Historic Fails Of Transactions Show Japanese Bond Market Broken

By Masaki Kondo, Bloomberg Markets Live commentator and reporter

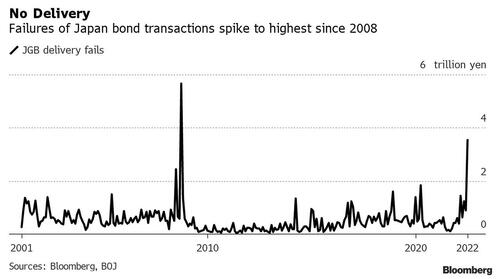

Historic failures of Japanese bond transactions will leave investors worried about the sustainability of the Bank of Japan’s easing and keep alive speculation of a future policy tweak.

The impact of the BOJ’s shock intervention in the bond market in June is quite visible in the central bank’s latest report on transaction failures. Sellers in the JGB market failed to deliver securities worth 3.53t yen in face value last month, the second-largest amount on BOJ data going back to 2001.

The central bank abruptly offered to buy unlimited quantity of cheapest-to-deliver securities last month to squeeze short bets in futures, causing a dash for the debt. The BOJ owned 76% of the CTD note as of Tuesday, leaving little in the secondary market.

The difference between cash bond and futures prices has almost normalized to pre-June levels, while demand for bond borrowing from the central bank has been slowing this month. The surge in fails shows just how extreme the BOJ’s bond operations have become. Though Japan’s bond market is regaining its calm on the surface, dislocation will continue as long as the central bank maintains its large presence in the market.

Tyler Durden

Tue, 07/12/2022 – 23:05