Oil Price Could Hit “Stratospheric” $380 If Russia Retaliates To G7 Oil Price Cap

As discussed previously, one of the most notable events of the past week was the decision by G7 leaders “to work” on a price cap for Russian oil as part of efforts to cut Moscow’s revenues.

However, it didn’t take long for the same G7 motley crew to realize that they have a major problem on their hands: as JPM’s commodity desk notes, given Russia’s strong fiscal position, the country can cut up to 5 mbd of production without excessively hurting its economic interest. Meanwhile, a 5mbd cut would spark a Europe-wide depression, confirming that once again Europe had not even done the simple math.

What about prices? According to JPM, given the high levels of stress in the oil market, a cut of 3.0 mbd could cause global Brent price to jump to $190/bbl, while the most extreme scenario of a 5 mbd slash in production could drive oil price to a stratospheric $380/bbl.

Let’s back up: as we noted last week, the stated goal set out by G7 leaders this week is two-pronged:

to limit upward pressure on global oil prices

to curb Russia’s revenues from oil sales.

To achieve those goals, the allies agreed to explore a new mechanism that aims to impose a ceiling on Russian oil prices. The idea behind this price cap is to permit countries that have not imposed import bans to buy Russian oil as long as it is priced at or below a predetermined price. The cap could be enforced via limits on availability of European insurance for Russian oil cargoes as well as shipping services and US finance. While G7 leaders have not indicated where the price cap would be set, it must be lower than the $80/bbl at which Russia’s Urals grade trades today (a $32/bbl discount to Brent) and higher than Russia’s marginal cost of maintaining production levels, estimated at around $40/bbl to ensure Russia’s earnings are reduced while production is maintained.

A $50-60 per barrel price cap would likely serve the G7 goals of reducing oil revenues for Russia while assuring barrels continue to flow. Of course, for the price cap to work, oil importers like India China and Turkey—which have significantly increased their purchases of heavily- discounted Russian grades—would need to agree to participate to access even cheaper oil.

That’s the background. Here are the 3 scenarios as to what happens next. They are, as one would expect from any plan conceived by hapless politicians, bad, worse and much worse.

Scenario 1: Russia does not cooperate and retaliates — a 3 mbd cut would likely deliver a $190/bbl oil price

The most obvious and likely risk with a price cap is that Russia would not to participate (which, of course, it won’t as why would Putin agree to produce oil at a lower price than clearing) and instead retaliates by reducing exports. In fact, as JPM head commodity strategist Natasha Kaneva notes, Russia had already showed its willingness to withhold supplies of natural gas to EU countries that refused to meet payment demands. Indeed, emboldened by a surging current account surplus, after entirely cutting off the flow of piped gas to the Netherlands, Bulgaria, Finland and Denmark, since the start of June Gazprom has reduced the flow of gas to Italy by 50% and to Germany by 60%—though claiming the latter reductions in June were due to maintenance-related issues.

As a result, the EU as a whole is now receiving 53% less gas from Russia than it averaged before the start of the war. Withholding gas volumes from Europe comes at a personal cost to Russia—as a measure to manage the reduced export-related flows, Russia has had to allow for natural production declines. According to Gazprom, the company will reduce its production by 17 Bcm this year, or 3% of 2021 production. That said, history suggests that there is far more capability for production reductions in Russia. For example, in 2019 Gazprom production was ~500 Bcm, while in 2020 Gazprom production fell to ~453 Bcm. So far in 2022, Gazprom production has been down 20 Bcm yoy, suggesting further declines are likely relative to Gazprom’s current forecast.

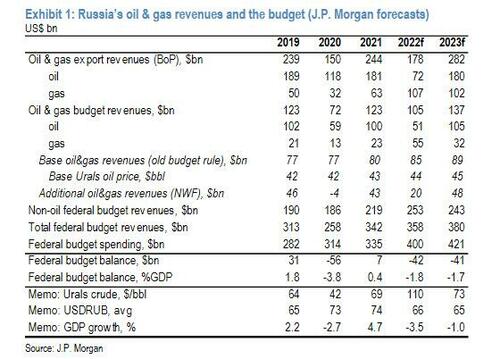

Unlike gas, which accounts for about one-fifth of Russia’s budget revenues, oil makes up over half. Russia’s policymakers will likely address the challenge of the oil price cap from the position of strength, and as JPM concedes, “Russia’s starting fiscal position is strong.” Besides, the global oil market has tightened, while the strong balance of payments opens room to accommodate lower export volumes without inflicting too much financing pain. Which brings up the key question: How much oil production can Russia realistically cut without hurting its economic interest?

