China Services PMI Crashes In March As COVID Crisis Worsens

Activity in China’s services industry contracted sharply in March, adding to the evidence that the current COVID outbreaks and the zero-COVID-policy-based-lockdowns to control them are dealing a devastating blow to the world’s second-largest economy.

While (reported) deaths remain negligible, China’s new wave of COVID cases has hit a new record high today as CCP reports 20,472 new daily Covid cases for Tuesday, driven by surging infections in Shanghai where local officials are building the world’s largest makeshift isolation facility to help contain the outbreak there.

Problematically for China’s Zero-COVID policy, the number of cases continues to rise in Shanghai and Jilin, despite the provinces being almost impenetrably locked-down since mid-March (exposing the difficulty of halting the spread of omicron once it has deeply penetrated a population).

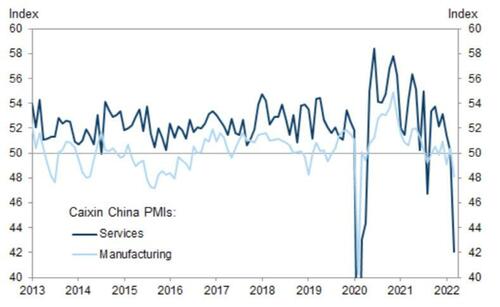

All of which is reflected in tonight’s report that China’s Caixin Services PMI crashed to 42.0 in March from 50.2 in February, the largest single-month decline since February 2020 (at the same scale as the sequential decline last August amid the local outbreak of delta variant in Jiangsu).

The new business sub-index fell in the services sector likely on the back of tightened restriction measures in March according to Caixin. Surveyed firms’ confidence (after seasonal adjustment) dropped on concerns over the pandemic and the Russia/Ukraine war.

As Goldman details, their proprietary Effective Lockdown Index (ELI) increased by more than ten points on average in March from February…

Price indicators suggest cost pressures persisted in the services sector. The input prices sub-index rose to 54.2 from 52.5 in February, while the output prices sub-index decreased to 50.8 from 51.4. Surveyed companies commented higher costs of raw materials, energy, food, transportation and higher Covid-related expenditures were the major drivers of rising costs, while they faced difficulties in passing through the higher costs to consumers due to weak domestic services demand amid the worsened Covid situation.

The sub-index of expectation of future output, after seasonal adjustment, fell to 58.4 in March (vs. 60.7 in February). And given the very recent surge in cases – and consequently harsher restrictions – we suspect the pain is far from over in China’s Services sector (and neither its manufacturing base). And that should be an ominous sign for the growing anxiety over global stagflation spreading virally through the world’s developed economies.

Tyler Durden

Wed, 04/06/2022 – 00:33