Key Events This Week: Every Eye On Peak CPI

After last week’s relentless barrage of news including the Fed’s biggest rate hike since May 2000, the bizarre shocker from the BOE, the Friday payrolls kicker and the record surge in US credit card usage, not to mention countless reports from the peak of earnings season, DB’s Jim Reid reminds us that we won’t have to wait too long for the next blockbuster event to help shape the debate as US CPI on Wednesday takes center stage this week with PPI the following day. There are lots of Fed speakers too to put some nuance to last week’s FOMC announcement.

Outside of this geopolitics will be key. Today marks the annual “Victory Day” in Russia where there will be a parade and a speech from Putin. It’s anyone’s guess what tone the President will take in this landmark speech but it could shape the next phase of the war. Staying with geopolitics, Finland may decide whether to apply for NATO membership this week and Sweden is due to publish its security policy assessment before Friday.

We will also get a pulse check on economic sentiment in May from the ZEW survey for the Eurozone and Germany (tomorrow) and, for the US, the University of Michigan survey on Friday. China inflation data on Wednesday will be interesting. In an otherwise quiet week for economic data, the UK will be an exception with a data-packed Thursday.

It will be a slow week for corporate earnings too now as the bulk of US/European companies have reported and we will instead focus on Japan’s corporate giants. As well as Fed speakers there are a number of ECB equivalents, with all comments pertaining to a possible July hike watched out for.

In terms of US CPI midweek, DB’s US economists are expecting a +7.9% reading, down from the four-decade-high 8.5% print in March, not least due to base effects. From here it should all be about the pace of the declines as things like the extreme YoY prices in used cars roll out of the data. However on the other side it is important to see how prolonged the rise in rents are. Remember that rents make up a third of the CPI basket and 40% of core. Used cars only make up a few percentage points. A reminder that the day by day calendar of events is at the end as usual.

A few words on earnings with around 90% and 75% having reported in the US and Europe. According to DB’s equity strategist Binky Chadha, the season has been pretty strong, especially in Europe which benefits from a better sector mix (eg Energy and Materials concentration and limited Tech which held the US back). One consistent theme in both regions is that margins remained strong suggesting that firms are for now still able to pass on inflationary pressures. On the macro front this makes it harder for the rate of inflation to fall sharply as price rises are being embedded into the economies for now. It won’t last forever as excess savings/liquidity will be run down but seems to be holding for now.

As noted above, with earnings season in its tail end, here are the few remaining companies on deck to report this week.

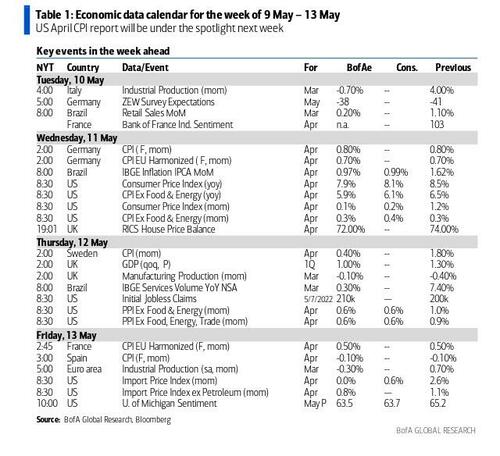

Courtesy of Deutsche Bank, here is a day-by-day calendar of events

Monday May 9

Data: US March wholesale trade sales, China April trade balance, Japan March labour cash earnings, France March trade balance, Canada March building permits

Central banks: BoJ minutes of March meeting

Earnings: Simon property group, BioNTech, Infineon, Palantir, AMC

Tuesday May 10

Data: US April NFIB small business optimism, Japan March household spending, Italy March industrial production, Germany and the Eurozone May ZEW economic expectations

Central banks: Fed’s Williams, Barkin, Waller, Kashkari and Mester speak, ECB’s Nagel speaks

Earnings: Sony, Nintendo, Suncor, Bayer, Occidental Petroleum, Roblox, Peloton

Wednesday May 11

Data: US April CPI, real average hourly earnings, monthly budget statement, China April CPI and PPI, Japan March leading and coincident indices, UK 4Q unit labour costs

Central banks: Fed’s Bostic speaks, ECB’s Lagarde, Vasle, Centeno, Buch, Muller, Schnabel, Knot and Nagel speak

Earnings: Toyota, Disney, Rivian

Thursday May 12

Data: US April PPI, initial jobless claims, Japan March trade balance, April bank lending, UK March monthly GDP, Q1 GDP, private consumption, government spending, March construction output, industrial and manufacturing production, index of services, trade balance

Central banks: BoJ summary of opinions, ECB’s De Cos speaks, Fed’s Daly speaks

Earnings: SoftBank, Siemens, Allianz, RWE, Telefonica, Affirm, Commerzbank

Other: US-ASEAN Summit begins

Friday May 13

Data: US May University of Michigan index, April import and export price indices, Japan April M2, M3, France Q1 wages, Eurozone March industrial production

Central banks: ECB’s Centeno speaks, Fed’s Kashkari and Mester speak

Earnings: Toshiba, Deutsche Telekom

* * *

Focusing on just the US, Goldman notes that the key economic data release this week is CPI inflation on Wednesday. There are several scheduled speaking engagements by Fed officials this week.

