Why Goldman Is Buying Every Barrel Of Oil It Can Find

With commodity markets suffering a historic rout in the past few weeks, it will not come as a surprise to anyone that recession risks now dominate all macro markets.

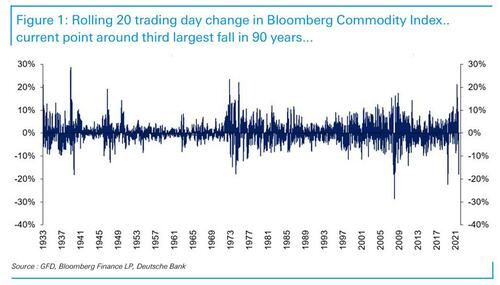

Earlier this week, Deutsche Bank economists wrote that the rolling 20-day move in their commodity index is now seeing the third largest decline in 90 years, behind only the GFC, the initial Covid shock, and on a par with that seen in the early days of WWII in 1940. In March, we saw the fourth largest 20-day uptick after the Russian invasion of Ukraine. The start of WWII and two occasions in the 1970s were the only bigger moves.

Goldman picks up on this and writes overnight that concerns over the deteriorating economic growth outlook in the US and Europe have dominated all markets lately, with commodities no exception. The BCOM and S&P GSCI total return indices respectively shed -18% and -16.5% relative to their YTD peak hit as the sell-off that initially started in industrial metals not only broadened to other sectors but intensified significantly over recent trading days.

As recession fears have gripped risky assets, Goldman’s chief commodity strategist Jeffrey Currie writes that “commodities have become positively correlated to equity and bond markets and negatively correlated to the US Dollar, a stark departure from previous months when commodities delivered outstanding diversification benefits to investors” (the full note available to professional subs).

Yet as we first noted in “Inside The Oil Market’s Jekyll-And-Hyde Moment“, Currie also writes that “this latest commodity sell-off is completely delinked from physical fundamentals and driven by financial liquidation.”

Meanwhile, in the physical realm, inventories of energy and metals continue to fall from already uncomfortably low levels as demand remains above supply in all cyclical commodities, except iron ore. Timespreads, the single most accurate measure of underlying fundamentals, trade at unprecedented levels of backwardation, irrespective of the price sell-off.

That’s because mobility remains robust globally and continues to recover strongly in China and the oil market is pointing to a 1 million b/d deficit. US and European aluminium premia remain historically high, while physical order books for metals remain strong.

As such, Goldman predicts that this micro scarcity paints a fundamentally constructive outlook for commodities despite the rising probability of a US and European recession over the coming 12 months, which commodities stand to weather on China’s large-scale counter-cyclical stimulus.

It is in this bifurcated world – one where financial liquidation pressures keep slamming prices even as physical fundamentals point to much higher demand, and thus price spike – that Goldman says “commodities remain the best macro hedge” adding that although the bank expects spot prices to remain vulnerable to spec length liquidations triggered by negative economic news flow, “we believe it is premature for commodities to succumb to recession concerns when the global economy is still growing and markets remain in deficit on strong demand.”

As a result, Currie writes, he views this price pullback as a longer-term buying opportunity, and barring a large synchronous negative global demand shock that creates a level-shift down in demand, demand rationing will remain the dominant theme for energy and food commodities while an accelerated stimulus program in China should help to create a turnaround in base metals pricing in Q3. Thus, Goldman believes the correlation between commodities and other risky assets is set to decline again given that commodities are spot assets while risky assets discount future expectations that have turned more negative. The bank also reminds its clients that with the exception of the GFC, commodities have been a great macro hedge, with all sectors delivering positive returns during large drawdowns in 60/40 portfolios since 1990.

But why have markets failed to understand the powerful upside fundamental case? Simple: as Currie explains, while many commodity markets remain remarkably backwardated so is volatility, making them harder to invest in.

