Futures, Yields Slide In Recessionary Start To New Quarter

As DB’s Jim Reid puts it “if you want the good news this morning it’s that H1 is now finally over. If you want the bad news it’s that there’s not much good news around as we start H2 and US equity futures are already down around a percent in the first few hours of the new half year. “

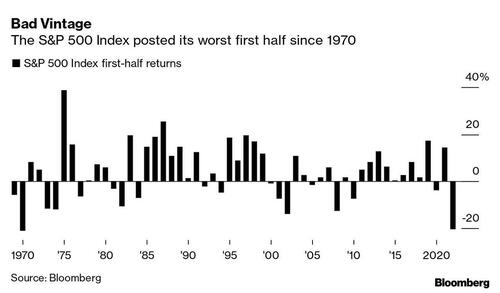

Indeed, just when you thoughts stocks couldn’t possibly slide any more after just concluding the worst first half in 52 years…

… and with investor and consumer sentiment at record lows, you’d be shocked to learn that futures and stocks started the new month and quarter by plumbing fresh lows as fears of soaring inflation and tumbling earnings boosted concerns about an imminent recession, and the resulting risk aversion lifted bonds and havens and sent risk sliding. The “Big Short” Michael Burry said we may only be about halfway through the market’s decline…

Adjusted for inflation, 2022 first half S&P 500 down 25-26%, and Nasdaq down 34-35%, Bitcoin down 64-65%.

That was multiple compression. Next up, earnings compression. So, maybe halfway there.

— Cassandra B.C. (@michaeljburry) June 30, 2022

… while Goldman was also downbeat, seeing global equities selling off further in the near term. As of 730am, S&P 500 and Nasdaq 100 pointed to declines of 0.3%, having shaved off as much as a 1% drop earlier…

… while 10-year US Treasury yield slid below 3% to the lowest since early June as markets now price in a record 10bps in rate cuts in Q1 2023 with markets confident the Fed will have to pivot to defeat the coming recession. Every Group-of-10 currency fell against the dollar and the yen, traditional havens, while bitcoin reversed a modest attempt at a breakout that briefly pushed it back over $20K.

In premarket trading, shares of US chip companies fell after Micron Technology issued a downbeat forecast on weaker demand for phones and computers. Bank stocks are also lower in premarket trading, putting them on track for their fifth straight day of losses amid a broader slump in equity markets. Other notable premarket movers:

Kohl’s (KSS US) plunges 15% in US premarket trading after CNBC reported it’s ending sale talks with Vitamin Shoppe owner Franchise Group.

Semiconductor companies are falling on Friday after Micron Technology issued a weak forecast for the current quarter due to lower demand for phones and computers. Micron (MU US) -5.5%, Nvidia -1.3% (NVDA US), Qualcomm (QCOM US) -0.7%.

Cryptocurrency-exposed stocks could be active again on Friday as Bitcoin dip buyers are triggering a rally for the largest digital token. Riot Blockchain (RIOT US), Marathon Digital (MARA US) edge up 2.4% and 2.6%, respectively, in premarket.

XPeng (XPEV US) burning cash in the short-term is unavoidable, Nomura says in a note that downgrades the Chinese EV maker to neutral from buy. Shares down 0.2% premarket.

Risk assets continued to be the target of sellers Friday as recession worries overtake concern about runaway inflation. With Federal Reserve policymakers resolute on getting price growth back to their 2% target, investors are assessing the hit to the economy from harsh rate hikes.

“Inflation is the key focus of central bankers; investors losing money is way down their list of concerns,” Chris Iggo, chief investment officer at AXA IM Core, wrote in a note to clients. “Interest rate and inflation markets are taking the view that what is priced in terms of monetary tightening will be enough to bring inflation down, but in order for that to happen, there also needs to be a cost to growth.”

Meanwhile, both stocks and bonds were rocked by outflows this week, reflecting investor fears about hawkish central bank policy. About $5.8 billion exited global stock funds in the week through June 29, Bank of America said, citing EPFR Global data. Bonds had redemptions of $17 billion. Separately, global companies have pulled more debt sales in the past six months than in all of 2020. More than 70 deals have been postponed or canceled so far in 2022, according to data compiled by Bloomberg.

