Blain: Why You Shouldn’t Panic About Bonds

Authored by Bill Blain via MorningPorridge.com,

“I would like to come back as the bond market. You can intimidate everybody.”

In bonds there is pain as prices tumble – but that does not change the fundamentals of investing in bonds. The risk is rising bond yields will expose the dangerous over-valuations low rate distortion has caused across other financial-assets, perhaps causing more than a few bubbles to pop.

I think we should pay a quick visit to Bond Market 101 this morning.

Stock markets might move higher because Tesla and Amazon announced stocks splits – bizarrely leading retail investors to believe they can own more of the company for less, or because vague indications of a Ukraine solution mean infinite upside. These illustrate the equity market is a perverse voting machine, reflecting flawed expectations because participants think as clearly as mud.

Bonds are different. Bond markets are also subject to participant voting, but they move with mathematical grace and elegance… or, at least they are supposed to. It’s the maths that makes them so critical for institutional investors in terms of their predictability to meet future liabilities and generate dull and boring returns. In Equities there is the excitement of potential appreciation, in bonds there are steady returns – which is why the old adage about the percentage of bonds in your portfolio should match your age.

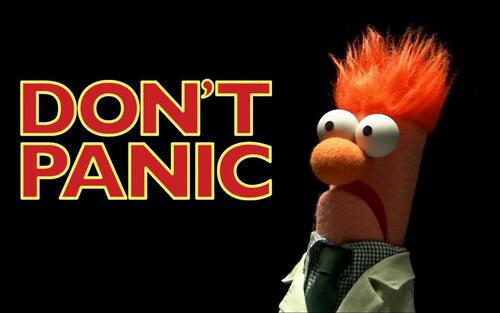

Judging by the number of articles in recent weeks panicking about “catastrophic” bond routs, and inverted yield curves, it might be time to remind ourselves on the fundamentals of bond markets, and why bond traders and fixed income managers are the smartest bods in finance.

The mathematics of bonds, and concepts like duration and convexity (which measure the sensitivity of a bond to changes in yield and price) are as complex as you want to make them – but fear not… I shall try to explain them in simple terms even I can understand by simply not mentioning them again….

(Christ on a bike – why am I even trying to explain bonds??? Trying to explain fixed income to equity investors is about as likely to succeed as teaching a rhinoceros to juggle monkeys, and vice-versa.. (Picture, if you will, an equity monkey trying to explain Tesla to bond rhinos!))

But, hey-ho, let’s give it a go…

In recent weeks bond yields have risen as central bank tightening and inflation expectations take hold… Rising yields means prices fall. (Doh!) Prices of low coupon bonds are more sensitive to changes in yields than high coupon bonds, and as 95% of global bonds have been issued in the ultra-low rate environment of the last 10-years, thus the price falls look precipitous even though yields have only risen less than a hundred basis points or so.

Let me try to illustrate the most dramatic aspect of this “Bond Catastrophe” with a classic horror story: Austria’s Euro 4 billion 0.85% 2120 “Century” Bond.

It was launched in June 2020 at a yield of 0.88%,

As interest rates fell, it rose to a price of 133.00 in Nov 2020.

The price has tumbled by more than half – it now trades at a price of 65.00%,

The yield has risen to 1.55%, thus,

The price collapse is dramatic,

But it will pay investors 85 cents per Euro 100 each year, and repay in full at 100% in June 2122 (subject terms and conditions, such as Austria still being there…)

Ah.. the magic of bond maths! (Yes; maths, not “math” as dyslexic Yanks misspell it.)

As a result of spectacular bond price changes, it’s no surprise I’ve been reading a plethora of despairing articles about bond market doom’n’gloom. There is lot of “End of the world” stuff. Financial scribblers have picked-up my mantra about “in bond markets there is truth”. They assume tumbling bond prices must mean bond markets are about to deliver death and destruction in the way the Kremlin can only dream of.

There is destruction if you bought bonds to trade – that a function of price. You have lost – thus far. Many people think bond yields could reverse and prices rise again: for all the tough talk about rising rates, they reckon central banks will blink and bail out markets by keeping rates low. It’s a contrarian trade.. and it might happen.

Meanwhile, the scribblers write how rising yields have triggered a massive collapse in bond values. But, even that’s not actually true – rising yields don’t change the “value” of a bond. They change its price – which is a different although very painful thing when yields rise. All things being equal it will still pay its annual coupon and redeem on its maturity date. In bonds there is certainty and dull, boring, predictability… (Which is why I hang around with equity people at parties..)

Let’s go back to bond basics.

A bond is a simple IOU. You lend me $100 and I agree to pay you $5 each year in coupon, plus $100 back in 5-years time. Thus it’s a 5% 5-year Bond.