In answering this question, JPM notes that Russia’s fiscal position strong: low deficit, low debt.

Russia’s sovereign balance sheet remains strong even as half of CBR’s reserves were frozen. Last year, Russia’s federal budget recorded a modest surplus of 0.4% of GDP or $7bn, while this year, as things stand, is tracking a modest deficit of less than 1% of GDP. Financing needs are equally low. The National Wellbeing Fund—effectively, a government deposit at the CBR—reached an equivalent of $198bn by May 2022, with $116bn in usable funds. Treasury cash balances exceed ~$85bn. Gross sovereign debt stood at 15.9% of GDP (~$279bn) as of end-2021.

Federal budget revenues, originally budgeted at RUB25tn ($347bn), are tracking about RUB26tn this year ($394bn) as higher oil & gas revenues more than offset the shortfall in non-energy fiscal revenues. If fiscal rule was still operational, Russia would accumulate around $80bn into the sovereign fund this year. Yet, as following the old fiscal rule has become challenging, the authorities decided to use additional oil & gas revenues to increase spending and reduce issuance instead. A new fiscal rule is being debated in the government.

So let’s assume the G7 plan is effectuated and a hypothetical $50/bbl price cap on Russian oil was imposed and effective, Russia could lose about $75bn per year in export revenues and about $42bn in budget revenues compared to JPM’s base case of an average annual price of around $80/bbl. The impact on budget balance would be smaller, as exchange rate would offset part of the impact.

JPM concludes that the Kremlin would not face big problem financing a deficit of ~$40bn given the large stock of savings and low initial level of debt. The local financial system should be able to absorb additional issuance, especially given the scarcity of available instruments for savings outside of Russia. For example, in 2020, the government raised an equivalent of 4.8% of GDP ($71bn) from the local market.

However, as JPM’s commodity team also notes, the Russian government will likely retaliate by cutting output as a way to inflict pain on the West, especially since the tightness of the global oil market is on Russia’s side, the continued appreciation pressure on the exchange rate would ease, and the strong public finances could absorb the revenue losses without too much difficulty.

As a hypothetical scenario, a cut of 3 mbd from JPM’s base case of 9.7mbd output assumed for this year could open up a deficit of $50bn at a $50/bbl price, which could be relatively easily funded by issuing local bonds without stressing the oil fund. Importantly, the imbalance in Russia’s external accounts, which generates excessive inflows of hard currency to the local market, might, ironically, even be considered as a relief.

Then there is the question of too much USDs and EURs to stomach. Russia’s key macro-economic challenge following the imposition of sanctions has been the unsustainable dynamics of the balance of payments, which has resulted in significant appreciation of the exchange rate. Main sanctions-induced developments were the following:

First, sanctions against the central bank made it close-to-impossible for the CBR to accumulate reserves. Last year, the CBR accumulated $64bn in reserves, while this year, if the fiscal rule was still operational and domestic crude price averaged ~ $80/bbl (at a big discount to Brent), the CBR would have had to purchase more than $75bn. Today, the CBR is only able to buy gold from local producers (small scale). Policymakers study the feasibility of buying assets of friendly EM countries, but infrastructure constraints, closed capital accounts, and lack of depth of EM markets will likely make the rollout of EM-buying slow and lacking scale in the near term.

Second, sanctions and, more importantly, risks of further financial sanctions (asset freezes) have made residents reluctant to accumulate foreign assets in ‘unfriendly’ countries. In the past, accumulation of foreign assets was traditionally the main channel of private capital outflows, averaging ~$80bn in the past 10 years. This has largely dried up now.

Third, trade and logistical restrictions have dramatically affected imports, which, judging by indirect data, halved. Given the strong oil revenues, Russia’s 2022 current account surplus to reach ~$170bn this year ($68bn in 1Q22).