In Europe, markets reversed sharp opening losses with the Stoxx 600 briefly turning green before sliding 0.5% lower with retail and utility names supporting on the recovery. Bund yields rose after data showed euro-area inflation hit a fresh record, surpassing expectations. Here are some of the biggest European movers today:

European airlines rise on Friday, paring some declines from previous sessions, as oil is headed for the third straight weekly drop on concerns that a potential recession will hurt demand. Wizz Air rises as much as +10%, EasyJet +6.2%, British Airways owner IAG +4.4%

Airbus shares rise as much as 4% after BofA analysts led by Benjamin Heelan added the aircraft manufacturer to the bank’s ‘3Q Best Ideas list,’ according to a note.

SBB shares advance as much as 21.5% Friday, its largest intra-day gain since April 2017, after the company was included in Nasdaq Stockholm’s OMXS30 index.

Sodexo shares gain as much as 5.6%, the most since April 8, after the French caterer reported 3Q revenue that beat the average analyst estimate. Morgan Stanley says Friday’s update is a “relief.”

Maersk shares rise as much as 3.0% after JPMorgan upgraded the stock to overweight from neutral and placed it and Kuehne Nagel on their “positive Catalyst Watch” for Q2, citing increased confidence in the longevity of current earnings.

European semiconductor stocks tumble after US memory- chip maker Micron 4Q outlook fell short of analyst expectations and said the industry demand environment has weakened. Chipmaker Infineon falls as much as 5.0%, ASML drops 4.9%

La Francaise des Jeux shares decline as much as 9.0% after Citi cuts the stock to sell from buy, citing concession fee to be paid that is worse than Street expectations.

Craneware declines as much as 12% after an offering of ~1.2m shares by holder Abry Partners VII priced at 1,600p, a 13% discount to last close.

OVH Groupe shares drop as much as 6.5% after the analysts adjusted their estimates amid a softening demand outlook.

Earlier in the session, Asian stocks declined for a third day, as traders assessed recession risks in the global economy after weak US consumer spending and soft factories data from the region. Investors are also keeping an eye on developments from the Chinese President’s Hong Kong visit. The MSCI Asia Pacific Index slid as much as 1.1%, adding to nearly 2% weekly loss, weighed down by tech and consumer discretionary stocks. Chipmakers including TSMC and Samsung extended their declines, contributing the most to the measure’s loss along with Australian miner BHP and Indian energy giant Reliance. Taiwan’s benchmark was again the region’s notable underperformer as it is on course for a bear market following more than a 20% fall from its January high, dragged down by technology stocks. Equity benchmarks in Japan and South Korea slipped more than 1%. Stocks in mainland China retreated after meandering between gains and losses while Hong Kong was closed for a holiday as its new chief was sworn in by Chinese President Xi Jinping. A further slide in June purchasing managers’ indexes in Asian countries except China and the drop in US consumer spending for the first time this year in May highlighted the fragile foundation of the world economy. Those data dimmed global economic outlook and further dented investor sentiment already weakened by ongoing worries about global central banks’ aggressive rate hikes to fight inflation.

“Overall, weakened US consumer spending will lead to a drop in global demand. It will affect export-dominated markets like South Korea in particular,” said Cui Xuehua, a China equity analyst at Meritz Securities in Seoul. “Traders are also looking to see if there will be policies benefiting Hong Kong, such as a re-opening of borders and increased trade” as Xi visits Hong Kong. Asian stocks plunged about 18% during the first half of this year, capping the first six months with the worst annual drop since 2008. Asian equities have struggled to rebound from a low in May as global recession worries and aggressive tightening by central banks triggered heavy outflows of funds from emerging markets. Chinese stocks have remained a bright spot last month as Beijing winds down its stringent virus restrictions and investors expected regulatory and monetary support for key sectors.