There are lots of different types of bonds:

Sovereign bonds – a county with financial sovereignty (one that controls the printing presses for its own currency) will not default. It sets the risk-free interest rate all assets in that currency are valued against. I put a level between them and…

Government/Semi-Sov bonds – (not everyone with agree with my nomenclature) are bonds issued by governments without financial sovereignty – like any European Euro nations, or agencies guaranteed by sovereign or government bond. Why the distinction?

The UK will always be able to repay Gilts by printing sterling. (That has potential other consequences like currency markets, but for the sake of the argument, let’s not worry.. this morning.) In contrast, the Italians have to politely ask Germany to agree to supporting the ECB lending them more to repay existing debt or approving more bond issuance when they are already up to the eyeballs in debt.… It’s an unsubtle difference.

Generally, the market likes to pretend this is not an issue – or a minor quibble at most. But the reality is Italy and Greek spreads to Germany (how much more yield they pay than Germany) widens every time people realise/remember the EU is not guaranteeing or standing behind Greek or Italian debt. That was illustrated when ECB head Mario Dragi said he’d “do anything”, including dancing naked with a unicorn.. Greece was yielding 25 percentage points more than Germany at the time. Now its 140 basis point – 1.4 percentage points. Draghi’s promise worked, although the unicorn said Dragi stepped on her hooves… Yeah, sure.. Greece is just a tiny bit more risky than Germany… (Choked and muffled laughter…)

Euro government credits are therefore a greater risk than US Treasuries, UK Gilts and Japanese JGBs for the simple reason the ECB is a political construct trying to align the bickering tribes of Europe, rather than a sovereign nation, while hoping German workers will pay the pensions of the French and Italian comrades.

Then you have the credit markets..

Credit markets feature the additional dimension of credit risk – the risk the company won’t repay. That is why they yield more than Govies. Corporates can explode, go bust, default or restructure. Credit risk changes in line with interest rates – generally credit risk rises as interest rates rise because financially stressed companies struggle to pay higher interest charges.

Credit markets can be further subdivided into areas like bank debt, which can be senior, subordinated, perpetual capital and a host of other things designed to obscure and complicate the matter. And then there is secured debt and securitisations.. and other loverly ways we used to relieve German banks of their deutschemarks… ah these were the days…

Bond markets have one apex predator. Inflation. It’s the big issue.

Lets assume you lend Germany 100 Euros for five years at 0% in a period of zero inflation, its safe money. You get back 100 Euros. The gain is you got your money back – and in such a deflationary market, you might have lost money in gold, housing or stocks.

If you lend Germany 100 Euros for five years and inflation is 5% per annum, then the value of your 100 euros in 5-years is about 28% less than what you initially invested.

In the case of the Austria bond 5% inflation means you will have lost about 1100% of your purchasing power within 50-years, so your Euro 100 will be effectively worthless… at least your annual 85 cents will buy you a drop of water – not.

Lots on investors are prepared to take the inflation risk – calculating inflation is often transitory and its worth trading it against the risks of a higher yielding asset that may be less damaged by inflation. They may also believe the world is moving towards deflation, and that the security and risk characteristics of a bond are better than anything else, and that the bond pixies will look after them.

But… The truth is hard to bear…

The real reason everyone is panicking about bonds is nothing to do with the maths of the bond market, or the perfectly predictable shift in prices we are seeing. …

What you need to understand about bonds is that they are very, very, very important. Equity is nothing more than pastry decoration on the financial market pie. Bonds… are the filling. That is because the yield of the bond markets is the de-facto baseline for every other price… As the perceived risks of any financial asset (bond, equity, gold, housing, real assets…) rises, the wider it trades to that base. We call that Govt Bond base yield the Risk-Free Rate.

But a problem has arisen. Since 2008 – when central banks intervened to save markets post Lehman, the waters have become murky… There is the ongoing expectation the Central Banks will step in again, and QE has introduced serious ongoing market distortion from monetary experimentation and artificially low interest rates.

If you artificially keep the baseline bond yield artificially low it makes every other financial asset look more attractive on a relative basis because they yield more… That simple fact basically explains the massive financial asset inflation we’ve seen since QE and central bank bond buying started… Its what’s driven equity prices higher, made the rich richer, and fuelled inequality.

But if you are an equity investor, you don’t call it financial asset inflation – you’ve embraced it as the great 2009-22 Equity Bull Market.

Sorry to burst your bubble… but its low interest rates rather than fundamental corporate value that underlay the bull market…

And now its about to pop.

This is where reality punches you harder than Will Smith ever could. We’ve all known that ever since Central Bank started distorting markets it would come to an end. When bond yields start to normalise… well that’s when the pain will spread not just to the inflated equity markets – but everything else priced of the Govie risk free rate – which is basically everything…

And that, boys and girls, is why you shouldn’t panic about bond markets…. you will likely get your money back (minus inflation.) In fact, that’s why bonds will be a safe-haven if things really deterioriate..

Don’t panic about bonds… but maybe just a wee bit of panic about every other asset in your portfolio…

Ouch….

Tyler Durden

Wed, 03/30/2022 – 12:45