Wall Street Stunned As June Payrolls Unexpectedly Smash Expectations As Labor Force Shrinks, Household Survey Tumbles

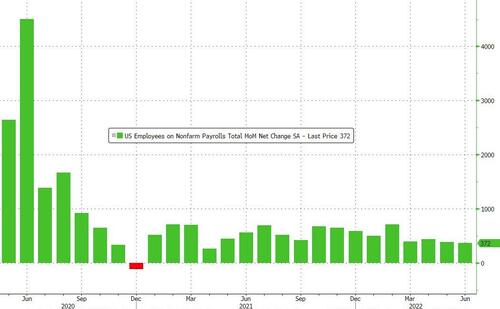

With even permabull economists conceding that the US economy is slowing rapidly and today’s payrolls report should show a big slowdown, moments ago the BLS confirmed yet again that the monthly payrolls number is nothing but a politically mandated homework assignment (where trends only change when someone gets a tap on the shoulder), when – at a time when US GDP is set to decline for two quarters in a row – it reported that in June US payrolls rose by 372K, smashing expectations of a 268K increase, coming well above the whisper number of 245K, and trouncing Goldman’s preferred payrolls range of 175-250K.

The change in total nonfarm payroll employment for April was revised down by 68,000, from +436,000 to +368,000, and the change for May was revised down by 6,000, from +390,000 to +384,000. With these revisions, employment in April and May combined is 74,000 lower than previously reported.

The June payrolls number was not only the 3rd consecutive beat to expectations, but the biggest beat going back to February.

Courtesy of Bloomberg, here’s the 28-month change in payrolls since the pre-pandemic highs in employment, broken up by industry from. Payrolls are just short 524,000 jobs from the pre-pandemic high of 152.5 million.

As a reminder, this is what Goldman said coming into today’s report: “the market wants not too hot not too cold to keep this bid. Strong enough to say the world isn’t going into recession. Not too strong to send US10s back to 3.25% on the day. Not too cold to highlight US data deteriorating while inflation will stay high and fed hiking 75bps into dramatic slowdown. Something like 175k to 250k.”

Surprisingly, while the establishment survey printed a red hot +372,000, the household survey showed just the opposite, tumbling by -315,000.

What is even more confounding is that according to “big data” watched by Goldman, today’s print should have been a -1 million drop.

… while seasonals alone were a 200K headwind.

While this was still the lowest number back to April 2021 (even after May was revised lower from 390K to 384K), the pace of slowing is nowhere near enough for the Fed to be satisfied that the economy is cooling fast enough, which means an economy-crushing 75bps rate hike in July squarely in the Fed’s sights.

Going back to the report, the unemployment rate came as expected, at 3.6% (and unchanged from last month), with black unemployment dropping to pre-covid levels, Hispanic unemployment slighlty higher up, and national flat.

Among the major worker groups, the unemployment rate for Asians increased to 3.0 percent in June. The jobless rates for adult men (3.3 percent), adult women (3.3 percent), teenagers (11.0 percent), Whites (3.3 percent), Blacks (5.8 percent), and Hispanics (4.3 percent) showed little or no change over the month.

Much more remarkable – and improbable – is that the underemployment rate printed 6.7%, the lowest on record!

Meanwhile, and perplexingly, the labor force shrank again – declining from 164.376 million to 164.023 million, and the participation rate dropped more than expected, dropping to 62.2%, from 62.3%, and below the expected increase to 62.4%.

Looking further into the participation rate decline, the hit was worst on Black and Asian workers, erasing all or nearly all of the prior month’s gains. The participation rate for Hispanic and White workers remained unchanged from May.

Going by age, the decline in labor participation from 62.3% to 62.2% was driven by a drop in the 55+ group (38.9 to 38.6) and also the 25-34 group (83.8 to 83.1)

On the wage front, average hourly earnings for all employees on private nonfarm payrolls rose by 10 cents, or 0.3%, to $32.08, in line with expectations and down from 0.4% last month. Over the past 12 months, average hourly earnings have increased by 5.1%, slightly hotter than the 5.0% expected.

The average workweek for all employees on private nonfarm payrolls held at 34.5 hours in June, and came in below expectations of 34.6, which however would have been a flat print vs last month which was also revised lower to 34.5. In manufacturing, the average workweek for all employees was little changed at 40.3 hours, and overtime fell by 0.1 hour to 3.2 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls remained at 34.0 hours.