In Australia, the S&P/ASX 200 index fell 0.6% for the week, as the risk-sensitive Australian and New Zealand dollars slumped to their lowest levels in two years amid ongoing recession worries that boosted haven assets. After a late sell-off Friday, shares swung to a loss of 0.4% to close at 6,539.90, driven by declines in energy and material stocks, with a group of mining shares hitting the lowest since Nov. 22 following commodity price drops. In New Zealand, the S&P/NZX 50 index fell 1.1% to 10,753.16

In FX, the Bloomberg Dollar Spot Index rose by around 0.3% as the greenback traded stronger against all of its Group-of-10 peers apart from the yen. Australian and New Zealand dollars plunged to new two-year lows. The euro fluctuated around $1.0450 after the latest data showed that euro-area consumer prices rose 8.6% from a year earlier in June — up from 8.1% in May. Economists surveyed by Bloomberg saw a gain of 8.5%. The yen rose and the nation’s bonds were steady to higher. One-week options in dollar-yen are once again overpriced as short-term risks make a strong case for long-gamma exposure. Bank of Japan’s quarterly Tankan report of confidence among Japan’s large manufacturers fell to 9 in June from 14 three months ago, the biggest drop since the peak of the pandemic.

In rates, the German curve bear-steepened, with long-end yields ~7bps cheaper after a manufacturing PMIs show notable softness in new orders. Cash Treasuries extended Thursday’s bull steepening move, with front-end and belly dropping over 10bp from prior day’s close while richer by ~4bps at the short end. Ten-year yields fell further to below 3%, breaching the 50-day moving average, while eurodollar strip bull flattens as recession risk and Fed rate cuts continue to be priced in for next year. 10-year yields dropped to as low as 2.937%, the lowest since June 6, before edging back above 2.95% in early US session, outperforming bunds by 5.5bps. The belly and front-end outperformance causing a steepening of 5s30s curve by 6bp on the day and 2s10s by 3bps; 5s30s peaks through 20bp and onto widest levels in a month. Two-year yield fell 10bp to 2.85%. The Eurodollar strip continues to bull flatten as rate hike premium is eased out of next year; Dec22/Dec23 spread drops to -63.5bp and fresh cycle lows. German government benchmark yields rose after data showed euro-area inflation hit a fresh record, surpassing expectations. The Stoxx Europe 600 Index wavered between losses and gains. Gilts are relatively quiet. Most peripheral spreads are modestly wider to core.

In commodities, crude futures advance. WTI drifts 1.9% higher to trade near $107.73. Brent rises 2% near $111.23. Most base metals are in the red. LME copper briefly drops below $8,000 a ton for the first time since February 2021. Spot gold falls roughly $12 to trade near $1,795/oz.

Looking to the day ahead, data releases include the flash Euro Area CPI reading for June, as well as June’s global manufacturing PMIs and the ISM manufacturing reading from the US, along with the UK’s mortgage approvals for May. From central banks, we’ll hear from the ECB’s Panetta and De Cos.

Market Snapshot

S&P 500 futures down 0.4% to 3,774.25

MXAP down 1.0% to 156.37

MXAPJ down 1.0% to 519.11

Nikkei down 1.7% to 25,935.62

Topix down 1.4% to 1,845.04

Hang Seng Index down 0.6% to 21,859.79

Shanghai Composite down 0.3% to 3,387.64

Sensex down 0.6% to 52,688.97

Australia S&P/ASX 200 down 0.4% to 6,539.91

Kospi down 1.2% to 2,305.42

STOXX Europe 600 little changed at 407.16

German 10Y yield little changed at 1.39%

Euro down 0.2% to $1.0459

Brent Futures up 0.8% to $109.95/bbl

Gold spot down 0.7% to $1,794.17

US Dollar Index up 0.26% to 104.95

Top Overnight News from Bloomberg

The Bank of Japan’s decision to pass up an opportunity to ramp up its policy defenses points to a fear of triggering a further weakening of the embattled yen

Japan’s state pension fund, the world’s largest, posted its first quarterly loss in two years as declines in global stock and bond markets during the three months through March weighed down the value of its assets

After years of subdued price swings caused by central bank intervention, a key gauge of volatility in the 1 quadrillion yen ($7.4 trillion) government bond market has surged in recent weeks to the highest level since 2008. That’s boosting demand for JGB traders, with Nomura Holdings Inc. noting signs of intensifying competition for talent

Copper sank below $8,000 a ton, hitting its lowest since early 2021, as deepening fears about a global economic slowdown drive a rout in industrial metals markets

Chinese President Xi Jinping urged Hong Kong to shore up its economy after an era of “chaos,” in a landmark visit that offered few clear answers for how to balance Beijing’s demands for limiting perceived foreign threats with its desire to remain an international financial hub

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks began the new trading month mostly in the red as the region digested a slew of data releases and amid headwinds from the US where Consumer Spending data disappointed and Atlanta Fed’s GDPnow model alluded to a recession. ASX 200 was just about kept afloat by resilience in nearly all industries aside from the commodity-related sectors. Nikkei 225 fell beneath the 26,000 level after the latest Tankan survey mostly disappointed. Shanghai Comp. traded indecisively despite the stronger than expected Caixin Manufacturing PMI data which rose to its highest since May 2021 as sentiment in the mainland was constrained by falling commodity prices, as well as the absence of Hong Kong participants and Stock Connect flows.