The higher current account surplus and the lack of private and public sector capital outflows has meant that the RUB has been the main adjustment valve. This has made Russia’s non-energy exports expensive and uncompetitive. Policymakers have focused their efforts on reviving imports, by stimulating domestic demand and addressing logistical challenges and the CBR has cut policy rate aggressively, while fiscal authorities are contemplating a stimulus of 2-3% of GDP. Obviously, given the nature of sanctions / trade restrictions, reviving imports, especially of investment-related goods, will be hard.

In addition, most of capital controls that were introduced at the height of the crisis have been removed. Also, a couple of quasi-sovereign institutions have had to accumulate foreign assets in recent months, but this is not seen as sustainable or desirable due to sanctions risk. As Russian officials often put it, USDs and EURs have become “toxic”.

Although authorities’ preference would be to increase imports and recycle petrorubles in friendly EMs, this does not look an easy task, especially in the near term. Hence, if the geopolitical situation requires, it now appears more likely that export cuts could be used as leverage / policy tool.

Putting it all together, JPM concludes that “given the high level of stress in the oil market, a cut of 3.0 mbd could cause global Brent price to jump to $190/bbl, while the worst-case scenario, a 5 mbd cut, could drive oil price to a stratospheric $380/bbl.“

* * *

Russia would be able to cut 3 mbd of production, if done temporarily

If Russia decides to make significant cuts to its output, JPM warns that there do not appear to be significant limitations to doing so if done temporarily. In general, halting oil production carries serious risks, depending on how long oil production reductions are needed. Prolonged cutbacks in specific Russian regions could potentially lead to some permanent shut-ins due to operational challenges across an industry with little storage capacity and natural geological constraints in a large number of maturing fields. Currently, Russia has more than 200 thousand active wells that are capital and labor intensive to operate, especially the country’s older wells, which have meager flow rates and poor economics. For some wells, the longer a reservoir remains idled, the higher the chance pressure, water content, and clogging could affect future production. For example, West Siberia—an oil producing region in central Russia that contributes more than half of Russia’s total crude output—is facing permafrost melting and rising associated water levels. A prolonged, large-scale shut-in would mean closing tens of thousands of marginal wells, many of which could never return to profit. For example, following the collapse of the Soviet Union, Russian crude oil production reached a record low of about 6.0 mbd in 1996, down from a record high of 11.4 mbd in 1987. Only after more than two decades of strong capital investment, equating to hundreds of billions of dollars, was Russia able to restore its crude oil production capacity.

The nearly 2.0 mbd decline in Russia crude oil production in May 2020—or around a fifth of its total output—was the first time since early 1990s that Russia experienced a double-digit collapse in the oil ouput. But despite the unprecedented magnitude and speed of the 2020 cuts— Russia shut in 1.94 mbd of oil production in just one month between April and May 2020—fears that future Russian oil production would be compromised didn’t materialize. As OPEC+ tapered its cuts over the following year and a half, there does not seem to be any indication that Russian oil fields had issues restoring output. Because the Russia-Ukraine war and the resulting sanctions on Russian oil supplies started before Russia had fully restored output—in March 2022, fields where Russia shut in production during 2020 were still producing about 350 kbd less than they were in January 2020—one cannot be certain that those fields would have returned to full output without issue, but the recovery in those fields leading up to April 2022 appears to have been relatively stable with few exceptions. Since there do not seem to have been significant issues in this circumstance, with oil fields at least partially shut in for nearly two years, JPM does not think that, if Russia decided to once again cut output, their ability to restore production would be a significant barrier to doing so, especially if those cuts were only expected to last a few months. Rotating shut-ins between fields or among wells within fields can also help limit the risk of reservoir issues. Simply throttling wells instead of shutting them entirely can also mitigate some of those risks.

