China Slowdown Risks May Be Bigger Than Fed Hikes

By Tomoko Yamazaki, Bloomberg Markets Live reporter and commentator

Policy and liquidity dictate China stock moves more than the global growth outlook but for now, the country’s Covid lockdown appears to be outweighing all other positive policy benefits as seen in stock performances today.

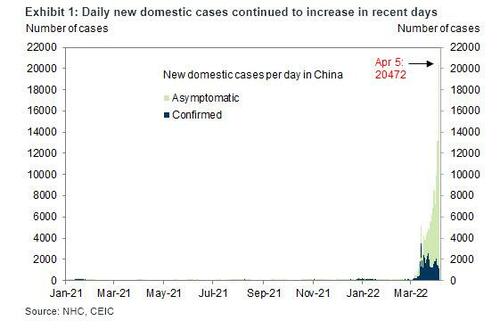

After all, China remains the world’s factory, and a slowdown in the world’s biggest economy could be a bigger risk than the actual Fed hikes (see “China Services PMI Crashes In March As COVID Crisis Worsens“).

Economic prints, including today’s PMI numbers, have been deteriorating due to China’s strict Covid policy. It’s a contrast with other countries that are shiftingto live with the disease. The outbreak worsened in Shanghai, where its large elderly population is under-protected by vaccines. The government just announced another lockdown as it conducts a new round of testing from today.

As seen on Weibo: Shanghai residents go to their balconies to sing & protest lack of supplies. A drone appears: “Please comply w covid restrictions. Control your soul’s desire for freedom. Do not open the window or sing.” https://t.co/0ZTc8fznaV pic.twitter.com/pAnEGOlBIh

— Alice Su (@aliceysu) April 6, 2022

Supply-chain woes are deepening with the wait times for semiconductor deliveries rising to another high in March, in part, due to China’s restrictions.

While Fed Governor Brainard’s comments rock the global bond and equity markets, the risk of Beijing’s response to rising cases should be kept in the back of one’s mind as a wild card.

Tyler Durden

Wed, 04/06/2022 – 11:05