Top Asian News

Chinese President Xi said “one country, two systems” has been successful for Hong Kong over the past 25 years and said Hong Kong is a window and a bridge connecting the mainland to the world, while he added that Hong Kong has to defend against interference and focus on development, according to Bloomberg and Reuters.

Hong Kong’s new Chief Executive Lee was sworn in and stated the National Security Law brought stability after chaos, while he added the government will strive to control and manage COVID-19 through scientific methods, according to Reuters.

UK PM Johnson said China has been failing to comply with its commitments on Hong Kong and the UK intends to do all it can to hold China to account, according to Reuters.

PBoC injected CNY 10bln via 7-day reverse repos with the rate at 2.10% for a CNY 50bln net daily drain, according to Reuters.

World’s Top Pension GPIF Posts Quarterly Loss on Stock Rout

Three Arrows Crypto Fund CEO Wants to Sell Singapore Mansion

Kishida Says LNG Supply From Sakhalin Won’t Immediately Stop

Japan Mulls LNG From Spot Market to Replace Russian Supply: METI

European bourses are back in the red after briefly recovering from opening losses. Sectors are mixed with no clear theme – Tech is the laggard and Utilities the outperformer. Chip stocks are after sources said TSMC has seen its major clients adjust downward their chip orders for the rest of 2022, whilst Micron’s guidance was underwhelming. Stateside, US equity futures remain in negative territory but off worst levels as the contracts coat-tail on some of Europe’s upside.

Top European News

French government spokesperson said a possible cabinet reshuffle could take place Monday or Tuesday, according to Reuters.

Euro-Zone Inflation Hits Record in Boost for Big-Hike Calls

Food Inflation Gets a Break as Wheat, Corn and Soy Oil Tumble

UK House Sales Slow as ‘Intense’ Market Starts to Cool

FX

Dollar regroups after late month end fade amidst broad gains ahead of US manufacturing ISM and construction spending – DXY retests 105.000+ levels from 104.640 low yesterday.

Yen bucks trend, but off recovery peaks as yields firm up and risk aversion wanes – Usd/Jpy around 135.500 vs 134.74 overnight base.

Aussie underperforms and hits fresh 2022 trough sub-6800 and Kiwi under 0.6200 after decline in ANZ consumer sentiment.

Pound undermined by downward revision to UK manufacturing PMI with Cable below 1.2100 and prone to test of Fib support if 1.2050 breached.

Euro back on 1.0400 handle and propped by better than forecast Eurozone manufacturing PMIs and stronger than expected inflation metrics.

Rand extends declines alongside Gold as SA power and pay issues rumble on – Usd/Zar above 16.3400, spot bullion below Usd 1800/oz.

Fixed Income

Debt futures rack up more safe haven gains before recovery in risk sentiment and sharp reversal.

Bunds recoil from 149.46 to 148.24, Gilts retreat to 113.79 from 114.52 and 10 year T-note pulls back from 118-29+ to 118-06 as benchmark yield retests 3% briefly.

Bonds subsequently bounce off lows awaiting US manufacturing ISM and construction spending ahead of long Independence Day holiday weekend.

Commodities

WTI and Brent front-month futures retrace some of yesterday’s losses with upside also spurred the recovery across the stock markets

Libya’s NOC announced a force majeure over Es Sider, Ras Lanuf Ports and the El Feel oilfield, while it noted that oil production decreased as daily exports ranged between 365-408k BPD which is a decline of 865k BPD, according to Reuters.

Spot gold is under pressure after the yellow metal breached USD 1,800/oz to the downside – with the next level to the downside at USD 1,786/oz, the May 16th low.

Base metals are softer across the board as recession woes grapple with the risk-correlated market. LME 3M copper briefly fell beneath the USD 8,000/t for the first time since January.

