Futures Soar After Report David Tepper Covers Nasdaq, Treasury Short

After tumbling as low as 3960 a few hours earlier, the lowest since April 2021, futures have reversed and are spiking higher not just due to the sporadic dip buying attempts discussed earlier but because CNBC’s Jim Cramer reported moments ago that hedge fund legend David Tepper, whose “Balls to the Wall” comment 12 year ago sent stocks soaring higher, has covered his Nasdaq – and more importantly – Treasury (which is just another long duration proxy) shorts.

“I was talking to David Tepper who’s been short. He covered his short, and feels that the selloff could be concluding” said Jim Cramer who added that “forced sellers equal bottom and it is a great time to be able to take a shot.”

Tepper also covered his bond short, Cramer added saying that “Tepper feels it is kind of an interesting trade” and that “it’s a major decision.”

In terms of levels, Tepper thinks that Nasdaq will hold 12,000 and is a buyer of the S&P if it drops lower; the Appaloosa trader also thinks the 10Y will trade in the range 2.9% to 3.2%, after being “pretty vocal against bonds.”

BREAKING: @DavidTepper tells @jimcramer: I covered my Nasdaq short. I think Nasdaq 12,000 holds. pic.twitter.com/8FtPZpaf1A

— Squawk Box (@SquawkCNBC) May 10, 2022

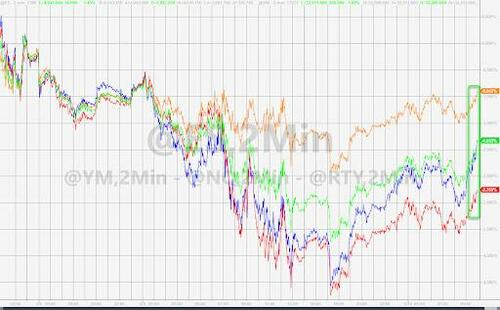

The market reaction to this “major change from Tepper”, has been quick and powerful, with Eminis now at session highs and more than 80 points above session lows…

… Nasdaq futures surging…

… and with 10Ys tumbling to 2.95% and sliding lower as buying duration is suddenly all the rage again…

… and just 20bps away from the 2.75% bogey we noted yesterday when the 10Y was trading at 3.20%.

Tyler Durden

Tue, 05/10/2022 – 09:03