Morgan Stanley: Soaring Dollar Will Crush Earnings Growth And Snuff The Rally In Stocks

By Michael Wilson, Morgan Stanley chief US equity strategist

One of the more popular views over the past decade has been the eventual demise of the US dollar. After all, with the Fed printing so many dollars since the global financial crisis and then doubling down after the Covid pandemic hit two years ago, this idea has merit. Indeed, the meteoric rise in cryptocurrencies was essentially a bet on the entire fiat currency world coming unglued. However, after the GFC, these printed dollars never made it into the real economy as they were simply used to patch up broken balance sheets from the housing bust. Therefore, M2 growth never got “out of hand”, exceeding 10% on a year-on-year basis only briefly in 2009 when QE first began and then again in 2012 when QE3 was started to help to offset the sovereign debt crisis. In fact, during the entire period after the Fed first embarked on QE in November 2008 through the end of the cycle in March 2020, M2 growth averaged just 6% – right in line with the long-term trend of M2 and nominal GDP growth. As a result, the US dollar maintained its reserve currency status and rose almost 40% during that decade.

However, as we pointed out back in April 2020, the stimulus provided during Covid was very different. At the time, we suggested that the coordinated fiscal and monetary policy was unprecedented and akin to “helicopter” money as described by Milton Friedman in his seminal paper back in 1969 and referenced by Ben Bernanke in 2002 as a tool the Fed could always use to avoid a deflationary trap. In other words, the seeds of today’s inflation were sown in those early months right after the pandemic with the first dose of helicopter money. That first drop was arguably necessary to prevent a deflationary bust. But, handing out free money is very popular with the people, so there were two more doses – one by each party – administered in January and March 2021 after we had an effective vaccine to help to reopen much of the economy. The result is that M2 growth exploded and since February 2020 has averaged 17%, or 3x the long-term trend – a truly unprecedented outcome that left us with much more inflation than was desired. Consequently, the US dollar fell sharply from March 2020 to March 2021 but, once M2 growth peaked, so did the dollar’s decline. Now, with the Fed reversing course so quickly and the checks having stopped long ago, M2 growth has fallen all the way back to its long-term trend of just 6%. Given the projected path for rate hikes and quantitative tightening, M2 growth is likely to fall even further and the dollar is unlikely to show any signs of demise until the Fed pivots, which seems unlikely any time soon, especially after Friday’s strong jobs report.

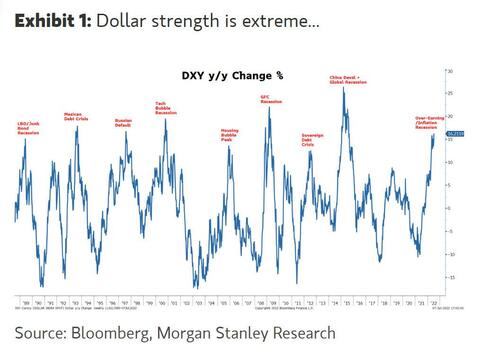

So why does this matter so much for stocks? Based on the extreme rally so far this year, the DXY is now up 16% year on year. This is about as extreme as it gets historically speaking and, unfortunately, it typically coincides with major financial stress in markets, a recession, or both.

Ultimately, the Fed wants a meaningful economic slowdown to curtail inflation and a stronger dollar is part of that cocktail. From the standpoint of stocks, the stronger dollar is going to be a massive headwind to earnings for many large multinationals. This could not be coming at a worse time as companies are already struggling with margin pressure from cost inflation, higher/unwanted inventories, and slower demand.

The simple math on S&P 500 earnings from currency is that for every percentage point increase on a year-on-year basis it’s approximately a 0.5x hit to EPS growth. At today’s 16% year-on-year level, that translates into an 8% headwind for S&P 500 EPS growth, all else equal.

Of course, things can change quickly, but it doesn’t seem likely until M2 growth stops slowing, which will require a Fed pivot. The main point for equity investors is that this dollar strength is just another reason to think earnings revisions are coming down over the next few earnings seasons, which starts next week. Therefore, the recent rally in stocks is likely to fizzle out before too long.

Tyler Durden

Sun, 07/10/2022 – 15:30