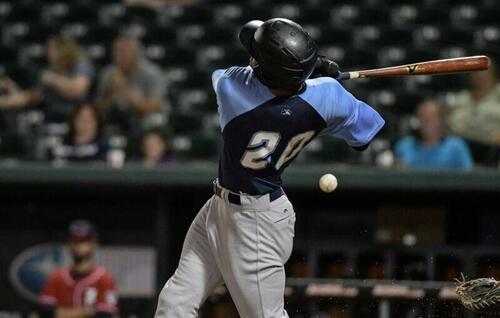

Strike Three For The Fed

Authored by Robert Wright via The American Institute for Economic Research,

America’s central bank, the Federal Reserve System (Fed), is currently decimating the US economy for the third time in its existence. Will the Fed’s strikeout be its final at bat, or shall fans of the American economy be burdened by this monetary John Gochnaur (the worst player in major league baseball history) for another century? Even though the Ty Cobb (arguably the best batter ever) of monetary systems, the Gold Standard, stands ready to pinch hit?

Remember, the Fed does not just try to control the macroeconomy, it tries to control it within political constraints. Recent events have exploded any notion that it is an enterprise independent of government, led by sophisticated technocrats just trying to find the right tradeoff between output and inflation. To some extent, it botches its job out of incompetence, like Gochnaur. To some extent, though, it puts its own interests ahead of those of the American people.

Strike one occurred during the Great Depression of the 1930s. The nation was still technically on the Gold Standard but the international monetary system was such a mess following the Great War (1914-1918) that the Fed enjoyed some domestic monetary policy discretion, the ability to expand or contract the money supply.

The Fed’s monetary stance proved too loose during the 1920s, which helped stock prices get too frothy. Following the Great Crash in 1929, though, its stance was too tight. Moreover, it failed to help struggling small banks, many of which went under, dragging depositors with them. That led to successive waves of bank runs that stymied economic rebound until after the Policy Monster of Hyde Park got elected president in 1932.

Strike two was the Great Inflation of the 1970s. The Fed might be forgiven for this one because it occurred during a switch to a new monetary policy regime, a solution to the Trilemma or Impossible Trinity that granted it full domestic monetary policy discretionary for the first time by freeing the international movement of capital and allowing foreign exchange rates to respond fully to market forces.

But it was warned! For the better part of a decade, pundits like NBC Radio financial journalist Wilma Soss had predicted that large budget and trade deficits would necessitate the end of the Bretton Woods system of fixed exchange rates. That would lead, she presciently warned, to rampant dollar depreciation internationally, domestic inflation, scarcity-inducing price controls, and the euthanasia of individual stock and bond investors.

The Fed fouled a pitch off during the Global Financial Crisis of 2008. Although it helped to create the subprime mortgage bubble with low interest rates and its wrong-headed thinking about financial exclusion, it did its job as lender-of-last-resort well enough to turn the economy around fairly quickly by massively subsidizing the banking sector. The tactics employed were suboptimal but at least the Great Recession did not turn into another depression.

The Fed, however, whiffed in 2020-21. It should have begun aggressively raising rates to combat the massive COVID fiscal stimulus that Congress passed that year. In fact, it could have saved America from the pain caused by the lockdowns merely by threatening to offset the stimulus with higher interest rates.

Lockdowns arguably made stimulus necessary, but the lockdowns themselves were clearly unnecessary. AIER vigorously argued against lockdowns for over a year, and its position has since been vindicated econometrically and scientifically. Unrestrained by lockdown regulations, retailers, gyms, and other businesses would have soon figured out that they simply needed to implement special hours or days for the maskers/vaxxers and other special hours or days for the antis. Experiments would have soon revealed which COVID protocols would be sufficient to suppress so-called superspreader events in various contexts, allowing most economic activity to continue relatively unimpeded without worsening the pandemic one iota.

But instead of sticking to its alleged two percent inflation target, the Fed caved in to pro-lockdown political pressure and kept interest rates low, even after the temporary threat of deflation had passed by the end of summer 2020 and prices began their steady ascent:

The Fed is finally raising interest rates aggressively but in the process it’s creating the largest operating losses in its history. Why, then, didn’t the Fed counteract massive fiscal stimulus with tighter monetary policy in 2021? Ultimately, it doesn’t matter. Bad batters always have excuses. The sun was in my eyes, the pitcher cheated, I’m just in a slump (aka my strikeouts are transitory), or I bet a lot of money on the other team. Meanwhile, fans in the stands know that it doesn’t matter, ya struck out!

No batter always gets on base but America, nay the world, has a high-quality pinch hitter that it benched a century ago: the Gold Standard. It’s not perfect but it is far better, and fairer, than the Fed. Returning to gold, or some other commodity standard, need not be scary. It just means replacing monetary policy technocrats of dubious ability or motivation with market forces, the same market forces that develop the products and technologies that seemingly magically appear whenever and wherever consumers want them. Money need be no different.

Tyler Durden

Tue, 07/05/2022 – 12:25