As such “trading frictions have pushed up near-dated volatility and raised initial margins to extreme levels, thus pushing more market participants off-exchange, which has cemented a negative spiral between low liquidity and high volatility.” As a result, price adjusted AUMs in commodity indices are down 24% YTD! On net, Goldman warns that “while current price levels do not seem to reflect current micro conditions nor the full impact of Russian sanctions, long-term investors in commodities will likely have to continue to stomach higher volatility in return for a significant total return pay-off.”

As an aside, Goldman also writes that a “mild recession” is not a risk for commodities, and, given the inherent structural supply constraints, should not stand in the way of further physical goods inflation because “the current macro demand set-up is very different to 2008/09, when an exogenous credit and deleveraging crisis led to a sharp downturn in demand. We also find that the US share in global commodity markets is now much lower than it was historically, with the share of demand in EMs, particularly China and India, much larger.”

Thus, Goldman writes, China and its zero-covid policy is significantly more important to commodities demand, and the bank sees growth and demand accelerating there in a counter-cyclical fashion to the West. Underlying physical demand itself remains solid for commodities, underscored by a rebound in oil demand growth, both seasonally and linked to a normalization in international travel, and robust order books for metals. Moreover, even in a recession, US demand would likely be supported by tight inventories of commodity-intensive goods (houses and autos).

* * *

Turning exclusively to oil, Currie writes that the recent sharp sell-off in crude oil prices has been driven by growing recession fears in the face of low trading liquidity, with technicals exacerbating the sell-off. Doing some math, the Goldman commodities team writes that “the declines in prices and refining margins since mid-June are now equivalent to the oil market pricing in a 1.1% downward revision to 2H22-2023 global GDP growth expectations.” Goldman believes this move has overshot, and while risks of a future recession are growing, the key to Goldman’s bullish view is that “the current oil deficit remains unresolved, with demand destruction through high prices the only solver left as still declining inventories approach critically low levels.”

Additionally, and as Goldman has explained in the past, the bank continues to see the oil market in a structural deficit that requires still higher prices to rebalance. Indeed, the oil market remained tighter than we had expected, reducing global inventories, after a record drawdown of 1350 million bbls to levels that were significantly lower than Goldman had previously expected. This more than offset the recent April-May surplus, the first after a record-long 23 months of deficits. This shift to surplus was driven by lower Chinese demand, record large SPR releases and a smaller-than-expected decline in Russian exports.

Notably, Goldman calculates that this surplus has now already come to an end, as the rebound in Chinese demand more than offsets the resilience in Russian exports, pushing inventories to historical new record lows. This deficit will likely persist at current oil prices given the expected moderate recovery in Chinese demand and declines in Russian exports (amid EU sanctions). While Goldman remains cautious on both, it expects the decline in Russian exports to accelerate from 0.3 mb/d to reach 1.5 mb/d by 1Q23 (versus 4Q21) given the logistical difficulties of now having to re-route nearly 5 mb/d of Western exports.

On the demand side, the negative global economic growth impulse remains insufficient to rebalance inventories at current prices while supply remains inelastic to prices – especially for shale – given investor and logistical bottlenecks. True, there will be higher core-OPEC supply later this year but this is mostly offset by the lack of progress on returning to the Iran Nuclear deal.

On net, even with Goldman’s cautious assumptions on China/Russia, the bank calculates that “oil prices need to rally further to normalize the unsustainably low levels of global oil inventories, as well as OPEC and refining spare capacities.”

As such, based on the bank’s latest supply and demand expectations, Goldman forecasts that Brent prices will need to average $135/bbl in 2H22-1H23 for inventories to finally normalize by late 2023, “the binding constraint to prices in our view.”

For long-only investors, Goldman advocates near-dated positions in Brent crude oil to benefit from the price upside as well as steep backwardation. The bank is also bullish Brent crude oil timespreads near-term as refinery runs ramp up by more than the risks to Russian production and Chinese demand. Having said that, there is also upside to longer-dated prices, such as Dec-23, as cost inflation and ESG drivers should exert upside pressure on long-dated prices while the multi-year supply response that needs to happen in order to rebuild spare capacity has yet to be triggered.

There is much more in the full Goldman report available to professional subs in the usual place.

Tyler Durden

Fri, 07/08/2022 – 15:10