Retail Flows Turn Negative As Last Market Bull Capitulates

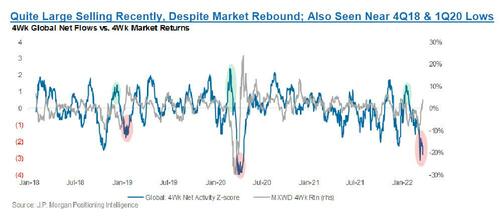

Last weekend, when looking at the latest JPMorgan Prime Brokerage data, we noted that the “pain trade” remains higher as unlike retail, hedge funds have been selling every rally aggressively with the largest US bank seeing “net selling in 8 of the past 9 days,” during which stocks have staged a torrid rally.

At the same time, we also observed that the bulk of the recent market meltup has been on the back of a massive short squeeze and covering of puts (creating a delta and gamma squeeze) which makes it especially difficult to predict what happens next as most if not all of the recent market meltup has been due to technicals and positioning, not fundamentals.

Still, we said that the simple conclusion is that that “either hedge funds will reverse their selling soon and jump on board the retail buying bandwagon (at which point it will again be time to short), or retail will run out of buying power amid the hedge fund-to-retail “distribution”, and stocks will tumble once again.“

Fast forward to today when we finally got the answer and it’s not the one bulls will like.

According to the latest weekly Bank of America Securities Client Flow Trend report (available to pro subs in the usual place), last week, during which the S&P 500 was -1.3%, BofA clients were net sellers of US equities (-$2.8B), dumping both stocks and ETFs.

What is more remarkable is that all three client groups were sellers, led by hedge funds (sixth consecutive week of sales, which we already knew and discussed previously), and institutional clients were also net sellers for a second week, but it was retail clients that finally turned sellers after several weeks of buying, and for only the second time YTD! Worse, rolling four-week retail flows have turned negative as well.

As discussed last week, BofA’s retail client flows have been a positive – not contrary – indicator of subsequent near-term S&P 500 returns, and in fact, a better market signal than hedge fund flows (yes, retail is now the smart money while hedge funds are the dumbest flows of all). As shown below, subsequent 4-week S&P returns have been tepid following retail outflows vs. stronger following retail inflows.

Breaking down the client flow, BofA’s clients sold large caps but bought small and mid caps.

There was a silver lining of sorts: while retail balked, the market’s last support pillar – buybacks by corporations – picked up slightly vs. a week ago but remained light according to BofA.

As we discussed last week, while buybacks are typically more tepid in the quiet period ahead of earnings – such as right now – overall this year we have seen evidence of a slowdown: corp. client buybacks as a percentage of S&P 500 market cap (0.06%) are below both 2021 (0.07%) and 2019 (0.10%) levels at this time! In short, most discretionary buyers are now sellers, while those entities that buy no matter the price (as long as they have access to bond markets to fund purchases) are quietly phasing out their purchases.

And speaking of who is buying back stock, the answer is simple: almost exclusively large cap tech companies.

Taking a closer look at what they bought and (mostly) sold, BofA clients sold stock in five of the 11 sectors led by Consumer Discretionary and Communication Services.

Most sector ETFs (except Energy, Utilities and Health Care) saw outflows with the exception of commodity ETFs which saw massive inflows.

Extending on the trend from last week, BofA writes that “Consumer Discretionary stock flows are the most negative in our data history (since ‘08) and more than one standard deviation (SD) below average as a percentage of sector market cap. In prior weeks of –1SD outflows, the sector continued to underperform over the subsequent month (by 70bp on avg.) but outperformed over the next three months by 1ppt on avg. (and >70% of the time).”

Finally, it wasn’t all puking, and Real Estate and Energy stocks saw the biggest inflows last week. Yet despite commodity price inflation and geopolitical conflict, Energy has seen only muted inflows YTD. Paradoxically, fund managers are still underweight Energy, while the sector has its weight in the benchmark double (in large) and quadruple (in small) off post-COVID lows.

more in the full note available to pro subs.

Tyler Durden

Tue, 04/12/2022 – 15:54