”

Unlike previous quarters, this time the fire and brimstone from Dimon was relentless, with the veteran CEO warning of an never-before-seen environment:

In our global economy, we are dealing with two conflicting factors, operating on different timetables. The U.S. economy continues to grow and both the job market and consumer spending, and their ability to spend, remain healthy. But geopolitical tension, high inflation, waning consumer confidence, the uncertainty about how high rates have to go and the never-before-seen quantitative tightening and their effects on global liquidity, combined with the war in Ukraine and its harmful effect on global energy and food prices are very likely to have negative consequences on the global economy sometime down the road. We are prepared for whatever happens and will continue to serve clients even in the toughest of times.”

It wasn’t all dire, and Dimon said that the bank “performed well,” with “growth across the lines of business” and of course, has a “fortress balance sheet.”

And then this from Dimon: “In the first half of 2022, we extended credit and raised $1.4 trillion in capital for large and small businesses, governments and U.S. consumers.”

Some other highlights from the balance sheet:

Loans $1.10 trillion, +6.1% y/y, estimate $1.08 trillion

Total deposits $2.47 trillion, estimate $2.56 trillion

Net yield on interest-earning assets 1.8% vs. 1.62% y/y, estimate 1.75%

Standardized CET1 ratio 12.2%, estimate 12%

Managed overhead ratio 59%, estimate 59.9%

Return on equity 13% vs. 18% y/y, estimate 13.5%

Return on tangible common equity 17%, estimate 16.7%

Assets under management $2.74 trillion, estimate $2.82 trillion

Tangible book value per share $69.53

Of note, debit and credit card spending was “up 15% with travel and dining spend remaining robust,” card loans were “up 16% with continued strong new account originations.” On the other end, home lending revenue fell 26%, which reflects the weakness in mortgage origination we’ve seen lead to job cuts across the industry.

And sticking with the consumer bank, JPM set aside $761 million for loans that go bad, but the reserve build – money set aside – was $150 billion. This time last year, they released almost $2 billion in credit reserves as banks touted the strength and the health of the consumer. This move reflects the more pessimistic tone we’re hearing on the US economy this quarter.

Overall the results were good. The bad news is that clearly Dimon sees the good times ending, and after unexpectedly building reserves by a shocking $806MM last quarter, in Q2 the bank added another $428 million in reserves due to “a modest deterioration in the economic outlook”, as well as taking $657 billion in charge offs (less than the 835 million expected), adding up to $1.1 billion in credit costs, slightly more than the $1.07 billion expected:

Going back to the income statement, the bank’s trading results in Q2 were a mess, with just equities and trading beating expectations, while FICC and investment banking both missing badly, to wit:

Q2 CIB Markets total net revenue $7.79 billion, +15% y/y, missing estimate $7.93 billion

Q2 FICC Sales & Trading Rev $4.71B, missing Est. $5.11B

Q2 Equities Sales & Trading Rev $3.08B, beating Est. $2.82B

Q2 Corporate & Investment Bank IB Fees $1.65B, missing Est. $1.9B

Q2 Investment Banking Rev. $1.35B, -61% Y/Y, missing Est. $1.92B

Q2 Advisory revenue $664 million, missing estimate $720.7 million

Q2 Equity underwriting rev. $245 million, in line with estimate $244 million

Q2 Debt underwriting rev. $741 million, missing estimate $934.9 million

The bad news wasn’t just the 54% drop in investment banking fees but also a $257 million writedown in its bridge book, which “consists of certain held-for-sale positions, including unfunded commitments.” This probably is not all leveraged loans, but that’s the market that has been really hammered in recent months.

Summarized:

Commenting on the results, Dimon said that in the Corporate & Investment Bank, “we generated strong Markets revenue, up 15% as we helped clients navigate volatile market conditions.” But “Global IB fees were down 54% compared to a record last year, in a challenging macro environment. Commercial Banking loans were up 7% on strong new loan originations and higher revolver utilization.” Dimon also said that “wealth management’s results were “strong” thanks to “the impact of higher rates and loan and deposit balances.”

Looking ahead, the bank sees the following relatively rosy picture:

JPMorgan Sees FY NII Ex-CIB Markets Above $58B, Saw Above $56B

Sees 2022 Net Interest Income Excl Markets to Be $58B+

Sees 2022 Card NCO Rate of

Sees FY NII Ex-CIB Markets Above $58B, Saw Above $56B

Sees FY Adj. Expense of About $77B, Market Dependent

JPMorgan: $257M of Markdowns on Hfs Positions in Bridge Book

It’s curious how JPM sees an increase in NIM in a time when all curves are inverted but we are confident someone will ask that on the call.

In kneejerk response to the soft earnings, the first reaction coming in now from Vital Knowledge’s Adam Crisafulli who writes that “the actual Q2 numbers themselves are decent – the EPS “miss” was driven largely by some one-time items within the investment bank (bridge loan commitments, Russia-related items, etc.) while expenses and NII/NIM were bright spots.” As for the buyback suspension: “The big negative is the buyback suspension – mgmt. says this will only be temporary (and capital ratios improved vs. Q1), but investors will be disappointed nonetheless.”

Meanwhile, as Octavio Marenzi of Opimas writes, results were “a mixed bag, but ultimately slightly disappointing” and “there was no clear direction for the bank as a whole, and this will be same story in the next quarter or two.”

Investor agree, and judging by the slump in JPM stock price premarket, they don’t like what they are seeing, sending the stock as much as 5% lower:

And while we pointed out the “temporary” end of the buyback it’s also worth noting that when looking into last month’s stress test results, JPMorgan announced that the Fed would begin requiring its CET1 capital ratio to be 12% starting in October, up from the current requirement of 11.2%. And then on top of that, JPMorgan is going to have a surcharge of 50 basis points starting next year just because it’s one of the “global systemically important banks.” That’s the G-SIB increase Dimon was referencing in his quote. So by next year, they’ll have to notch a CET1 ratio of 12.5% — and they clocked in at an estimated 12.2% this quarter.

The full invest presentation is below (pdf link):

Tyler Durden

Thu, 07/14/2022 – 07:38