Stellar 30Y Auction Sees Buyers Emerge Ahead Of Friday’s CPI

After two mediocre auctions this week, when both the 3Y and 10Y sales tailed with subpar internal metrics, moments ago the week’s last sale, that of a 29-year 11-month reopening, and taking place just a day before the summer’s most important CPI print, priced in what was without doubt the week’s best auction.

Pricing at a high yield of 3.185%, today’s sale of $19 billion in ultra long dated paper, came in well above last month’s 2.997% and was the first 3%+ yielding auction since March 2019. Yet despite the 3.185% yield, the coupon on the auction was below 3%, and was still 2.875%, same as the recent past. One final note on the pricing: the high yield stopped through the When Issued 3.200% by 1.5bps, the biggest stop through since March.

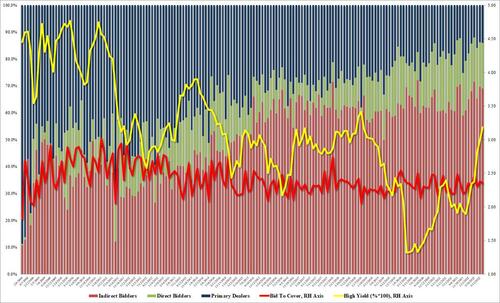

The bid to cover on the auction was 2.351, not far from last month’s 2.382 and modestly above the six auction average of 2.336.

The internals were also solid, with Indirects taking down 69.0%, in line with recent auctions but above the six-auction average of 66.7%. And with Directs taking down 16.9% (also above the 13.2% average), Dealers were left holding just 14.08%, which wasn’t a record low but wasn’t too far from it (the all time low for the series was 12.1% in March).

Overall, a very solid auction, curiously taking place less than a day before Friday’s closely watched CPI report is released, and one which helped push yields across the curve modestly lower.

Tyler Durden

Thu, 06/09/2022 – 13:16