Consumer Credit Hits A Brick Wall With Credit Cards Maxed Out

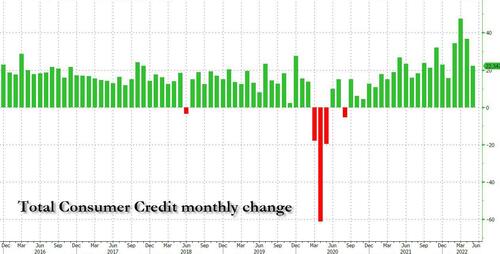

Last month, when we reported that the latest (April) consumer credit numbers were an absolute shocker, with another month of blowout revolving (credit card) debt confirming that US consumers had tapped out, and were spending themselves silly with money they don’t have, we said that the hangover was going to be brutal and painful.

Well, fast forward one month to the Fed’s latest, just released consumer credit data (for the month of May) which confirmed that as expected, US consumers had maxed out their credit cards and the hangover had started.

Starting at the top, total consumer credit rose just $22.3 billion, the lowest monthly total since January, and a sharp drop from both April’s $36.8 billion and March’s record $47.5 billion.

The drop was driven entirely by a sharp slowdown in revolving debt (i.e., credit card usage) which rose by just $7.4 billion, the lowest since last August, and nearly 75% below March’s record $25.9 billion.

Meanwhile, non-revolving credit, which is far more stable as it funds less discretionary items such as cars and college education, rose by $14.9 billion, below April’s $18.8 billion, if in line with the average monthly increase of 2021.

Bottom line: the sharp drop in credit card growth (if not yet decline) is precisely why Q2 GDP is on pace for a big slowdown. But what’s worse is that once the mass layoffs kick in in addition to the soaring inflation, at a time when most marginal credit cards are maxed out, the pain across US consumers will be unbearable, as it will come just as most households are tapped out and no longer have dry powder on their credit card for discretionary purchases.

In short, the recession which unofficially started in Q1 and worsened in Q2, is about to get much worse in Q3 when the key support pillar of the US economy, consumer spending which accounts for 70% of GDP, goes into reverse now that maxed out credit cards have to finally be repaid.

Tyler Durden

Fri, 07/08/2022 – 15:44