India raised the basic import tax on gold to 12.5% from 7.5%, according to BQ Prime citing a Gazette notification.

US Event Calendar

09:45: June S&P Global US Manufacturing PM, est. 52.4, prior 52.4

10:00: May Construction Spending MoM, est. 0.4%, prior 0.2%

10:00: June ISM Manufacturing, est. 54.5, prior 56.1

DB’s Jim Reid concludes the overnight wrap

If you want the good news this morning it’s that H1 is now finally over. If you want the bad news it’s that there’s not much good news around as we start H2 and US equity futures are already down around a percent in the first few hours of the new half year. Having said that it’s eminently possible that whatever age you are reading this you might ALL have now witnessed the worst first half of a year in your career either looking back or forward. So if you’ve survived that it might not all be bad news. Younger readers can come back to me after the awful H1 2055 and tell me I’m wrong.

Henry will put out some more stats in our usual month-end performance review shortly, which reads like a bit of a horror story, but for what it’s worth the S&P 500 has now seen its worst H1 total return performance in 60 years, and also in total return terms it’s fallen for two consecutive quarters for the first time since the GFC. Meanwhile 10yr Treasuries look set (with a final calculation imminent) to have recorded their worst H1 since 1788, just before George Washington became President.

As I mentioned in a previous chart of the day, bad H1’s for equities have tended to be followed by much better H2’s. But with increasing warnings that a recession is round the corner, it isn’t so obvious where things are headed this time round. Indeed, equities saw another significant selloff yesterday as those fears were magnified yet again by another weaker than expected round of data which genuinely puts the US at risk of a technical recession in H1 already. That included the US weekly initial jobless claims for the week through June 25, which although coming in inline at 231k (vs. 230k expected), did send the smoother 4-week moving average up to its highest level so far this year. Our preferred measure, namely containing claims, edged up but is not yet signalling a recession though.

Personal spending also came in at just +0.2% in May (vs. +0.4% expected), and the prior month was revised down three-tenths as well, whilst real personal spending (-0.4%) saw its first monthly decline of the year as well. That translated to a 0.3% MoM Core PCE reading, below expectations of 0.4%, while the YoY reading was 6.3%. The prospect of the Fed being forced into hikes to fight stubborn inflation while growth is rolling over appears to be something the markets will have to wrestle with sooner rather than later. Indeed, the Atlanta Fed’s 2Q GDP nowcast estimate was revised down from 0.3% to -1.0% which if proved correct will signal a technical recession as a minimum. Today’s ISM will be a big sentiment driver on this front.

Against the weak growth backdrop, the S&P 500 (-0.88%) continued its run of having declined every day this week, whilst Europe’s STOXX 600 (-1.50%) saw even sharper losses. Utilities (+1.10%) were the clear outperformer, as investors rotate into defensive sectors. In turn, the NASDAQ underperformed, closing down -1.33%, also finishing in the red every day this week to date. The S&P 500 lost -20.58% in the first half of the year, its worst first half performance since 1970. Meanwhile, the NASDAQ has fared even worse, declining -22.44% this quarter alone and -29.51% in the first half of the year, its worst first half in the data available in Bloomberg.

But in some ways the fear was more evident among sovereign bonds, which rallied significantly as investors continued to seek out safe havens and grew more doubtful about whether central banks would be able to persist in taking policy into aggressive territory. Indeed, the rate priced by Fed funds futures for the December 2022 meeting came down -6.5bps to 3.39%, and the rate priced by December 2023 came down an even larger -13.6bps to 2.96%. Those shifting expectations meant that yields on 10yr Treasuries fell back beneath 3% in the session for the first time in nearly 3 weeks, ultimately settling -7.6bps lower on the day at 3.01%. The decline in 10yr yields was split between breakevens and real yields, as both had a volatile session to end the quarter. Breakevens fell -4.7bps to 2.35%, their lowest levels since September. Other recessionary indicators were flashing warning signs of their own, with the near-term Fed spread down another -14.9bps to 142bps, meanwhile the 2s10s curve managed to eek out a marginal steepening, but is still flirting with inversion, closing at just 5.1bps. This morning, 10yr UST yields (-5.92 bps) are lower again, moving back below 3% to 2.95% with the 2s10 curve flattening -1bps at 4.13% as we type.

