June Payrolls Preview: Big Data Hints At A Huge Negative Surprise

In previewing tomorrow’s nonfarm payrolls report, Goldman trader Matthew Fleury writes that “the market wants not too hot not too cold to keep this bid. Strong enough to say the world isn’t going into recession. Not too strong to send US10s back to 3.25% on the day. Not too cold to highlight US data deteriorating while inflation will stay high and fed hiking 75bps into dramatic slowdown. Something like 175k to 250k.”

It’s probably not a surprise then that with markets hoping for a print just north of 200K that consensus is also in the same ballpark (median consensus is at 268K). But while the rate of payrolls growth is expected to cool again in June (from 390K in May), once again traders will be paying close attention to the wage metrics within the data to help shape expectations about whether the Fed will raise rates by either a 50bps or a 75bps increment at the July FOMC meeting.

As Newsquawk writes in its NFP preview, the jobs report is one part of the equation in forming these expectations, the other being the June CPI Data due next week. The data releases could also determine the course for rate hikes through the rest of this year; a recent dovish repricing of the trajectory of Fed rate hikes (on the back of recession fears) has been unwinding, and money markets now assign an approximately 50% chance rates will rise to 3.25-3.50% by year-end. Another note of caution: high-frequency data on the labor market generally indicate weakness in June employment, with all three indicators consistent with an outright decline in seasonally-adjusted payrolls (see below).

Here is what Wall Street expects:

Analysts expect the rate of job additions will continue to cool in June, with the consensus looking for 268k payrolls to be added; that would be lower than May’s 390k, which is lower than recent averages too (3-month average 408k, 6-month average 505k, 12-month average 545k).

Analysts see the jobless rate holding at 3.6% in June; the Fed’s recently updated economic projections see the unemployment rate ending this year at 3.7%, rising to 3.9% next year, and then 4.1% in 2024.

Fed Chair Powell in June said that unemployment at 4.1% would be a successful outcome and is still a historically low level, suggesting the Fed will be happy to allow unemployment to rise to this level as the Fed attempts to return inflation to target.

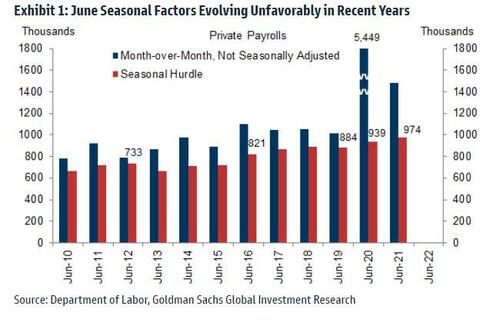

Goldman is uncharacteristically below consensus, and estimates nonfarm payrolls rose by 250k in June, a sharp slowdown from the +408k three-month average. The bank also estimates private payrolls rose 200k in June (vs. consensus +235k), and notes the possibility that the June seasonal factors are overfitting to the reopening-related job surges in June 2020 and June 2021. This higher seasonal hurdle represents a headwind of roughly 200k, in Goldman’s view, other things equal

Average Hourly Earnings: As has been the case for many months now, traders will be carefully watching measures of wage growth for signs of how the ‘second round’ effects are faring. Average hourly earnings are expected to rise 0.3% M/M, matching the May rate; the annual measure is seen cooling to +5% Y/Y from 5.2% in May. The FOMC’s June meeting minutes said that some contacts had reported that, because of previous wage hikes, hiring and retention had improved and pressure for additional wage increases appeared to be receding, while Powell at the June FOMC said we are not seeing a wage-price spiral but he did note wage growth is elevated.

Arguing for a weaker-than-expected report:

Evolution of the seasonal factors. The June seasonal factors have evolved unfavorably in recent years, with a month-over-month hurdle of 974k in June 2021 and 939k in June 2020 compared to the 821k hurdle in June 2016 and 733k in June 2012 (these were also 5-week June payroll months). Goldman cautions of the possibility that the June seasonal factors are overfitting to the reopening-related job surges in June 2020 and June 2021. This higher seasonal hurdle represents a headwind of roughly 200k.

Employer surveys. The employment components of business surveys generally decreased in June. The Goldman services survey employment tracker decreased by 0.2pt to 54.5 and its manufacturing survey employment tracker decreased by 0.3pt to 55.8.

Job cuts. Announced layoffs reported by Challenger, Gray & Christmas increased 74.0% month-over-month in June, after decreasing 32.0% in May. The June increases were particularly pronounced in the real estate, autos, and media industries.

Big Data. High-frequency data on the labor market generally indicate weakness in June employment, with all three indicators consistent with an outright decline in seasonally-adjusted payrolls, averaging well over 1 million jobs lost in June! However, we note that these signals significantly understated BLS payroll growth in both April and May, which is why economists tend to place less weight on them for this report. Of course, one day they will be right…

Jobless claims. Initial jobless claims increased from very low levels during the June payroll month, averaging 222k per week vs. 200k in May. Continuing claims in regular state programs decreased 19k from survey week to survey week before rebounding after the end of the payroll month.

Arguing for a stronger-than-expected report:

Job availability. The Conference Board labor differential—the difference between the percent of respondents saying jobs are plentiful and those saying jobs are hard to get—edged up by 0.2pt to +39.7. JOLTS job openings decreased by 427k in May to 11.3mn. Despite the sequential weakness, the level of labor demand remains very high, which likely supported continued job growth in the leisure and healthcare sectors.

Labor supply constraints. When the labor market is tight, job growth tends to slow during the spring hiring season in March/April/May. It then tends to pick back up in June with the arrival of the summer youth labor force. For example, nonfarm payrolls rose 224k in June 2019 after just +75k in May (first-reported basis).

Policy Implications: The Federal Reserve’s recently updated economic forecasts acknowledge that aggressive rate hikes ahead will weigh on growth and the labor market. But officials have talked up the strength of the economy, and seem confident in their ability to tighten policy without causing significant damage to the labor market. Officials have noted that the jobs market is strong, demand for labor continues to outstrip supply, unemployment is near a 50-year low while job vacancies are at historical highs, and there is elevated nominal wage growth. Officials have recently been suggesting that the debate in July will be between 50bps and 75bps, and any upside surprise in the wages data will embolden calls for the Fed to raise rates by 75bps again on July 27th. Currently, money markets are assigning an approximately 85% chance that rates will be lifted by the larger increment, but if this metric was to post a downside surprise, it could help pricing tilt back into the 50bps bucket. It is also worth keeping in mind that Fed officials decided to go with a larger-than-guided 75bps rate hike in June after the hotter-than-expected May CPI data; accordingly, next Wednesday’s CPI Report for June will also play an instrumental role in setting policy expectations for the July meeting.

Some have suggested that the jobs data and inflation report might end up having more of an impact on pricing beyond the July meeting. Amid the recent growth fears, market pricing for rates to end this year between 3.25-3.50% diminished to the point that 3.00-3.25% was a more likely outcome; however, in recent sessions, we have seen the implied probability of a move to 3.25-3.50% rise and is now about 50/50.

Finally, those looking at the recent past for hints of what’s to come, keep in mind that 7 of the last 8 payrolls days have ended lower 6 hours after the print (whether it was a beat or a miss).

Which probably means we are overdue for a reversal…

Tyler Durden

Thu, 07/07/2022 – 22:08