Morgan Stanley: As The Recession Arrives, Will We See A Surge In Corporate Defaults

By Vishwanath Tirupattur, global head of Quantitative Research at Morgan Stanley

For some time, our economists have been highlighting that recession risks are rising globally. In their mid-year outlook, they lowered their 2022 global growth forecast sharply to 2.9%Y, less than half the 6.2%Y level a year ago. Since then, deceleration has continued. The combination of updated forecasts for a recession in the euro area, weaker incoming data, and revisions to 1Q GDP has led our US economists to shift down their 2022 US GDP forecast to 0.9% 4Q/4Q, and they have suggested that the risk of a US recession by the end of this year is high. A hallmark of the last three US recessions has been a spike in corporate credit default rates. We would argue that the credit default experience in a potential US recession may be more moderate this time around. However, despite the significant repricing in June, valuation adjustment is still incomplete.

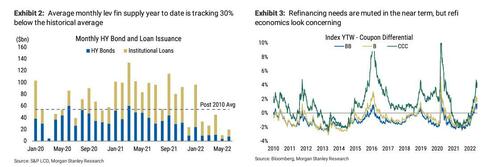

At the onset of the current hiking cycle, credit fundamentals were on a much healthier footing than in other cycles. Despite some deterioration at the margin in the last quarter, fundamentals remain reasonable and in line with pre-Covid levels – low net leverage, high interest coverage, and still-healthy cash on balance sheet. The ratings mix of the high yield bond market has improved. Currently, over half of the benchmark HY bond index is BB rated, versus 43% in 2018-19 and 40% in the aftermath of the GFC. Furthermore, refinancing needs are low. During 2022-24, only about 10% of the US$3 trillion in leveraged finance debt (high yield bonds and leveraged loans combined) is due to mature.

We expect higher risk premiums in credit but do not anticipate a spike in corporate defaults over the next 12 months. Our credit strategists, led by Srikanth Sankaran, forecast HY default rates to track 2-2.5% on the Moody’s count-weighted measure through 2Q23 – double the current levels but well inside prior recession peaks. While this would be a notable departure from the experience of the last three recessions, it is not without precedent. In the 1970s and 1980s, we had recessions but without a spike in corporate default rates. No doubt stresses could increase over the medium term, but the more imminent concern is downgrades.

Leveraged loans are the segment of the credit markets most vulnerable to higher rates, given their floating-rate nature. Over the course of past few years, we have seen the loan market drift towards the lower-quality segments (B3/B- ratings). Moody’s estimates that if rates were to increase by 300bp, absent meaningful earnings growth, as many as half of the B3 rated companies would see their interest coverage fall below 1.0x – a level more typical of a Caa rating than B3. Not surprisingly, the downgrade potential is much greater for companies that depend on leveraged loans (floating-rate liabilities) rather than the fixed-rate high yield bonds for funding. Thus we expect downgrades, particularly in the loan market, to be a bigger and more immediate concern for credit markets over the next 12 months rather than spiking defaults.

Until about a month ago, we could argue that credit markets in general, and leveraged credit in particular, were underpricing recession risks. After the sell-off in June, US HY spreads are ~150bp wider, loan prices are down 2.5 points, CCC spreads have breached 1,000bp, and stressed tails have doubled. Clearly, growth risks are starting to be priced, but we think that the credit markets need to calibrate the risk of a recession more fully. For context, IG and HY spreads are at 155bp and 569bp, respectively, while garden-variety recessions/growth scares tend to see spreads go north of 200bp and 750bp, respectively. Thus, more repricing is needed since spreads are still shy of historical levels heading into a recession, especially in the lower-quality segments of the market. Unlike some previous credit cycles (such as the energy sector downturn in 2015-16), we don’t have a ‘problem sector’ per se. As such, identifying defensive sectors and flagging sectors to stay away from is more complicated this time around. Companies with a heavy reliance on low-end consumer demand, elevated wage intensity, and commodity/logistics input costs remain vulnerable in this regard.

As the market recalibrates growth and liquidity risks, we expect decompression and dispersion themes to re-emerge. We would fade any rally in credit markets and recommend investors move up in quality/improve the liquidity profile of their portfolios.

Enjoy your Sunday.

Tyler Durden

Sun, 07/03/2022 – 16:00