“They’re In Desperate Need Of Capital” – SoftBank Halts Investments As It Scrambles To Raise Cash

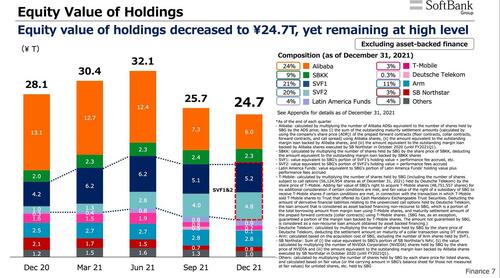

2021 was a difficult year for Softbank, and so far, 2022 is shaping up to be even more punishing. The Japanese telecoms giant/VC firm/conductor of the “AI Revolution” booked massive losses on its investment portfolio as massive bets on Didi and Grab soured (among other holdings), saddling the firm with tens of billions of dollars in losses for 2021 (this according to the firm’s most recent earnings report). And as shares of Alibaba and other prominent SoftBank holdings continued to tumble during Q1, dragging SoftBank shares lower in tandem, the situation has only continued to deteriorate.

As SoftBank shares have tumbled, founder Masayoshi Son has seen roughly $25 billion of his net worth evaporate.

The firm’s investment losses – spurred by a crackdown in Beijing (which has sheered $9 billion off the firm’s Didi holdings, and that’s just one stock), the war in Ukraine, and other factors outside SoftBank’s control – could represent an existential threat, since SoftBank borrows heavily against its own shares to finance investments in early-stage companies. Because of this heavily leveraged structure, if the company’s financial position deteriorates too aggressively, it could trigger a brutal margin call “doom loop” that could force it to sell even more of its holdings. Masa Son lost his first fortune during the dot-com blowup. The last thing he wants is to be financially ruined a second time.

To try and guard against this eventuality, Masa Son has reportedly ordered his lieutenants to halt investments in new firms as the company seeks to conserve cash as the value of its portfolio continues to deteriorate.

Here’s more from the FT:

SoftBank founder Masayoshi Son has told his top executives to slow down investments, as the world’s largest tech investor seeks to raise cash amid falling tech stocks and a regulatory crackdown in China.

The Japanese billionaire made the remarks to his leadership team at a recent meeting, according to people briefed on the discussions, as the group responds to the massive hit to the value of its holdings in recent months. The previously unreported discussions offer a rare glimpse into the growing tension within SoftBank, which has disrupted the tech investing landscape since launching its first Vision Fund in 2017.

Instead of looking for new innovative tech companies to pump money into (or soliciting backers for a third iteration of its ‘Vision Fund’), SoftBank is evaluating its portfolio to decide which holdings might be best suited for liquidation. One insider said the firm doesn’t expect valuations of its Chinese holdings to rebound any time soon.

“Valuations for Chinese companies listed overseas have collapsed,” said one person close to SoftBank’s China team. “We don’t expect a turnround anytime soon.” One person familiar with the company’s plans added that SoftBank is pushing to raise cash and is evaluating assets that could be liquidated.

As the firm pointed out in its latest quarterly report, its loan-to-value ratio (a key metric in the eyes of financial analysts) is getting dangerously close to the red line separating a sustainable from an unsustainable debt burden.

The company’s shares have shed 40% of their value over the past year, and during Q1, its portfolio shed another $20 billion and $30 billion.

Back in October 2019, we speculated that SoftBank might be the tech bubble era’s “short of the century”. Aside from a few short-lived rallies, our timing on that call could not have been better.

SoftBank’s present difficulties follow one of the busiest years for dealmaking in the firm’s history: it closed investments in 195 private companies last year, the most in recent memory.

Now, in a bid to raise cash, SB is scrambling to borrow against its stake in British chipmaker Arm Holdings (which is headed or an IPO spinoff following the collapse of a deal to sell it to Nvidia) and other holdings. Still, to many on Wall Street, this strategy reeks of desperation.

In a bid to raise cash, SoftBank has also used stock in Coupang and other large holdings in the Vision Fund as collateral for loans. The Japanese tech group is also finalising loans worth as much as $10bn tied to the IPO of UK chip designer Arm Holdings, following the collapse of its $66bn sale to US rival Nvidia last month. “If you look at all the action, it’s very clear that they are in desperate need of capital,” said Amir Anvarzadeh, a strategist for Japan equity at Asymmetric Advisors who has recommended shorting SoftBank.

The firm’s long-term solution focuses on its Vision Fund. Executives at SoftBank’s second Vision Fund, which manages $40 billion of SoftBank’s own money, say they’re hoping to make fewer investments of a higher quality. The big question now, as Alibaba shares continue to struggle in the face of a crackdown by Beijing: how much longer can SoftBank hold out without being forced to sell more shares of its ‘golden goose’?

Tyler Durden

Thu, 03/31/2022 – 22:00

Recent Comments