Additionally, Russia has tools outside its domestic production to interfere in the global oil supply. About 80% (~1 mbd) of Kazakhstan’s crude exports are shipped from the Caspian Pipeline Consortium terminal in the Black Sea port of Novorossiysk, controlled by Russia. Most of this crude goes to the EU. In Libya, political unrest continues to escalate, and fighting is at levels not seen since 2020, when General Khalifa Haftar, supported by the Russia-linked Wagner Group led his forces to take Tripoli. Libya’s oil production is now likely below 400 kbd after Libya’s National Oil Corp. announced on Thursday that it has declared force majeure on two of its three largest oil export terminals this week, while two other major oil export ports have not shipped any oil in months.

2. Scenario 2: China and India don’t cooperate—the end of the European insurance dominance

History shows that oil sanctions are notoriously leaky, and sanctioned oil supplies almost always find a buyer at the right price, and China and India might not cooperate with the goals of Western governments. The state-run Shipping Corporation of India has in the past carried Iranian oil for state-run Indian refiners when the West first sanctioned Iran in 2012. The Indian government has previously approved coverage from state-run insurers, setting a precedent that it could do so again in the future, should the need arise. Similarly, China’s COSCO vessels have in the past transported Iranian oil in 2013 with Iran commenting that insurance was handled by the “Chinese side.” Similarly, Japan had also guaranteed up to $1 billion of insurance claims for Iranian shipments made in 2012.

Russia and some buyers have already found alternatives to European insurance markets, effectively circumventing European cargo insurance bans. While Russia initially struggled to find a replacement for Western consumers of its oil products and has had to shut in refining capacity, Russian crude oil has not only found new buyers, but waterborne flows of Russian crude are actually higher than they were before the Ukraine crisis. Not only are Russian crude oil deliveries resilient, but there are signs that shipments of bottom-of-barrel oil products like fuel oil are beginning to recover as well (Exhibits 6 & 7). The reality is that with almost 1/5 of global oil production capacity today under some form of sanctions (Iran, Venezuela, Russia), there is no practical way to keep these barrels out of a market that is already exceptionally tight.

The state-controlled Russian National Reinsurance Company (RNRC) is now acting as the main reinsurer of Russian ships, including Sovcomflot’s fleet. In mid-June, Sovcomflot disclosed that it has insured all its cargo ships with Russian insurers and the cover meets international rules, likely enough to keep Russian vessels sailing around the world. To guarantee RNRC has adequate resources to provide reinsurance, Russia’s central bank in March raised RNRC’s capitalization to 300 bn rubles ($5 bn) and hiked its guaranteed capital to 750 billion rubles.

India is also providing safety certification for ships operated by Sovcomflot, enabling oil exports to India and elsewhere. Certification by the Indian Register of Shipping (IRClass)—one of the world’s top classification companies—is the final link after the insurance coverage for gaining access to ports. Chinese insurers are also apparently looking to take on business that was previously covered by their Western counterparts, but they would likely require a sovereign guarantee, which China would provide.

Scenario 3: Russia fully re-routes exports from west to east but loses pricing power, prices stabilize in low-$100s

Left to their own devices, JPMorgan strategist write that energy markets tend to work very efficiently and effectively, and the market adjustment mechanism has kicked in. Record oil product prices and rapidly tightening central banks are cooling consumption so that supply can catch up. In the US, a lackluster driving season so far pushed gasoline demand further below pre-pandemic norm, contributing to an unseasonal build in national stockpiles. As the EU gradually but unequivocally transitions away from Russian energy sources, Russia will continue to re-route its discounted oil flows toward other buyers and global ex-OPEC+ supply growth would have time to grow sufficiently to fill at least some of the Russia-sized hole in global oil supply. US production growth will likely be very strong (especially once the Democrats lose the midterm elections), adding more than 0.7 mbd through the end of 2022, though that growth is expected to halt in 1H 2023 as natural gas infrastructure constraints in the Permian Basin place a temporary cap on oil output. These conditions should be sufficient to stabilize global oil prices in low-$100s in 2H22 and high-$90s in 2023. Because JPM expects global refinery margins to normalize in 2023 and for refined products prices to fall from current levels, a sustained $100/bbl crude oil price, though still substantially higher than it has been since 2014, should be low enough allow demand to continue to grow. This process of normalization is already under way and is especially visible in other commodities like metals, where there is less policy intervention.

Consequently, Russian revenues from crude oil exports have declined.

Tyler Durden

Sun, 07/03/2022 – 14:15