Among those not in the labor force who wanted a job, the number of persons marginally attached to the labor force, at 1.5 million, essentially unchanged in June. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. Discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, numbered 364,000 in June, little changed from the prior month.

Some more details from the Household survey:

Among the unemployed, both the number of permanent job losers, at 1.3 million in June, and the number of persons on temporary layoff, at 827,000, changed little over the month. These measures are little different from their values in February 2020.

In June, the number of long-term unemployed (those jobless for 27 weeks or more) was essentially unchanged at 1.3 million. This measure is 215,000 higher than in February 2020. The long-term unemployed accounted for 22.6 percent of all unemployed persons in June.

The labor force participation rate, at 62.2 percent, and the employment-population ratio, at 59.9 percent, were little changed over the month. Both measures remain below their February 2020 values (63.4 percent and 61.2 percent, respectively).

The number of persons employed part time for economic reasons declined by 707,000 to 3.6 million in June and is below its February 2020 level of 4.4 million. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs.

The number of persons not in the labor force who currently want a job was essentially unchanged at 5.7 million in June. This measure is above its February 2020 level of 5.0 million. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

Believe it or not, the covid pandemic is still impacting the labor market according to the BLS:

In June, 7.1 percent of employed persons teleworked because of the coronavirus pandemic, down from 7.4 percent in the prior month. These data refer to employed persons who teleworked or worked at home for pay at some point in the 4 weeks preceding the survey specifically because of the pandemic.

In June, 2.1 million persons reported that they had been unable to work because their employer closed or lost business due to the pandemic–that is, they did not work at all or worked fewer hours at some point in the 4 weeks preceding the survey due to the pandemic. This measure is up from 1.8 million in the previous month. Among those who reported in June that they were unable to work because of pandemic-related closures or lost business, 24.8 percent received at least some pay from their employer for the hours not worked, little different from the previous month.

Among those not in the labor force in June, 610,000 persons were prevented from looking for work due to the pandemic, up from 455,000 in the prior month.

Looking at the jobs by sector we find the following:

Employment in professional and business services continued to grow, with an increase of 74,000 in June. Within the industry, job growth occurred in management of companies and enterprises (+12,000), computer systems design and related services (+10,000), office administrative services (+8,000), and scientific research and development services (+6,000). Employment in professional and business services is 880,000 higher than in February 2020.

In June, leisure and hospitality added 67,000 jobs, as growth continued in food services and drinking places (+41,000). However, employment in leisure and hospitality is down by 1.3 million, or 7.8 percent, since February 2020.

Employment in health care rose by 57,000 in June, including gains in ambulatory health care services (+28,000), hospitals (+21,000), and nursing and residential care facilities (+8,000). Employment in health care overall is below its February 2020 level by 176,000, or 1.1 percent.

In June, transportation and warehousing added 36,000 jobs. Employment rose in warehousing and storage (+18,000) and air transportation (+8,000). Employment in transportation and warehousing is 759,000 above its February 2020 level.

Employment in manufacturing increased by 29,000 in June and has returned to its February 2020 level.

Information added 25,000 jobs in June, including a gain of 9,000 jobs in publishing industries, except Internet. Employment in information is 105,000 higher than in February 2020.

In June, employment in social assistance rose by 21,000. Employment continued to trend up in child day care services (+11,000) and in individual and family services (+10,000). Employment in social assistance is down by 87,000, or 2.0 percent, since February 2020.

Wholesale trade added 16,000 jobs in June, including 8,000 in nondurable goods. Employment in wholesale trade is down by 18,000, or 0.3 percent, since February 2020.

Mining employment rose by 5,000 in June, with a gain in oil and gas extraction (+2,000). Mining employment is 86,000 above a recent low in February 2021.

Naturally, with the number coming in hot, it’s clear that the Fed will have to move even more aggressively: as Steve Chiavarone at Federated Hermse notes, “for equity markets, the too-hot number will mean a continued/more aggressive Fed, which increases recession risk. This is bad for growth stocks, which get hit by higher rates.”

Bloomberg’s Chris Antsey echoes this take writing that “The hawkish interpretation is solidifying on Wall Street. It’s now 12 basis points higher for the 2-year yield, a strong move. And we’re at a 0.9% drop for stock futures. No Fed pause in sight.”

As for the White House, it will be a tough spin because they will want to showcase the continuing job gains and the continuing wage gains as a good thing, the flip side is that without some slowdown, it adds to inflationary pressures, and right now inflation remains the No. 1 concern among US households.

Tyler Durden

Fri, 07/08/2022 – 08:37