De-Globalization: New Supply Chains Are Inefficient And Will Drive-Up Inflation

Authored by Mike Shedlock via MishTalk.com,

De-globalization is underway. A key ramification is higher inflation…

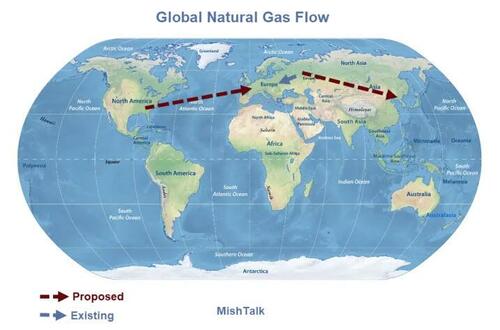

Global map from Nations Online Project, annotations by Mish

EU Existing Gas Supply

The EU gets about 40% of its total natural gas supply from Russia. That gas gets to EU countries over existing pipelines.

Russia and the EU just finished an an additional pipeline, Nord Stream II, to supply even more gas to Europe.

After Putin invaded Ukraine, the EU set a goal of getting no natural gas from Russia.

Proposed Gas Supply

Instead of using existing pipelines over short distances, the EU wants the US to deliver Liquified Natural Gas (LNG) via shipment across the Atlantic Ocean to Europe. This is far more expensive and will require more LNG terminals.

The US Greens are not exactly happy about the US fracking more natural gas. And how much energy is lost compressing and transporting LNG to Europe?

It’s not as is Russia will be unable to sell its natural gas. Russia and China are building new pipelines for Russia to pipe gas to China instead of the EU.

Russia, China Agree 30-year Gas Deal Via New Pipeline, to Settle in Euros

On February 4, Reuters reported Russia, China Agree 30-year Gas Deal Via New Pipeline, to Settle in Euros.

The announcement came before Russia invaded Ukraine on February 24.

The new pipeline is expected to be in operation within three years but given sanctions and threat of new sanctions, I suspect Russia and China will work to expedite the timeline.

Power of Serbia

Russia-China pipelines courtesy of Refinitiv

“Piped gas from Russia can be supplied to northern China at prices that are competitive when compared with LNG,” said Ken Kiat Lee, analyst at consultancy FGE.

If this sounds convoluted, it’s because it is. But it is a pittance compared to oil workarounds.

Money, Commodities, and Bretton Woods III

Credit Suisse economics contributor, Zoltan Pozsar, discusses supply chain disruptions in Money, Commodities, and Bretton Woods III

The bottom line is that it will take months longer for oil to get where its headed. And that does not eliminate Europe’s need for oil.

The details are quite amazing.

Zoltan notes that as Russian oil gets diverted to China, China will then buy less oil from the Middle East and then Middle Eastern oil will now have to be shipped to Europe with the same loss of efficiency as the shipment of Baltic oil to China.

But heaver ships cannot fit through the Suez Canal so they have to unload oil from the tankers, pipe it around the canal, then get it bank on the tanker to head to Europe.

De-globalization will add to inflation. Here is the key paragraph from Pozsar.

Bretton Woods

Bretton Woods II served up a deflationary impulse (globalization, open trade, just-in-time supply chains, and only one supply chain [Foxconn], not many), and Bretton Woods III will serve up an inflationary impulse (de-globalization, autarky, just-in-case hoarding of commodities and duplication of supply chains, and more military spending to be able to protect whatever seaborne trade is left).

Bretton Woods refers to the agreement after WWII in which established floating currencies and trade imbalances settled in gold.

In 1971, president Nixon defaulted on gold settlement resulting in “Nixon Shock” then massive globalization ultimately led by China.

Bretton Woods III

Pozsar describes the end of de-globalization and the end of just-in-time manufacturing which he labels Bretton Woods III.

The new trinity of will be about “our commodity, your problem”, says Pozsar.

That is a take on Nixon Shock when Nixon’s Treasury Secretary famously told a group of European finance ministers worried about the export of American inflation that the dollar “is our currency, but your problem.“

Nixon Shock

Many problems today including deficit spending, trade deficits, and income inequality have their roots in 1971.

For discussion, please see my September 30, 2019 post Nixon Shock, the Reserve Currency Curse, and a Pending Currency Crisis.

What About NAFTA?

Many people mistake NAFTA as the reason for US outsourcing to Asia. They are wrong.

Once Nixon ended forced convertibility of gold for dollars, countries were able and willing to inflate at will. The US then became the global consumer of choice.

For discussion of the NAFTA fallacy and president Trump’s inept attempt to fix things, please see Disputing Trump’s NAFTA “Catastrophe” with Pictures: What’s the True Source of Trade Imbalances?

Can the Fed Fix This?

If anyone thinks the Fed has any chance of fixing inflation other than huge demand destruction and a very hard-landing recession, please tell me how.

And if the Fed does not do this, then what is the beneficiary if not gold and commodities?

Arguably in a Bretton Woods III scenario, commodities are the big beneficiaries regardless of what the Fed does.

Plea for More Inflationary Free Money

Meanwhile, the demand for more free money and thus more inflation is running rampant.

For example, Age Group 18-34 Wants More Free Money for Themselves. But Who Will Pay for the Free Money?

Senator Elizabeth Warren keeps asking for Biden to forgive student debt. Will he? If he does and it survives a court test it will greatly add to inflationary pressures.

For discussion of inflation measures including an additional focus on food, please see Let’s Look at Four Measures of Inflation Plus a Spotlight on Food

The economic illiteracy of Progressives is astounding.

* * *

Tyler Durden

Tue, 04/05/2022 – 11:04