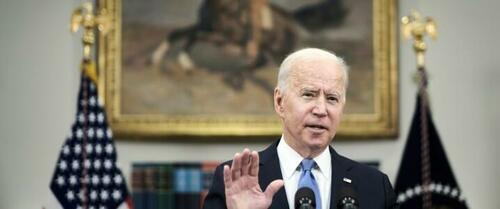

Biden’s Latest Plan To Curb Soaring Gasoline Prices Angers Drillers

Authored by Tsvetana Paraskova via OilPrice.com,

U.S. President Joe Biden outlined a series of steps the White House is taking to reduce high prices at the pump.

The U.S. President called on Congress on Thursday to make American oil companies pay fees on wells from leases they have not used in years and on acres “that they are hoarding without producing,” as part of a plan to respond to “Putin’s price hike at the pump.”

While the Administration announced a massive release of 180 million barrels of oil from the Strategic Petroleum Reserve (SPR) over six months, the largest ever in history, it did not spare criticism toward the domestic producers. According to the U.S. Administration, oil firms are not ramping up production fast enough to fill the gap in global oil supply and ease the upward pressure on U.S. gasoline prices.

“Still, too many companies aren’t doing their part and are choosing to make extraordinary profits and without making additional investment to help with supply. One CEO even acknowledged that, even if the price goes to $200 a barrel, they’re not going to step up production,” the White House said.

U.S. shale producers, apart from keeping a capital discipline, are constrained by supply chain bottlenecks in ramping up production RIGHT NOW, as the Biden Administration wants.

For example, even if ConocoPhillips decided to pump more oil today, the first drop of new oil would come within eight to 12 months, CEO Ryan Lance told CNBC earlier this month.

According to the U.S. Administration, however, the U.S. oil and gas industry “is sitting on more than 12 million acres of non-producing Federal land with 9,000 unused but already-approved permits for production.”

“Companies that are producing from their leased acres and existing wells will not face higher fees. But companies that continue to sit on non-producing acres will have to choose whether to start producing or pay a fee for each idled well and unused acre,” the White House said today.

The U.S. industry has already signaled its frustration with the talk of the leases and the pump-more-right-now calls.

“The talk about price gouging is tiresome. Discussion of federal leases and those leases being unused without an honest discussion about all the constraints and regulatory issues to drill is also unhelpful,” an E&P executive said in the quarterly Dallas Fed Energy Survey earlier this month.

“The regulatory environment is not friendly,” another executive noted.

Tyler Durden

Thu, 03/31/2022 – 15:25