We saw much the same pattern in Europe yesterday, albeit with even larger moves lower in yields that sent those on 10yr bunds (-18.3bps), OATs (-15.2bps) and BTPs (-13.3bps) sharply lower. As in the US, European sovereign yield declines were driven by falling inflation compensation, with the 10yr German breakeven coming down by -12.3bps to 2.03%, which is its lowest closing level since Russia’s invasion of Ukraine began. That was echoed in a declining oil price with Brent crude down -1.60% yesterday at $109.52/bbl, meaning that oil prices saw a monthly decline in June for the first time since November 2021, back when the Omicron variant first emerged and travel restrictions started going back up again.

Speaking of energy prices, there were a few interesting headlines on that front yesterday, including a comment from President Biden that he is seeking more production from the Gulf states. Biden is set to travel to the Middle East from July 13-16, so that’s an important event on the geopolitical calendar, and ahead of that, we also saw the OPEC+ group move to ratify yesterday a further supply hike of +648k barrels per day in August. In Europe however there was more bad news on the energy side, with natural gas futures up a further +3.53% to a fresh three-month high of €144.51 per megawatt-hour. My colleague George Saravelos put out a fascinating blog yesterday (link here) that highlighted how worried he’s becoming on the gas supply situation, with year-ahead natural gas prices making fresh record highs and electricity prices skyrocketing. A key event as part of that will be the shutdown of the Nordstream pipeline from July 11-21 for regular annual maintenance, and press reports are suggesting that authorities are attempting to find a solution on sanctions restrictions to move gas turbine components back to Russia. So while we all spend most of our time thinking about the Fed and recessions, what happens to Russian gas over H2 is potentially an even bigger story. Mark July 22nd in your dairies to see whether the gas supply starts getting back to normal or not.

Asian equity markets are reversing early morning gains and are mostly down again. The Kospi (-1.04%) is the largest underperformer across the region followed by the Nikkei (-0.88%). Over in mainland China, the Shanghai Composite (-0.30%) and CSI (-0.20%) are down but are trimming losses, as the nation’s private factory activity rose at the fastest pace in 13 months in June (more on this below). Markets in Hong Kong are closed for a holiday marking the 25th anniversary of Chinese rule. Bucking the regional trend is Australia’s S&P/ASX 200 which is trading +0.26% higher at the time of writing. Outside of Asia, stock futures are once again sliding with contracts on the S&P 500 (-0.84%) and NASDAQ 100 (-0.86%) indicating a disappointing start in the US later today.

Early morning data showed that China’s Caixin/Markit manufacturing PMI advanced to 51.7 in June, returning to expansion territory for the first time in four months against a previous reading of 48.1 and well above analyst expectations for an uptick to 50.1. The recovery as suggested in the survey was propelled by a strong rebound in output, as the easing Covid restrictions sent factories racing to meet recovering demand.

Over in Japan, Tokyo’s June CPI rose +2.3% y/y (v/s +2.5% expected) and against a +2.4% increase in the prior month. Core CPI advanced +2.1% in June from a year earlier, notching the fastest pace of increase in seven years in a sign of broadening inflationary pressure in the world’s third largest economy. Separately, the unemployment rate in Japan surprisingly edged up to +2.6% in May from +2.5% in April. Meanwhile, sentiment at Japan’s large manufacturers deteriorated in the April-to-June period as the headline index worsened to a level of +9, a decline from the previous quarter’s reading of 14.

Looking at yesterday’s other data, French CPI came in at +6.5% as expected on the EU-harmonised measure in June, although German unemployment unexpectedly rose +133k in June (vs -5k expected) as Ukrainian refugees are now being included in those looking for work. Looking back to May however, the Euro Area unemployment rate hit its lowest level since the formation of the single currency at 6.6% (vs. 6.8% expected). Finally in the US, the MNI Chicago PMI came in at 56.0 (vs. 58.0 expected).

To the day ahead now, and data releases include the flash Euro Area CPI reading for June, as well as June’s global manufacturing PMIs and the ISM manufacturing reading from the US, along with the UK’s mortgage approvals for May. From central banks, we’ll hear from the ECB’s Panetta and De Cos.

Tyler Durden

Fri, 07/01/2022 – 07:57