Monday, May 9

10:00 AM Wholesale inventories, March final (consensus +2.3%, last +2.3%)

Tuesday, May 10

06:00 AM NFIB small business optimism, April (consensus 92.9, last 93.2)

07:40 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will give a speech at a NABE/Bundesbank economic symposium in Eltville am Rhein. Text and moderator Q&A are expected.

09:15 AM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Thomas Barkin will discuss inflation at an event hosted by the Cecil County Chamber of Commerce. Audience Q&A is expected.

01:00 PM Fed Governor Waller (FOMC voter) and Minneapolis Fed President Kashkari (FOMC non-voter) speak: Fed Governor Christopher Waller will take part in a discussion moderated by Minneapolis Fed President Neel Kashkari before the Economic Club of Minnesota. Audience Q&A is expected.

03:00 PM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will speak on a panel discussing “Monetary Policy and Financial Stability Challenges During Balance Sheet Normalization” at the Atlanta Fed’s annual financial markets conference in Florida. Text and audience Q&A are expected.

07:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will discuss monetary policy and the economy during his bank’s annual financial market conference in Georgia. Audience Q&A is expected.

Wednesday, May 11

08:30 AM CPI (mom), April (GS +0.15%, consensus +0.2%, last +1.2%); Core CPI (mom), April (GS +0.42%, consensus +0.4%, last +0.3%); CPI (yoy), April (GS +8.01%, consensus +8.1%, last +8.5%); Core CPI (yoy), April (GS +6.01%, consensus +6.0%, last +6.5%): We estimate a 0.42% increase in April core CPI (mom sa), which would lower the year-on-year rate by 0.5pp to 6.0%. Our forecast reflects upward pressure on core goods categories such as auto parts and home furnishings related to the Ukraine-Russia war and China covid lockdowns. We also estimate a smaller decline in used car prices, and we expect positive residual seasonality in new car inflation with the implementation of new source data. Within services, we believe the continued reopening of the economy likely boosted prices of hotels, airfares, and car insurance. We estimate rent increased by 0.45% and OER increased by 0.43%, with the latter reflecting a drag from imputed utilities. We estimate a 0.15% monthly increase in headline CPI, reflecting a decline in seasonally adjusted energy prices but higher grocery and restaurant prices.

12:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will discuss monetary policy and the economy during an event hosted by the World Affairs Council of Jacksonville. Audience Q&A is expected.

Thursday, May 12

08:30 AM PPI final demand, April (GS +0.6%, consensus +0.5%, last +1.4%); PPI ex-food and energy, April (GS +0.7%, consensus +0.6%, last +1.0%); PPI ex-food, energy, and trade, April (GS +0.7%, consensus +0.6%, last +0.9%): We estimate a 0.7% increase for PPI ex-food and energy and PPI ex-food and energy, and trade, reflecting a continued boost from supply chain bottlenecks, labor shortages, and commodity prices. We estimate that headline PPI increased by 1.0% in April.

08:30 AM Initial jobless claims, week ended May 7 (GS 195k, consensus 190k, last 200k); Continuing jobless claims, week ended April 30 (consensus 1,360k, last 1,384k): We estimate that initial jobless claims edged down to 195k in the week ended May 7.

04:00 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will take part in a moderated fireside chat in Anchorage, Alaska.

Friday, May 13

08:30 AM Import price index, April (consensus +0.6%, last +2.6%): Export price index, April (consensus +0.7%, last +4.5%)

10:00 AM University of Michigan consumer sentiment, May preliminary (GS 63.0, consensus 64.0, last 65.2): We expect the University of Michigan consumer sentiment index declined by 2.2pt to 63.0 in the preliminary May reading, reflecting weaker signals from other consumer confidence measures and an expected drag from stock market volatility.

11:00 AM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will take part in a discussion on energy prices and their impact on inflation at an event co-hosted with the Dallas Fed.

12:00 PM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will discuss monetary policy during and after the pandemic during a virtual event jointly hosted by the Fed, ECB and Euro Area Business Cycle Network. Audience Q&A is expected.

Source: DB, Goldman, BofA

Tyler Durden

Mon, 05/09/2022 – 10:13