Fed Model Shows S&P 500 Is Cheap, It May Get Cheaper

By Ven Ram, Bloomberg markets live reporter and commentator

The selloff in US stocks this year means that they are now more attractive relative to bonds, according to the Fed Model. Still, the S&P 500 Index may get even cheaper if slowing growth and burning inflation mean corporate earnings trend lower while the Fed keeps raising rates.

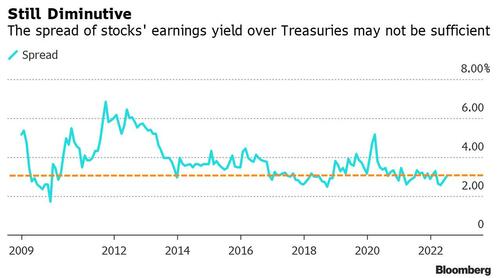

The estimated earnings yield on the S&P 500 is about 5.95%, meaning that investors in stocks get to earn some 300 basis points more than what they get from 10-year Treasuries

Given that spread, the Fed Model would posit that stocks are undervalued. However, as the chart shows, the gap widened far more emphatically in the aftermath of the recession triggered by the financial crisis, and the current spread is less than the average of 380 basis points since then.

The Fed Model fails to address the premium that investors require to hold riskier equities rather than Treasuries that are, to all intents and purposes, free from default risk.

In fact, given the current macroeconomic backdrop, investors may decide that a more demanding risk premium may be appropriate.

The estimated earnings per share on the aggregate of the S&P 500 is around $241 in the four quarters that began in July, which may be at risk of being lowered should fears about a slowing economy prove well-founded.

Even such a scenario is unlikely to deter the Fed from continuing to raise rates and run off its balance sheet given how much higher inflation is running above its target. In other words, the discount rate used to assess the intrinsic value of stocks is likely to trend higher.

A downward revision in earnings and an upward revision in the discount rate will pose a double-whammy to stocks.

How far could we plumb lower though?

Based on current projections of earnings and interest rates, the S&P is likely to trend toward 3,581, implying a further decline of about 7% from Monday’s closing level. For the Nasdaq 100, my calculations suggest a drop of about 10% toward 10,572.

Even with this year’s decline, the aggregate market capitalization of the universe of US stocks to gross domestic product is elevated at 1.60. While that’s a far cry from extremely lofty levels that prevailed earlier this year, they are still elevated, which may make value investors shudder.

What could go wrong with my view? A deeper-than-forecast economic downturn that causes the Fed to pause or abandon its hiking campaign would lower the discount rate applicable to stocks and buoy them from current levels, but as things stand, that prospect looks like a tail risk rather than the base-case scenario.

The S&P has already slumped almost 20% this year and the Nasdaq 100 some 27%, bringing them closer to fair value than they have been in years. Still, the correction has room to run, suggesting that investors should brace for further declines in the months to come.

Tyler Durden

Wed, 07/13/2022 – 10:46