Russia Now Demands Rubles For Grain As World’s Largest Wheat Exporter

After threatening to do so for a couple months now, Russia has pulled the trigger on expanding the list of commodities for which it demands payment in rubles to now include grain exports, effective Friday per a government legal website.

So now grain, sunflower oil and extracted meal are the next to follow the March decision to charge clients from “unfriendly” countries – including major customers in Europe – in rubles for natural gas instead of the normative dollars and euros.

On top of this move, recently Agriculture Dmitry Patrushev announced that Russia’s agricultural products will go to “friendly countries” only, and according to “who needs it most” – a hugely significant statement sure to continue sowing uncertainty and chaos for the global food supply.

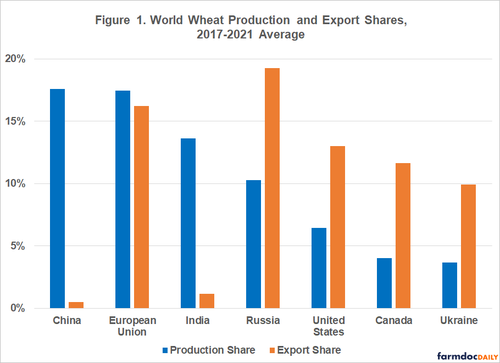

Via Farmdocdaily: Russia and Ukraine account for 14% of global wheat production and rank 1stand 5threspectively. Both countries are prominent exporters, providing nearly 30% of global wheat exports. The EU, U.S., and Canada are also major producers and exporters of wheat. China and India are major wheat producers, but are net importers and provide relatively small shares of global wheat exports. Other countries with fairly large wheat export shares include Australia (8.4%), Argentina (6.6%), Kazakhstan (4.1%), and Turkey (3.4%).

Russian state media detailed further of the new decree published to a government law portal, “It also provides for a one-year extension of duties to be paid in the national currency in respect of exported sunflower oil and sunflower meal until August 31, 2023.”

And further, “As part of the new payment mechanism, the base price for calculating the export duty on wheat will be 15,000 rubles (over $267) per ton.”

While Russia has blamed Western sanctions aiming to punish and isolate the Russian economy for blowing back on the global food supply, and especially the Middle East and African countries already heavily reliant on Ukraine and Russia grain exports, G7 countries days ago at their summit in Germany blasted Moscow in a statement for what it called “a geopolitically motivated attack on global food security.”

As these “attack on food supply” charges against Russia from the West have been persisting especially within the last couple months as Ukraine’s grain exports have remained blocked at war-torn ports, the Kremlin has also blamed Ukraine’s military mining its own coastline for blocking grain ships’ safe passage. The so-called “Putin price hike” – as the White House has dubbed it – has also been a central talking point in discussing rising inflation fears.

In statements last Friday, Russian President Vladimir Putin laid blame on the “irresponsible actions” of G7 countries themselves. He said at the time, according to a Russian media translation:

“The sharp increase in inflation did not happen yesterday – it is the result of… many years of irresponsible macroeconomic policy of the G7 countries,” Putin said during the BRICS Plus meeting.

“We are certainly ready to continue to fulfill in good faith all our contractual obligations for the supply of agricultural products, fertilizers, energy carriers and other critical products,” Putin stressed. He further took a swipe at what Western leaders often refer to as Russia’s flouting of the ‘rules-based order,’ questioning sarcastically: “What rules? Who made those rules up?”

Farmdocdaily: Ukraine and Russia are the leading producers and exporters of sunflower oil which comprises a 9% production share and nearly a 2% export share for the world vegetable oil market. Nearly 60% of world sunflower oil production occurs in Ukraine and Russia, and the two countries account for over 75% of world exports.

Meanwhile The New York Times earlier in the summer assessed just where things stand on the US-EU efforts to inflict severe and lasting damage on the Russian economy, writing, “Russia’s invasion of Ukraine triggered global condemnation and tough sanctions aimed at denting Moscow’s war chest. Yet Russia’s revenues from fossil fuels, by far its biggest export, soared to records in the first 100 days of its war on Ukraine, driven by a windfall from oil sales amid surging prices, a new analysis shows.”

“Russia earned what is very likely a record 93 billion euros in revenue from exports of oil, gas and coal in the first 100 days of the country’s invasion of Ukraine, according to data analyzed by the Center for Research on Energy and Clean Air, a research organization based in Helsinki, Finland,” the report continued, based on the study.

Tyler Durden

Sat, 07/02/2022 – 11:00