One Bank Spots A Big Red Flag For Stocks: Buybacks Are Inexplicably Tumbling

Forget the inverted yield curve and the coming recession: a far more ominous development for stocks has emerged according to Bank of America: stock buybacks are suddenly sliding…

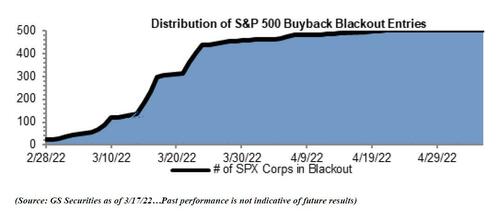

Three weeks ago, when an otherwise bullish Goldman Sachs was urging its clients to (correctly) buy stocks ahead of the quarter-end bear market rally/melt up (the same bear market rally, which Morgan Stanley now says is over), the bank warned that one of the bigger risk factors entering Q1 reporting period is the end of buybacks, and what back then was 45% of the S&P in a buyback blackout has now risen to 95%:

As Goldman wrote, “the avg notional executed by corporates (street wide) during the open window is ~$4b per day in U.S. mkt. During blackout period our corporate desk’s executions typically decline by 25 – 30%. Fair to assume at least $1b of demand is removed from market place on a daily basis during blackout period.”

And as we approached a full blackout late last week ahead of the upcoming official Q1 earnings launch, the lack of indiscriminate stock buying (by corporations) finally got to the market and we saw the biggest stock drop in weeks amid weakness that has spread into the current week.

So far, so good, but this morning Bank of America quant Jill Carey Hall made an ominous observation: in her weekly equity client flow trends note, she writes that while buybacks typically slow at the end of each quarter ahead of earnings season, buybacks by corporate clients slowed to their lowest weekly level in 12 months, and on a rolling 4-week average basis, are down YoY for the first time since late 2020.

As shown in the chart below, while the $ amount of buybacks in 1Q was above other 1Qs post-crisis, as a % ofS&P 500 market cap, 1Q buybacks were the lowest in five years.

Perhaps even more concerning is that while 1Q S&P 500 buyback announcements (as a % of mkt. cap) – while similar to 1Q21 levels – were 50% below the pre-COVID 5-year avg.

While BofA refuses to argue that buybacks lead to higher stock prices (we are happy to do so: “more buybacks lead to higher stock prices”, there you go) the bank make the point that a “backdrop of more supply (IPOs) and less demand (buybacks) as a reversal of a multi-decade bullish trend for US equities (shrinkage).”

The BofA strategists also note that they see a “greater case for dividends > buybacks in 2022 amid political risks to buybacks, a rising cost of debt (fewer levered buybacks), elevated valuations vs.rising demand for dividend income (10 reasons for S&P 500 dividend growth note).”

Finally, in the aftermath of Starbucks’ shocking announcement earlier this week, when the company’s woke CEO Howard Shultzannounced that he planned to halt share buybacks, effective immediately, in order to “invest more into our people and our stores – the only way to create long-term value for all stakeholders”, could it now be the case that the only companies that pursue critical – for shareholders – buybacks are the unwoke ones.

Considering the tremendous gains by “evil, dirty, and unsnowflake” fossil fuel companies in recent months – just as we predicted would happen in 2020 – is corporate America about to suffer another clear example of “get woke, go broke”, and is the blowback against corporate wokeism – observed in the past 24 hours with Elon Musk effectively taking control of that woke, circle-jerking echo chamber cesspool of liberal “bluechecks” that is Twitter – about to finally hit, because while everyone can pretend to be all up with the latest snowflake bullshit, once people’s money is on the line it’s amazing how everyone remembers that only one “green” matters and that conservative values actually are far more beneficial for one’s financial health than socialist liberal ones.

Tyler Durden

Tue, 04/05/2022 – 15:26