Goldman Repeats ZeroHedge Analysis, Concludes “A Labor Market Slowdown Is Well Underway”

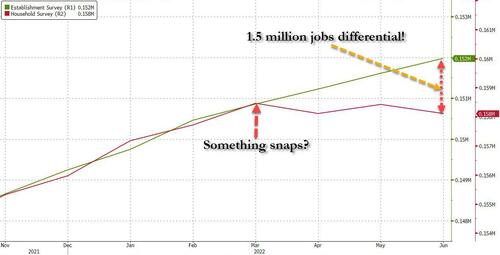

On Friday, when the pro-Biden echo chamber of cheerleading economists was patting itself on the back because the BLS reported that in June the US added 372K jobs, far higher than the median consensus expectation, and thus “confirmed” that a Biden recession was still far away or something, we immediately countered that the big picture is far uglier than represented and pointed to the Household survey, where there was a loss of 315K workers. We also observed that full-time and part-time jobs had tumbled at the expense of surging multiple-jobholders, and that something apparently had broken a few months ago, around March, when the Establishment Survey kept on rising as if with the magic of excel’s goalseek function, while the Household Survey hit some unexplained brick wall, and hasn’t moved at all.

Indeed, since March, the Establishment Survey shows a gain of 1.124 million jobs while the Household Survey shows an employment loss of 347K!

Today, confirming that imitation is the sincerest form of flattery, none other than Goldman’s chief economist Jan Hatzius published a note (available to professional subs) in which he writes that while “fears of an imminent US recession have abated somewhat after the 372k nonfarm payroll gain reported for June” he also counters that “there is no doubt that a labor market slowdown is underway.”

Goldman also echoed our latest JOLTS analysis, and notes that “job openings and quits are declining, jobless claims are rising, the ISM employment indices in manufacturing and services have fallen to contractionary levels, and many publicly traded companies have announced hiring freezes or slowdowns.” This, too, we have been pounding the table on (see “We Could See A Million Layoffs Or More” – Here Comes The Job Market Shock“)

Going back to the jobs report, Hatzius verbatim copies what we said on Friday, and writes that “perhaps most tellingly, the household survey of employment has shown essentially no job gains for the past three months, both on a headline basis and when adjusted to the definitions of the establishment survey. While the household survey is much noisier than the establishment survey on a month-to-month basis, it picks up changes in net new firm creation in real time and therefore often outperforms the establishment survey at cyclical turning points, provided both measures are averaged over several months.”

This to Goldman suggests that “the still-robust nonfarm payroll prints of recent months probably overstate true job growth” which of course regular ZH readers knew on Friday when we panned the jobs report “Something Snaps In The US Labor Market: Full, Part-Time Workers Plunge As Multiple Jobholders Soar“, while Goldman’s kneejerk response was erroneously full of praise.

It took Goldman the weekend – and reading this website – to figure out how correctly read the data.

There is much more in the full Goldman note which makes the case that Zero Hedge readers (if not the fed) are all too familiar with: the US economy is rapidly crashing into a recession, if not depression.

Tyler Durden

Mon, 07/11/2022 – 12:17